Assessing the state of Aave and Compound after a year of ups and downs

- Aave and Compound experienced a decline in unique users and monthly deposit volume.

- Aave V3 saw a spike in TVL recently, while Compound experienced a stable uptrend.

Aave [AAVE] and Compound, the dynamic duo of lending and borrowing platforms that helped pioneer the Decentralized Finance (DeFi) movement, weathered a year of ups and downs. Despite facing what some may call a tumultuous time, how have these two powerhouses fared, particularly with the introduction of their highly anticipated V3 releases?

Read Aave (AAVE) Price Prediction 2023-24

Deposits, users fall on Aave and Compound

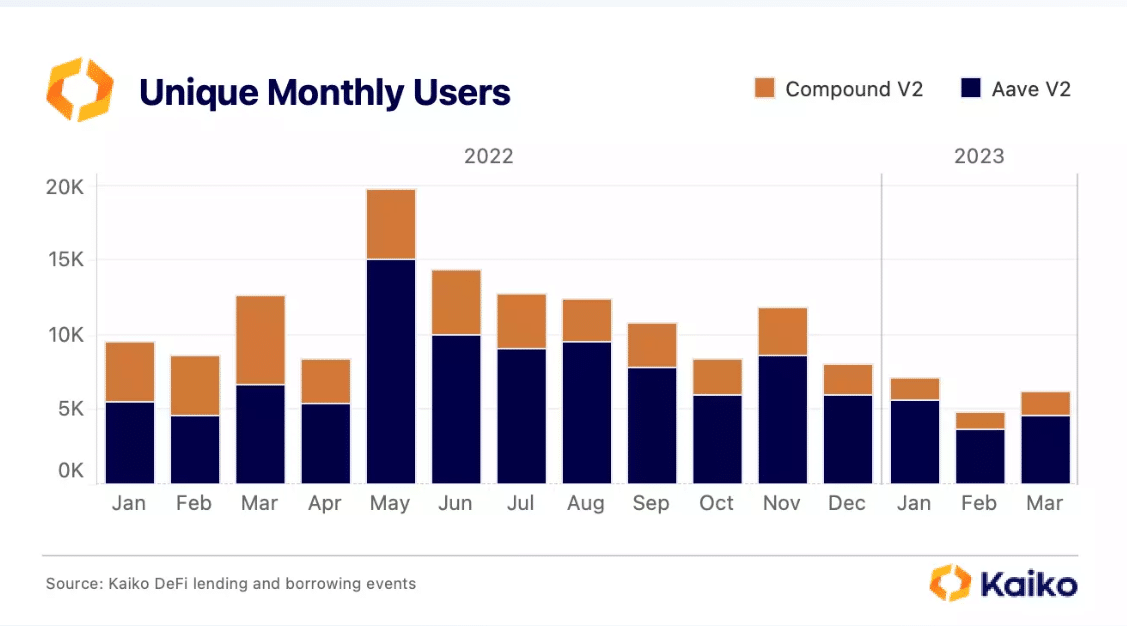

Based on Kaiko’s data, both Aave and Compound experienced a consistent decrease in the number of unique users since May 2022. However, Compound’s decline was more notable.

The only two months that showed a deviation from this trend were November 2022, which coincided with FTX’s collapse, and March 2023, when USDC’s de-pegging occurred.

In February 2023, user activity hit a particularly low point, with Aave V2 receiving just over 3,500 monthly users and Compound V2 attracting 1,000.

The bear market had a noticeable impact on the monthly deposit volume for both platforms. At the start of 2022, Aave saw an average of $8 billion in monthly deposits. However, in 2023, the average dropped by half to around $4 billion.

The only exception to this trend was March when the platform experienced a surge in deposit volume. This was due to the popularity of flash loans, a feature where tokens are deposited and withdrawn in the same block.

These loans accounted for a staggering $10 billion in deposits in just three days.

Aave and Compound’s V3 sees TVL respite

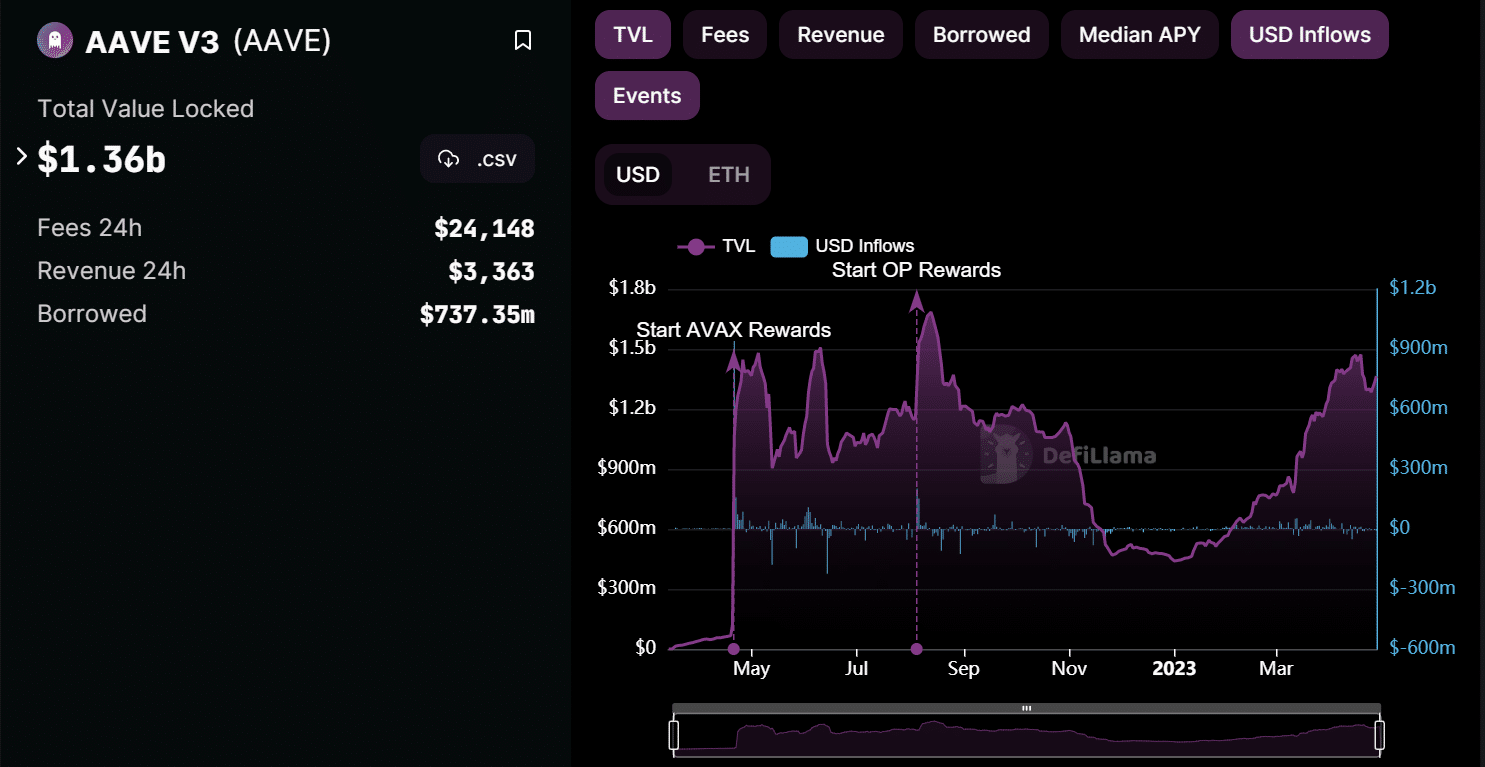

According to DefiLlama’s data, Aave V3 was on an upward trend. Although the platform experienced a dip in October 2022, the Total Value Locked (TVL) resumed its ascent. As of this writing, the TVL stood at $1.3 billion, despite a sharp drop between 20 April and 23 April.

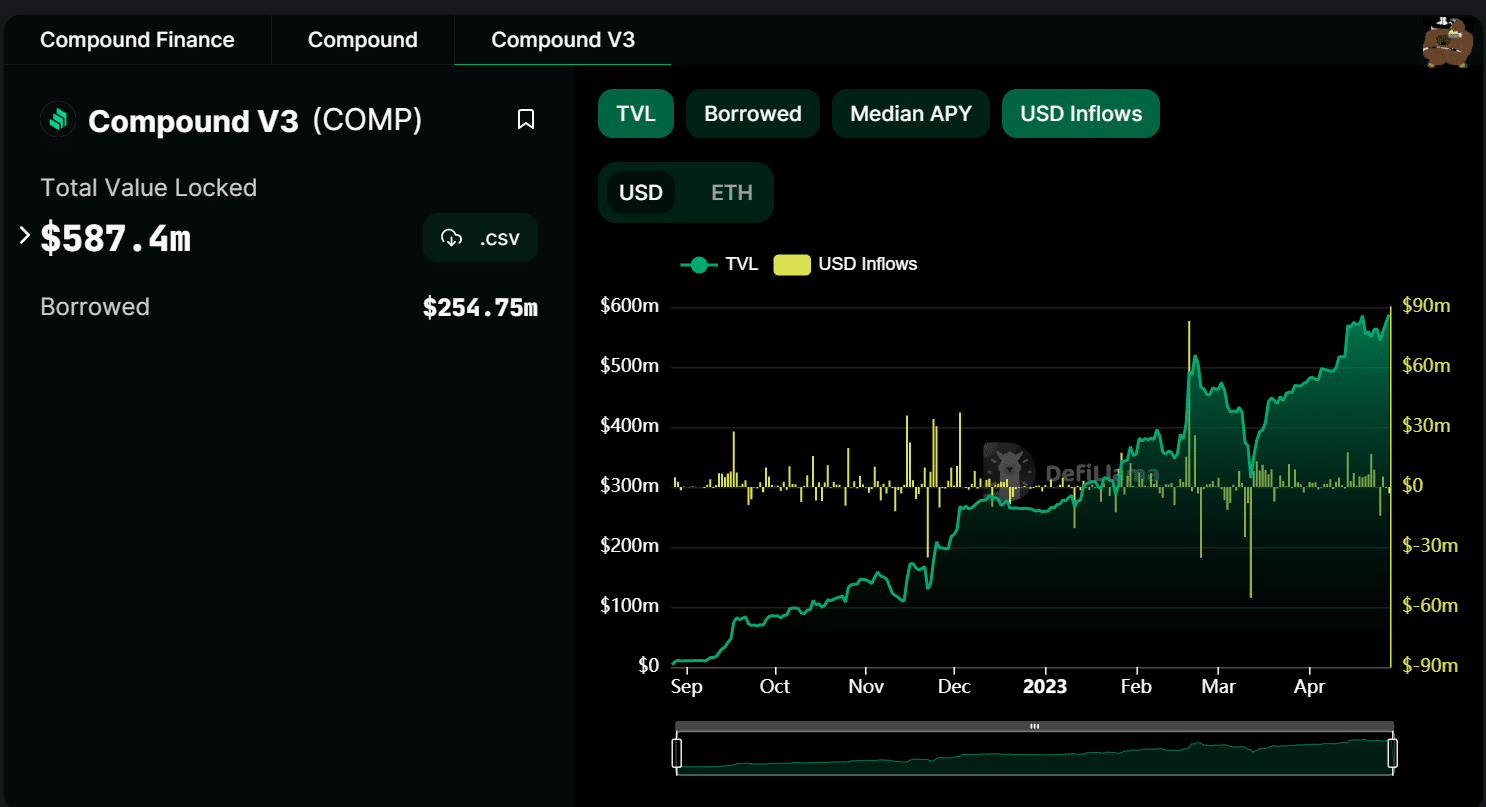

In contrast to Aave, Compound experienced a relatively stable uptrend in terms of TVL, with the only significant dip occurring in March. The platform’s TVL surged and stood at over $587 million.

Furthermore, there has been a consistent flow of stablecoins into the system, although outflow currently dominates.

– How much are 1,10,100 COMPs worth today

30-day MVRV check

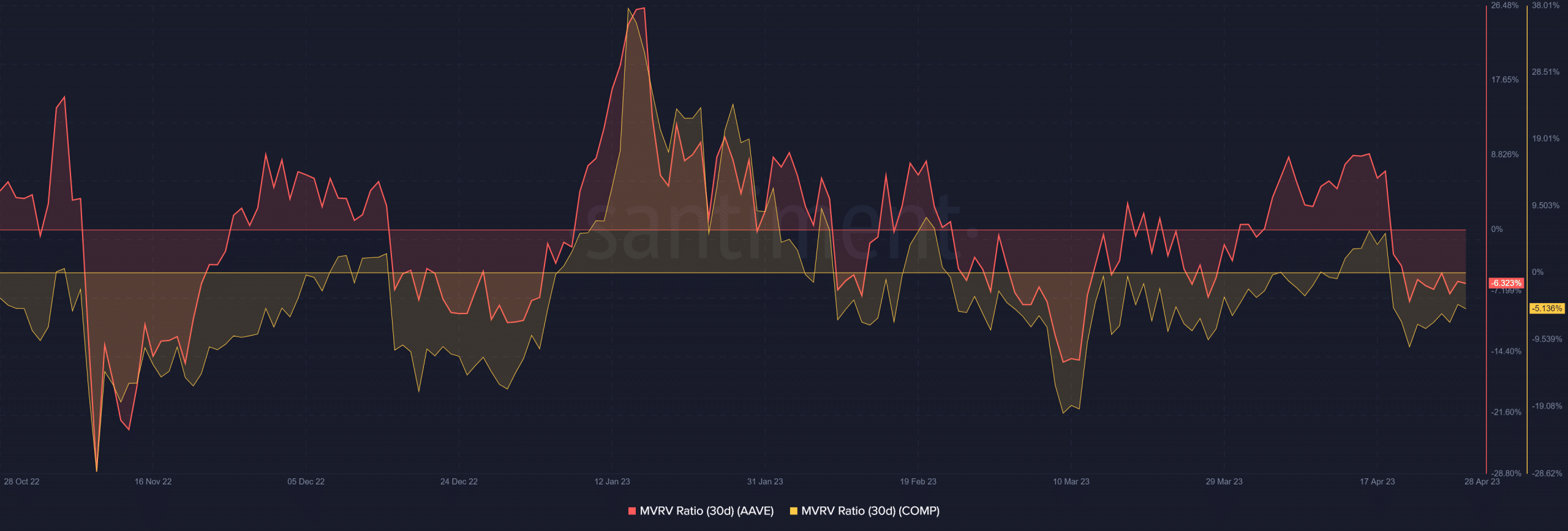

Upon examining the 30-day Market Value to Realized Value (MVRV) of both Aave and Compound, some similarities in valuation emerged. As of this writing, Aave’s MVRV was -5%, while Compound’s MVRV was -6%.

The MVRV suggested that both tokens were currently undervalued and could potentially rise in value. In addition, at press time AAVE was trading at approximately $71, while COMP was exchanging hands at around $40, both at a loss of less than 1%.