Is Avalanche’s performance on this front to be blamed for its bearish price action

- Hexagon launched a new extension to protect Avalanche users from various threats

- However, as per metrics, last week was full of troubles for AVAX

The network security of Avalanche [AVAX] got a notch better with a new partnership with Hexagate, which was announced on 12 December. With the new extension, Hexagate will help Avalanche users protect their Web3 transactions from fraud and various threats.

We are excited to announce that the Hexagate Transaction Analysis browser extension now supports @avalancheavax. With the extension, Hexagate will help Avalanche users to protect their Web3 transactions from fraud and various threats.

So how does it work?

1/5 pic.twitter.com/z2c624s8KP

— Hexagate (@hexagate_) December 12, 2022

Read Avalanche’s [AVAX] Price Prediction 2023-2024

Before consumers sign transactions, the browser extension will examine them to look for financial and cybersecurity concerns, including phishing, front-end hacking, market manipulation, etc. The new browser extension will be compatible with Core, Metamask, Coinbase Wallet, WalletConnect, and more.

Here are the weekly stats

AVAX Daily, a popular Twitter handle that posts updates regarding the Avalanche ecosystem, recently published the network’s weekly stats. The tweet revealed that the transaction volume of the Avalanche ecosystem on 12 December was about two million transactions per day.

Avalanche Subnet Weekly Stats

Total Subnets: 39

Total Blockchains: 30

Total Validators: 1194

Total Stake Amount: 253,05M AVAXOverview??#AVAX #Avalanche $AVAX pic.twitter.com/8qPFvdY6On

— AVAX Daily ? (@AVAXDaily) December 12, 2022

Despite these developments, AVAX’s price decreased by 5% in the last week. At press time, Avalanche was trading at $12.81 with a market capitalization of over $3.9 billion.

A troublesome week for Avalanche

Despite AVAX’s 5% price plunge, its DeFi space witnessed significant growth. DeFiLlama’s data revealed that Avalanche’s total value locked (TVL) registered a spike on 12 December, and at the time of writing, the value was at $2 billion.

However, Santiment’s chart shed some light on what might have gone wrong during the last week. Despite new partnerships and integrations, Avalanche’s development activity went down sharply. This was a negative signal.

AVAX’s Binance funding rate was also comparatively lower, reflecting less interest from the derivatives market. Not only that, but AVAX’s social mentions also took a blow last week and went down by 42%, reflecting less popularity for the network.

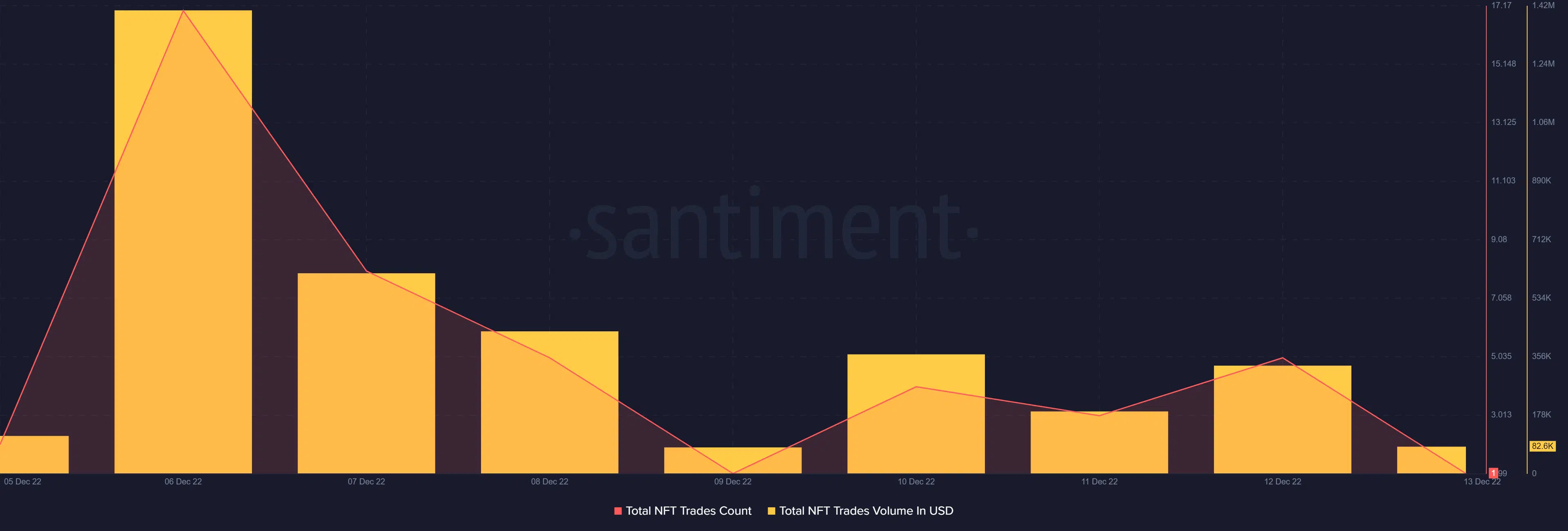

Avalanche’s NFT space also did not boast of promising growth, as after spiking on 6 December, the network’s total NFT trade count went down. This was true for the NFT trade volume in USD as well, suggesting that AVAX’s NFT space gained little traction over the past week.