Beyond Bitcoin and altcoins, this is what investing in crypto is all about

When it comes to crypto, everyone knows Bitcoin. In fact, Bitcoin is known much more widely than the word “cryptocurrency” itself. Since its inception, the concept of a decentralized financial system has taken everyone by surprise. And to watch it develop into what it is today is nothing more than a once-in-a-century instance.

However, as the understanding of crypto and participation grew, hundreds and thousands of new cryptocurrencies began appearing. Some of them failed disastrously while many others succeeded to become some of the topmost digital assets today. Naturally, people jumped in to invest in these digital assets and soon, a new kind of investment vehicle came to life.

But, there are always these few questions that people ask whenever the topic of crypto comes up – Is that it? Are Bitcoin and a few altcoins my only options to invest in? Is DeFi really worth it, etc.?

So, here I will be answering the question of what else and sharing with you the reasons why Bitcoin and altcoins are not the ends of the line. Instead, they might actually be the beginning of a new world of investment.

The Cryptocurrencies

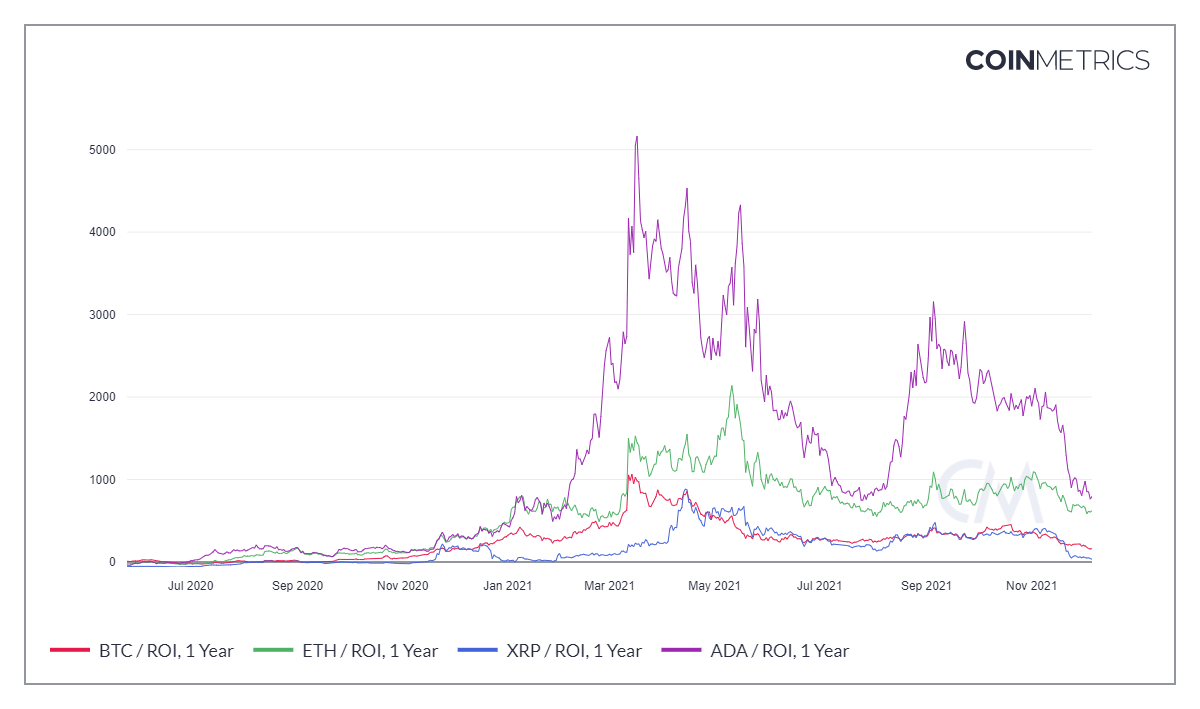

If we’re going to talk about where you could invest, it is important to gauge every existing kind of crypto asset. And for that, obviously, we need to analyze the topmost coins. The reason why people primarily rush to invest in cryptos is because of the ridiculous ROIs these assets offer.

Over the year, Bitcoin has seen a price rise of almost 77%, with its ROI for 1 year standing at around 161%, at press time. The market dip of 4 December definitely caused the king coin, as well as other altcoins, to fall considerably. In fact, Bitcoin even touched the $43k level at its lowest.

But, if you’re wondering why the ROI of BTC is so low, it is because Bitcoin still sits at a high price of $51k. Its rise and fall continue to maintain a tight structure, one that keeps volatility relatively minimal.

Bitcoin Year to Date rise | Source: TradingView – AMBCrypto

On the contrary, altcoins that don’t cost as much did go berserk this year. Ethereum performed really well as its price shot up by 501.8% while its ROI was 620% at press time. And yet, it still has nothing against the biggest hit of 2021 – Solana.

SOL broke the market this year after the altcoin’s price witnessed a 13,292% rally, rising from $1.5 all the way to $201.

Solana Year to Date rise | Source: TradingView – AMBCrypto

The altcoin’s ROI is at a staggering 10,976%, making it the most profitable asset of the year.

The likes of Cardano and XRP did not disappoint either as the coins rose by 793% and 290%, respectively, and returned a profit of 789% and 32.8%.

RoI comparison | Source: Coinmetrics – AMBCrypto

The DeFi boom also played a significant role in the rise of these altcoins.

However, these cryptocurrencies have also been subject to criticism, more so than most due to the volatile nature that pushed many institutions to take drastic measures against them. The ongoing Securities and Exchange Commission v. Ripple Labs lawsuit is a prime example.

Then, there was the issue of crypto-trading and mining ban in China. It affected the entire market badly, with the latter taking weeks to recover. Following the same, there was the FUD around India’s proposed crypto-bill and what its contents would mean for the country’s strong crypto-community.

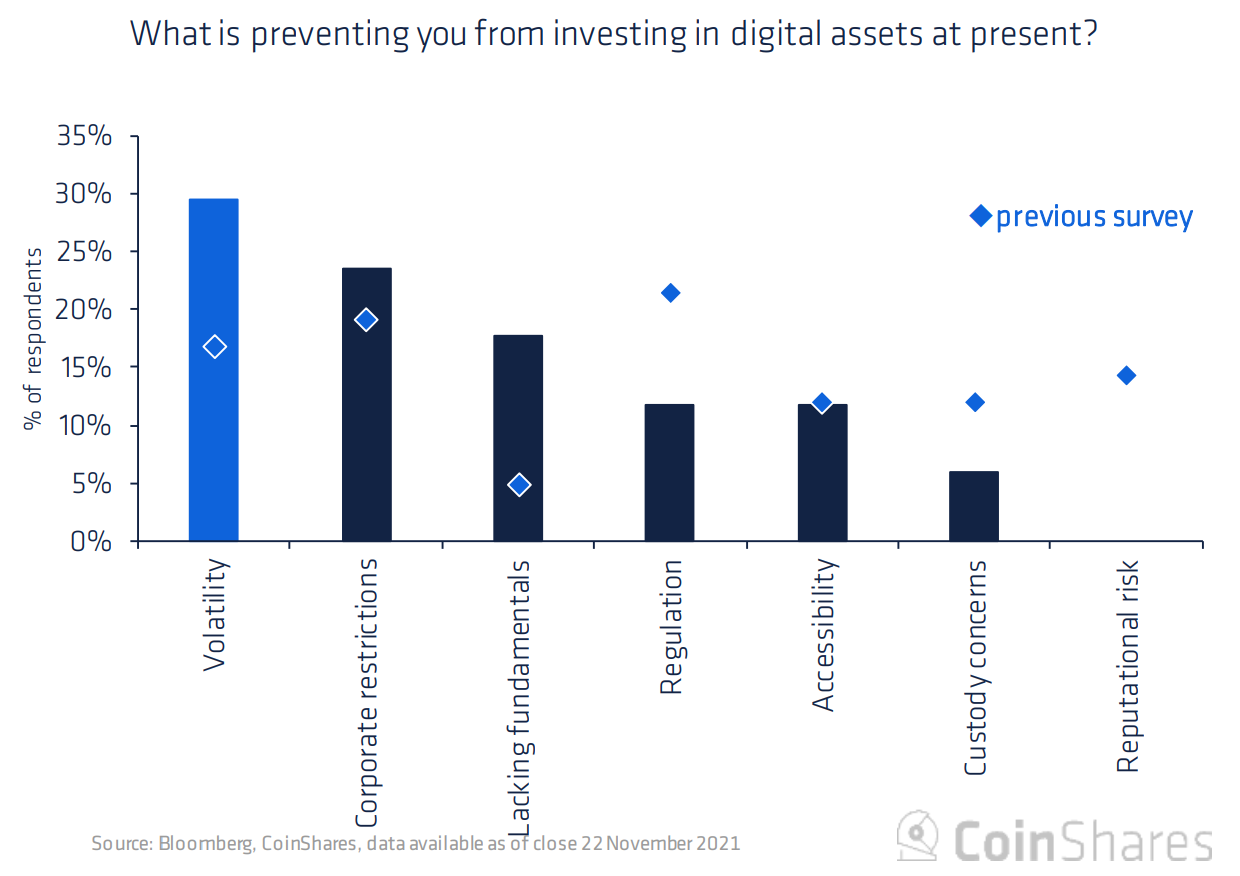

But, this volatility is a concern of investors as well.

In a recent survey by CoinShares, it came to light that the biggest issue investors have is volatility, more so than regulation and accessibility.

Investors biggest crypto investment concerns | Source: CoinShares

Plus, most investment in cryptocurrencies is still born out of the “get rich quick” mindset, instead of actually adopting the use cases of the technology behind it.

This has led people to look into other forms of crypto-investments. This brings us to…

The Crypto-based Companies

There are many blockchain companies that delve into mining as a source of income, who also trade on traditional stock exchanges, but remain backed by crypto. Some well-known examples of the same are HIVE Blockchain Technologies Ltd., Galaxy Digital, Bitfarms, etc. who have all been mining cryptocurrencies. Consequently, their tickers have witnessed successful growth over the year.

Their hikes are actually in line with most of the top cryptocurrencies’ growth. HIVE offers an ROI of 1575%, BITF (Bitfarms) promises returns worth 1,166% and Galaxy Digital’s GLXY gives a 369% return on your investment.

HIVE Blockchain Technologies Ltd. RoI | Source: Blockchain

In addition to the already established companies, there have also been instances of crypto-based companies using the SPAC method to plan and raise investments and become public companies.

Prime Blockchain, with over 10,300 rigs for mining BTC and 2,600 rigs for mining ETH, is a recent example. It merged with 10X Capital Venture whose combined value is placed at almost $1.5 billion.

However, people still want to feel the heat of crypto, but with the safety of the traditional investment route. This led to the demand of…

Crypto-based Exchange Traded Products

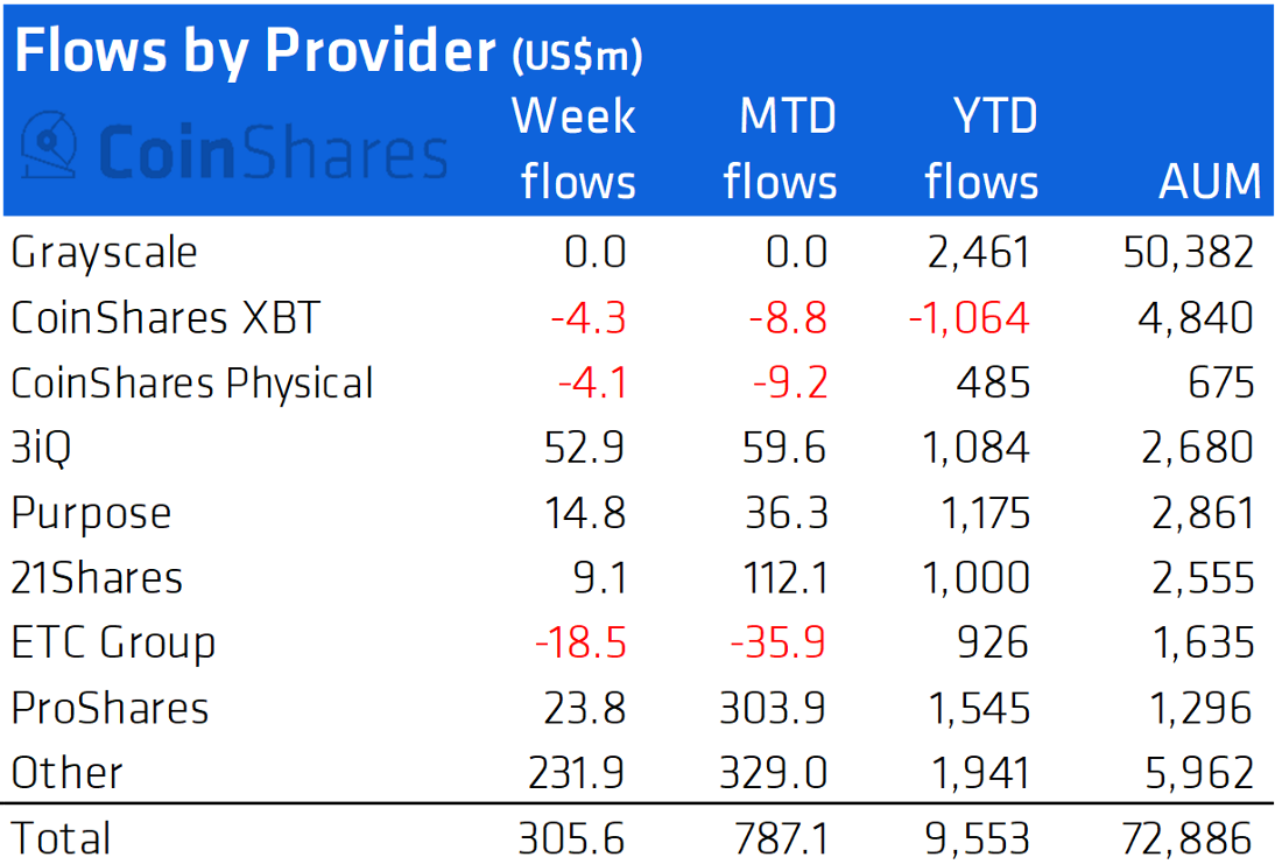

Also known as ETPs, these include ETFs, ETNs, etc. that have drawn investors’ attention over the years. This year, the demand for ETFs has been absolutely crazy and investors actually got what they wanted with the ProShares Bitcoin ETF (BITO) that launched on 19 October in the middle of the SEC v. Ripple lawsuit.

Now, the reason why these ETFs are so popular is that a) They are SEC-approved and thus can’t be subject to legal objections, b) The ease of buying an ETF compared to an actual cryptocurrency, and c) Because of their tax return policies. In fact, ETFs only create a taxable event when they are sold.

Thus, based on the duration of time held, these ETFs receive either long-term capital gains treatment (If held for more than a year) or short-term capital gains treatment (If held for less than a year).

If the ease of buying and tax benefits come into the discussion, then GBTC is equally important thanks to its 401k advantage. However, GBTC does not qualify as an ETF. Since it is trust-based, it is qualified as a company as per regulations. This results in GBTC having limited shares. And yet, with $37 billion worth of AUM, it is definitely the biggest crypto-backed investment vehicle in the market.

Grayscale Bitcoin AUM | Source: Grayscale

However, even ETFs’ hype has come down with the entire crypto-market witnessing an underperforming November. In the first week of BITO’s launch, ETFs brought in inflows worth almost $1.46 billion. The figures for the same fell by 79% to $305 million this week.

ETF inflows as per week ending November 26 | Source: CoinShares

But these are not it…

Traditional investment vehicles have been observing and banking on the crypto-hype to propel themselves up. Tesla, Square Inc., and the most famous MicroStrategy have been accumulating Bitcoin and other altcoins to draw investors towards their stock tickers.

And surprisingly, it has paid off. All of these companies saw staggering growth this year. In fact, presently, MicroStrategy is the biggest corporate holder of Bitcoin in the world, acquiring 121,044 BTC in almost a year.

In any case, the biggest issue to crypto-investments lies not in what’s before you, but in what is not.

The true purpose of cryptocurrencies…

… was decentralization. Bitcoin was created with the notion of making currency decentralized and the improvements over the last 13 years have been done in order to make it a reality. And these crypto-based companies, ETPs, and traditional investment vehicles banking on the crypto-hype are proof that we are still far from achieving it.

Even today, when Decentralized Finance (DeFi) is being pushed forward, people still opt for centralized routes. Despite the existence of Decentralized Exchanges (DEXs), many people still choose Centralized Exchanges (CEXs).

The top DEX in the market, PancakeSwap, currently handles $4.3 billion worth of trades every day. On the other hand, the top CEX – Binance – operates trade volumes of almost $29 billion in 24 hours.

Binance 24-hour volume at press time | Source: CoinMarketCap

The consistent need for centralized investment options represented by the paramount demand for ETPs and CEXs is a testament to the long-standing psychology of faith in centralized systems only because they have a face.

So, what is the right way?

Well, in my opinion, there is no “right way.” Every investment option comes with its own bag of boons and banes. The traditional and relatively “secure” options are subject to limited growth, whereas crypto-assets might see skyrocketing hikes worth more than 100% in a single day.

But then, they also go through sudden liquidations, drops in demand, and excessive volatility which can harm your own investments.

Besides, even if faith in decentralized systems does increase, centralized options will never be obsolete. Because people will always want a visible system to put their money into. This is why even investment through banks are some people’s preference.

Thus, put simply, risk-takers can go after the traditional crypto-investment options i.e. cryptocurrencies, NFTs, crypto-based companies, etc.

And safe players who want to dip their toes into cryptos without being subject to excessive risks can go with safer crypto-investments such as ETFs, GBTCs, crypto-enthused companies, etc.