Binance Coin: Could this move by Binance clear FUD and help BNB rally?

- Binance recently announced becoming a member of the ACSS.

- This move came after the FUD surrounding BNB due to the FTX collapse and SEC inquisitions.

In recent weeks, there has been a lot of fear, uncertainty, and doubt (FUD) surrounding Binance Coin [BNB] after FTX’s [FTT] collapse and the downward trend of its native cryptocurrency. The collapse caused exchange tokens to be looked at with distrust.

Read Binance Coin’s [BNB] Price Prediction 2023-24

Also, the situation with Binance was made even worse because the exchange came under scrutiny from the SEC. Binance has taken an innovative approach as of late to deal with the issue of compliance punishments.

Binance to work on regulatory compliance

Per a statement on 6 January, Binance made history by being the first cryptocurrency exchange to join the Association of Certified Sanctions Specialists (ACSS). According to an official statement, the company’s team will train at ACSS as part of the process.

#Binance joins the Association of Certified Sanctions Specialists (ACSS).

As the first crypto exchange to join the association, we aim to leverage ACSS training materials, databases, and networks to further compliance standards within the crypto industry.https://t.co/uEOw147gke

— Binance (@binance) January 6, 2023

The purpose of the ACSS training is to educate the staff working for the exchange on the guidelines provided by the Office of Foreign Assets Control (OFAC) within the United States Treasury and to alert them of the potential dangers associated with violating those criteria.

BNB in compliance?

The daily timeframe chart of BNB‘s price action revealed that the token saw a surge in late October 2022. It saw a climb into the $350 range during October. The price range tool revealed that BNB lost nearly 26% of its value from when the token’s slump began in November until the observed timeframe.

As of this writing, the token’s value hovered around $260. Its price rose by almost 2% in the last 48 hours, suggesting that the latest news has positively affected its movement.

According to the chart, a new support level might form if the token sustains or continues its advance. The range for the current support level was between $235 and $217.

The Relative Strength Index line, visible above the neutral line, showed that the token was in a bullish trend. Additionally, the Bollinger Band displayed a sign of contraction, indicating that volatility, most likely to the upside, is about to occur.

Are your holdings flashing green? Check the BNB Profit Calculator

The tale of profit and loss

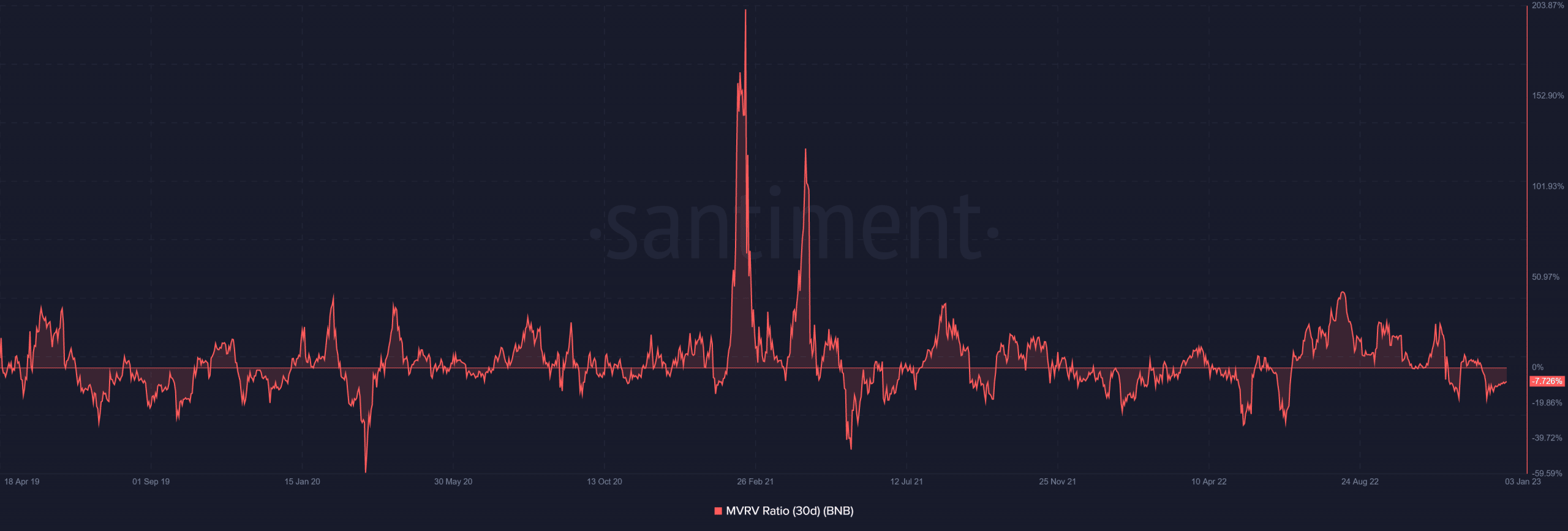

The Market Value to Realized Value Ratio showed that BNB has had difficulty being profitable over the past 30 days. As of the time of writing, the MVRV ratio was about 7.7%, and holders had been switching between profits and losses. The observed returns may be considered respectable, given the recent FUD engulfing the token.

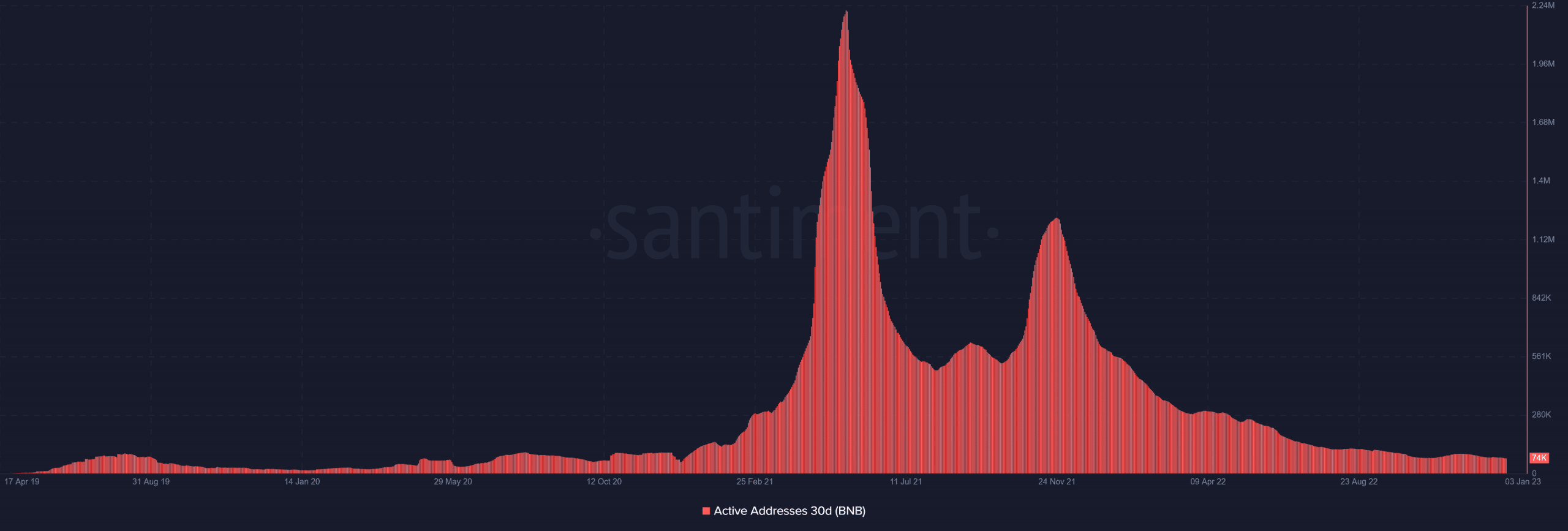

A peek into the active address metric revealed that the activity level was largely constant. This indicates that fewer investors are trading the tokens at the present time.

The most recent action taken by Binance is designed to increase user confidence in the exchange’s activities. This might also increase the value of the exchange’s tokens.

As people become more confident in the exchange, there may be an increase in the number of active addresses. Also, a sizeable increase in the volume of transactions might be witnessed.