Bitcoin: Here’s why this update could make a difference in the current state of BTC

- New Arkansas bill seeks to protect miner interests especially from government overreach.

- BTC miners incentived to sell some of their holdings as the market slows down.

Not so long ago, U.S regulators attempted make it seem like they were embracing Bitcoin [BTC] and altcoins. Only for them to switch up and ban banking access to the crypto market. A classic case of actions speaking louder than words.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bitcoin has so far demonstrated resilience against FUD attacks. As evident by its ability to survive and thrive for more than a decade while gaining more popularity.

This is largely because of Bitcoin’s decentralized nature. But what if governments attempted to attack or take advantage of the Bicoin mining system, the underlying mechanism behind Bitcoin decentralization?

Lawmakers in Arkansas, U.S seem to be siding with Bitcoin and are interested laws that will protect Bitcoin from government overreach. The US Arkansas Data Centers Act of 2023 aims to implement measures that will protect Bitcoin miners from unfair taxes and regulations.

The US Arkansas Data Centers Act of 2023 seeks to establish guidelines for Bitcoin miners and protect them from discriminatory regulations and taxes, guaranteeing that firms have the same rights as data centers. “Discrimination against digital asset mining business [is]…

— Wu Blockchain (@WuBlockchain) April 10, 2023

Based on Arkansas’ official publication regarding the new act, Bitcoin mining facilities will be treated as data centers. So, why is this new Arkansas Act important for the crypto industry?

Well, this is because governments might deploy unfair tactics such as heavy taxation to cripple the industry. Unfavorable regulations might discourage crypto mining activities.

Is Bitcoin at risk of unfair taxation and regulation?

In a hypothetical scenario, if a government was to act aggressively against Bitcoin in an effort to prevent mining, it might discourage mining. The potential outcome would be a slight dip in the hash rate, or a migration of miners to other favorable jurisdictions.

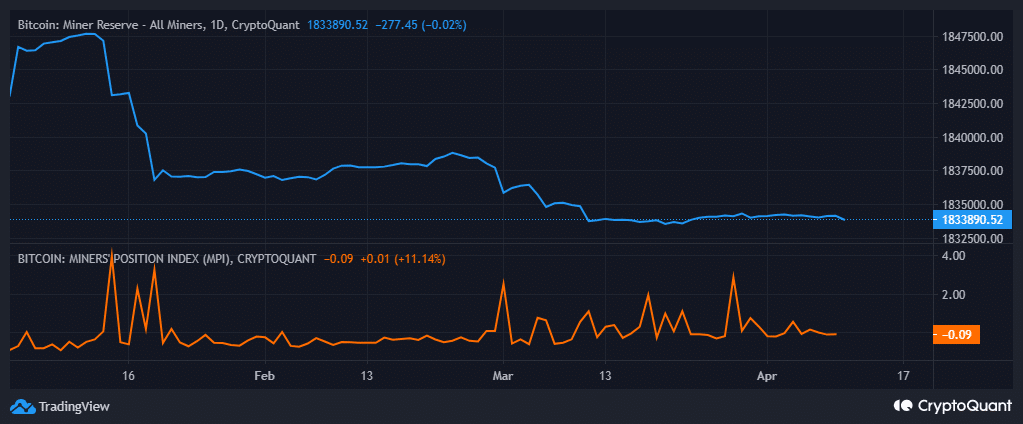

If anything, one could argue that unfair tax and regulatory measures against BTC mining would take away opportunities for the affected jurisdiction. The impact of such measures would likely also have a notable impact on Bitcoin miner reserves. The latter, at press time, stood at its YTD lows.

How many are 1,10,100 BTCs worth today

Furthermore, Bitcoin miner reserves remained low reflecting a lack of confidence in the bulls dominating. The Bitcoin miner position index also depicted a low value, confirming that miners were still contributing to sell pressure.

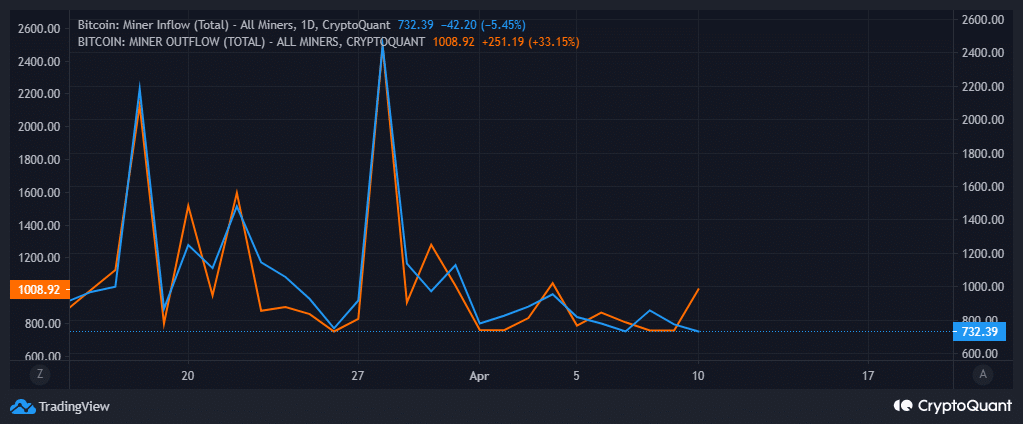

A look at miner flows revealed a surge in miner outflows in the last 24 hours as miner inflows dropped.

The above outcome is likely because the market has slowed down, leading to a drop in transactions, hence a drop in miner revenue. As such, miners have to sell some of their BTC holdings to cover their mining costs.