Bitcoin: This might be your best option in today’s market

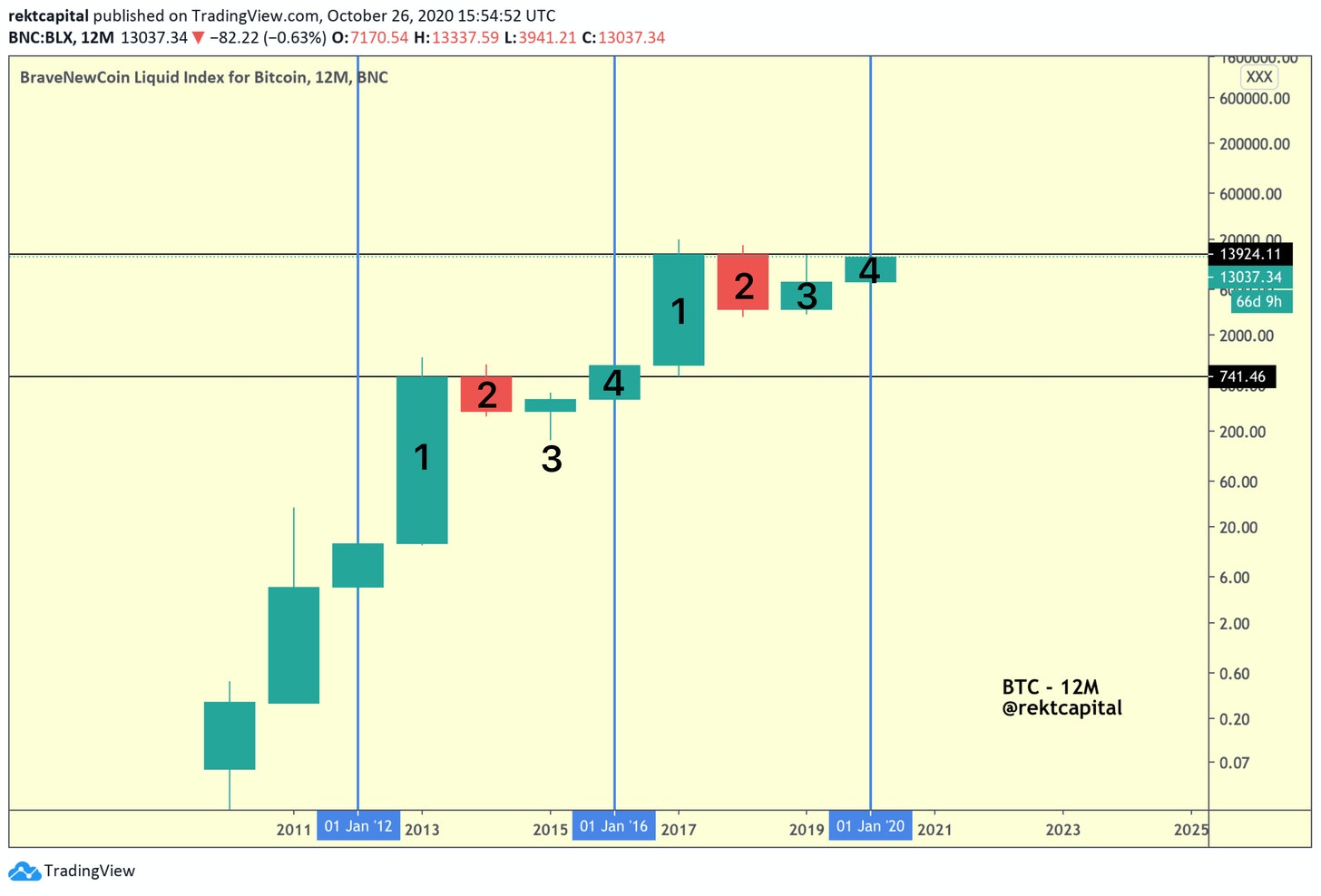

Speculations around Bitcoin’s halving and quantitative hardening and its effects on its price movement have been an intrinsic part of the king coin’s journey since the beginning. Halvings have historically correlated with gigantic price surges, leading to analysts believing that BTC follows a four-year price cycle that is centered around the periodic block reward halving.

If such speculations are to be believed, it would mean that BTC’s bull run earlier this year was a result of the third halving that took place last year and the higher highs for this cycle have already been lost. In fact, according to former bull Clem Chambers, this is just the case, with the CEO of ADVFN claiming in a recent interview that BTC could soon hit the $10,000 price range. He predicted,

“I see it going under 20k easily and probably quite soon and then I see potentially a bottom around 10k but I think 12-13k is a good bottom for the market.”

Referring to this period as the Crypto-Winter, he said that the price will worsen and become stagnant over the next 2-3 years before it experiences highs again. Rekt Capital broke down this cycle into four parts last year, starting with what it called exponential highs. Price during this phase peaks, as the coin reaches new ATHs, and investor sentiment is euphoric. This is usually followed by a correction as selling pressure mounts and valuation falls.

As BTC starts to bottom out, discounted prices trigger the phase of accumulation. According to the analyst, this is the time for the maximum financial opportunity as the prospect for reward greatly increases. Finally, the Recovery and Continuation phase sets in, one where market psychology plays a huge part in the shift from selling to buying.

Source: RektCapital

According to Chambers, BTC’s price movement has followed a very similar pattern over the past decade, one which was triggered by “hardening.” He added,

“It goes up like a rocket, it comes down like a rock. Every time it goes up like a rocket, it tends to double and then it comes back to a level which is basically double the low of the time before.”

Historically, Bitcoin’s halving has caused exponential growth in the BTC market. The first halving occurred in 2012 and was followed by a 3400% price increase from $11 per coin to $1,150 by the end of 2013. However, its price declined by 80% post reaching the 2013 peak. Similarly, the second halving that took place in 2016 was followed by the 2017 bull run when the price rose from $650 in 2016 to $19,600 by the end of December 2017 – A 4,080% hike.

After the May 2020 halving, Bitcoin’s price started touching new heights in October, rising up to a new ATH of $64,000 in April this year before it entered the correction phase.

Many believe that the latest corrections were caused by recurring tweets by Elon Musk coupled with the FUD caused by China. However, Chambers asserted that this was not the case as the event would have occurred regardless.

“When a market does something, they always want to stick it to a person.. They don’t like non-personified reasons. It’s to do with the technicals, the money flows, etc.”

With investor sentiment at an ATL and external factors along with speculation driving the market further below, what should investors do? HODL said the analyst, but only if you know the rules of the trading game.

“In a highly speculative, highly volatile, highly dangerous market, of which Bitcoin is, unless you absolutely know what you’re doing, don’t do it.”

Knowing that the cycle is going to repeat itself is paramount, Chambers concluded. He also suggested that assets should be bought when selling pressure is high and prices are low, and vice versa. His game plan for this cycle would be to buy and accumulate at the bottom over the next few years and then sell at higher highs, which he said could touch $100,000 when the ongoing cycle matures.