Bitcoin traders can benefit from short selling if ‘this’ support is breached

- BTC was in a slight upward momentum.

- The king coin could break out below $16,442.38.

- A break out above the 23.6% Fib level of $16,766.50 will invalidate the bias.

Bitcoin (BTC) has been stuck in the $16.92K – $16.45K range for over 10 days. The sideways structure of BTC has stalled the entire crypto market, with limited volatility and volume – a double nightmare for traders.

At press time, BTC was trading at $16,587. However, the price could fall even lower based on technical indicators and on-chain metrics.

Read BTC price prediction 2023-24

The support at $16442.38: will it hold?

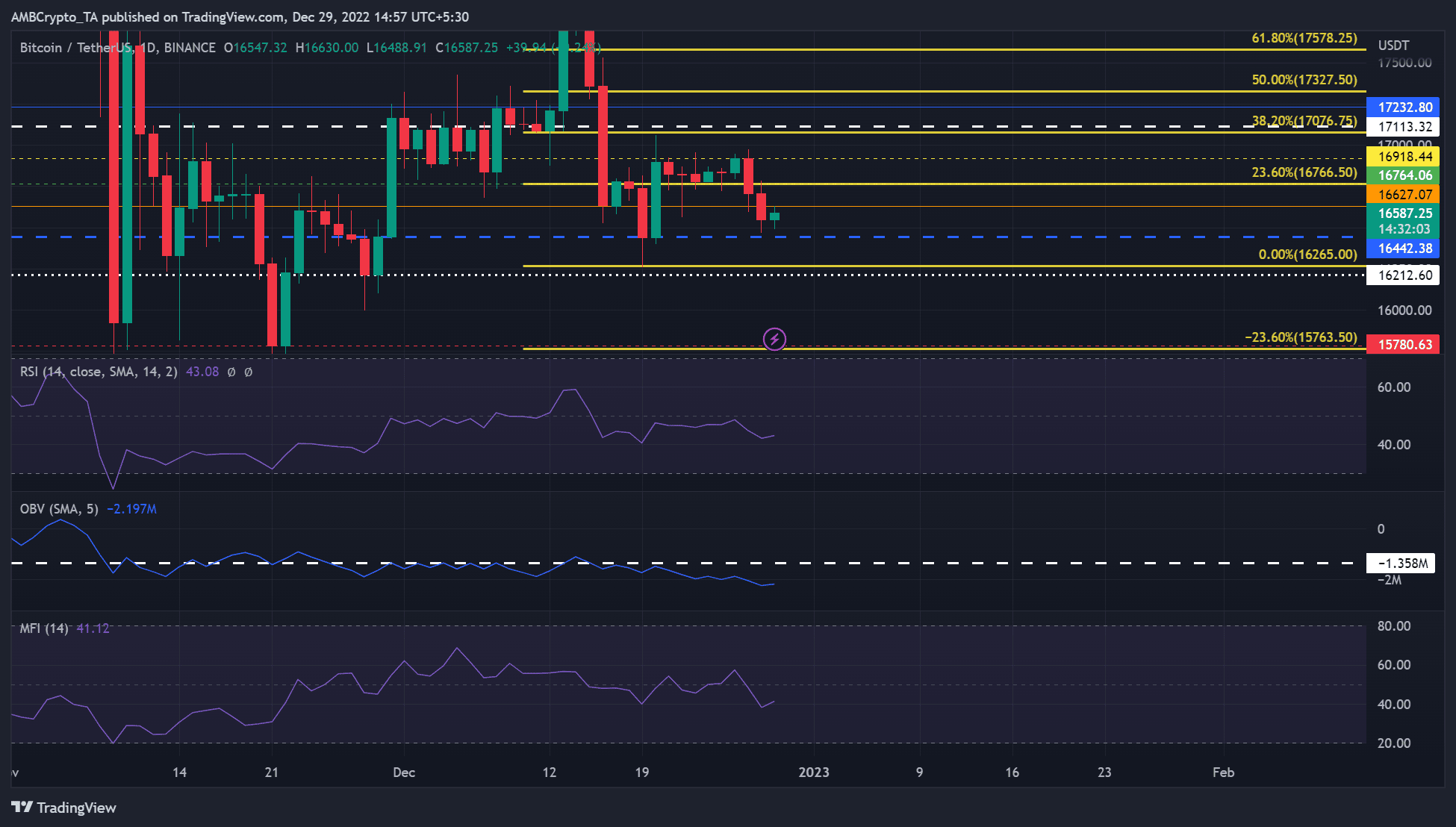

BTC rallied after the FOMC meeting and reached a high of $18.4K, up about 9%. After that, the price correction cleared all the gains and dropped lower.

Since the $18.4K high, there have recently been four major price pullbacks. The first one settled at $16,627.07 and faced a price rejection at the 23.6% Fib level, which initiated the second phase of the correction.

The second correction settled at $16,442.38, but the attempt to recover was rejected at $16,918.44. This level has since become a bearish order block and influenced the third phase of correction, which settled at the 23.6% Fib level.

At press time, the fourth phase of price correction had broken below the 23.6% Fib level and could also break below $16,442.38, a previous support level.

The On-Balance Volume (OBV) was negative, indicating that the asset was sold more than it was bought, suggesting high selling pressure. In addition, the Relative Strength Index (RSI) has moved away from its mean and declined, indicating that buying pressure eased.

Therefore, BTC could break below $16,442.38 and retest $16765, providing short-sale targets.

However, a break above the 23.6% Fib level of $16,766.50 would invalidate the above bias. This would allow the bulls to target the bearish order block at $16,918.44. However, the bulls need to overcome the obstacle at $16627.07 to advance.

Long-term BTC holders suffered more losses as whale transactions dropped

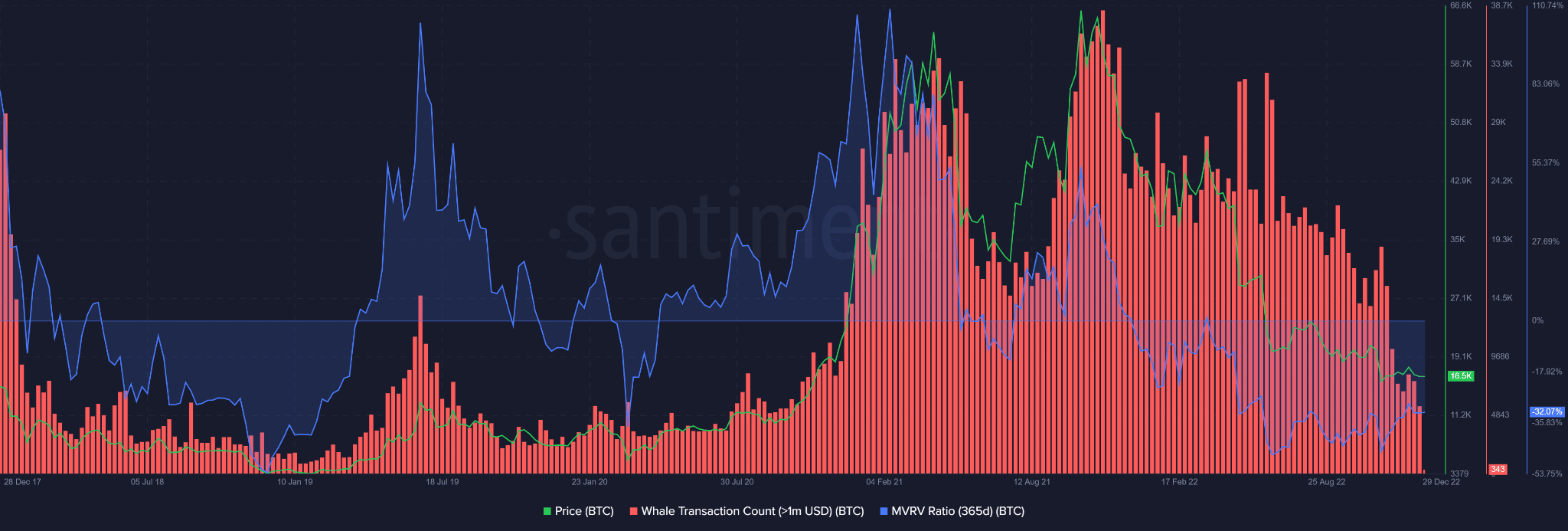

According to Santiment data, the number of BTC whale transactions was at its lowest level, almost as low as in December 2020. Such a metric makes it difficult for BTC prices to rise, as whale actions directly affect price trends. Therefore, BTC holders might start 2023 on a less happy note.

Furthermore, long-term holders of BTC have suffered losses throughout the year, as evidenced by the 365-day MVRV, which was deep in negative territory throughout the year. At the time of going to press, long-term holders were experiencing losses of over 30%.

Are your BTC holdings flashing green? Check the Profit Calculator

A further decline in whale transactions could mean more losses for the HODLers. However, an increase in the number of whale transactions could reverse prices.

It is worth noting that the highest number of whale transactions in December occurred around 13 December, the day of the FOMC announcement. If the trend repeats, we could see the next jump in whale transactions during the next FOMC meeting in late January 2023 (January 31/February 1).