Bitcoin: What can help the ailing king as prices decline yet again?

- Bitcoin’s price declined, causing FUD in the market.

- Long positions got liquidated, Open Interest rose.

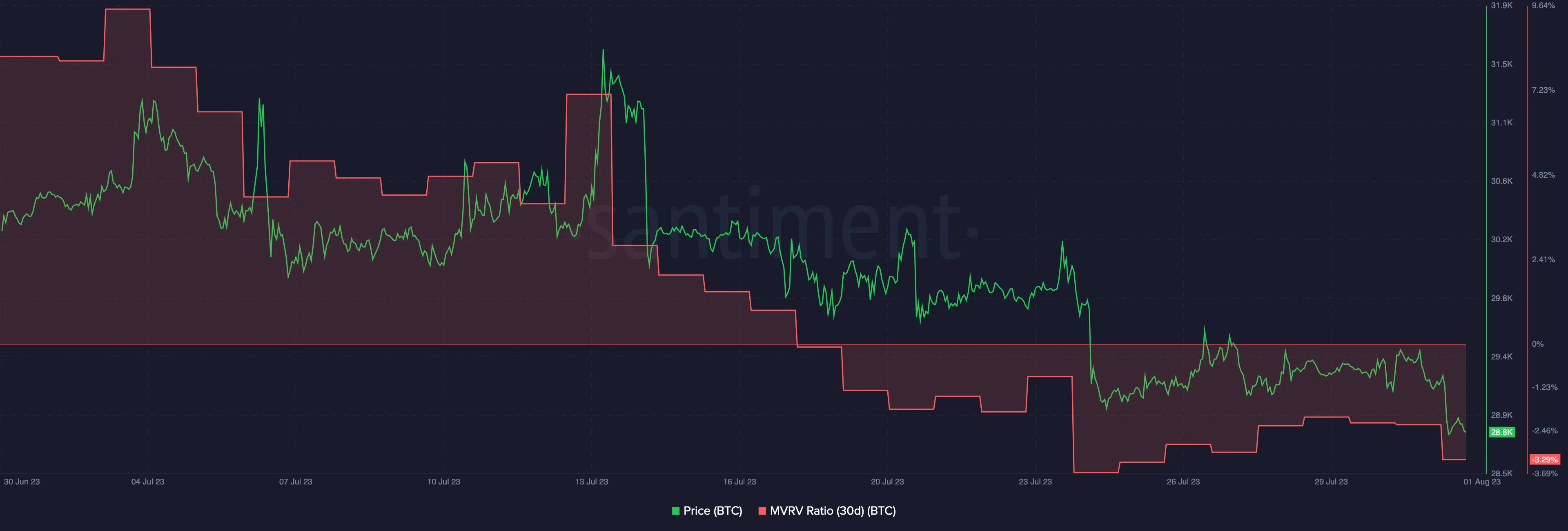

As Bitcoin’s [BTC] price dipped below the $29,000 range, the uncertainty around its future started to rise yet again. However, taking a look at the state of BTC on exchanges may provide some context as to what to expect from BTC in the future.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Exchange behavior

According to Glassnode, Bitfinex held 320k BTC, Coinbase held 439k BTC, and Binance held 650k BTC, making them the top three exchanges with the most Bitcoin.

#Bitcoin drops below $29,000 as OI spikes while funding rates go lower. As a result of the biggest long liquidation since 24th July. pic.twitter.com/i86FKizQGf

— James V. Straten (@jimmyvs24) August 1, 2023

When analyzing the average withdrawal price of all exchanges (coins that are withdrawn from all exchanges), Bitfinex’s cost basis was 10,000. This means that on average, the Bitcoin they held was acquired at a price of around $10,000 per Bitcoin.

During the 2017 bull run, Bitfinex’s exchange balance surged from 11K to 370K BTC, and then coins were withdrawn at a similar amount and pace during the bear market.

Similarly, during the 2021 bull run, coins were being offloaded at a comparable pace. In anticipation of a future bull run in the next 18-24 months, looking at Bitfinex’s exchange balances would be pivotal.

How are traders doing?

Coming to trader behavior, it was seen that Open Interest in Bitcoin had started to rise incrementally. The reason for the surge in OI was due to the fact that BTC had dipped below $29,000.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Many traders were optimistic about BTC’s future and had gone long on the cryptocurrency. However, due to the decline in BTC’s price, many of these long positions were liquidated. Could this be the reason behind the king coin’s unusual behavior?

At press time, Bitcoin was trading at $28,800. Its MVRV ratio had also fallen, implying that most addresses were not profitable at the time of writing.