BTC’s hashrate leads to rising tensions- Is mining industry at a crossroads?

- Bitcoin hashrate is at an all-time high, and competition for block rewards is fierce.

- Miners’ revenue has declined, and the selling pressure may increase anytime soon.

Bitcoin’s hashrate reached a new all-time high recently. This increase in hashrate meant that more miners are participating to keep the network secured and more decentralized. However, it also meant that the competition for block rewards was becoming more fierce and that some miners are likely to be pushed out of the market.

Miners face uncertainty

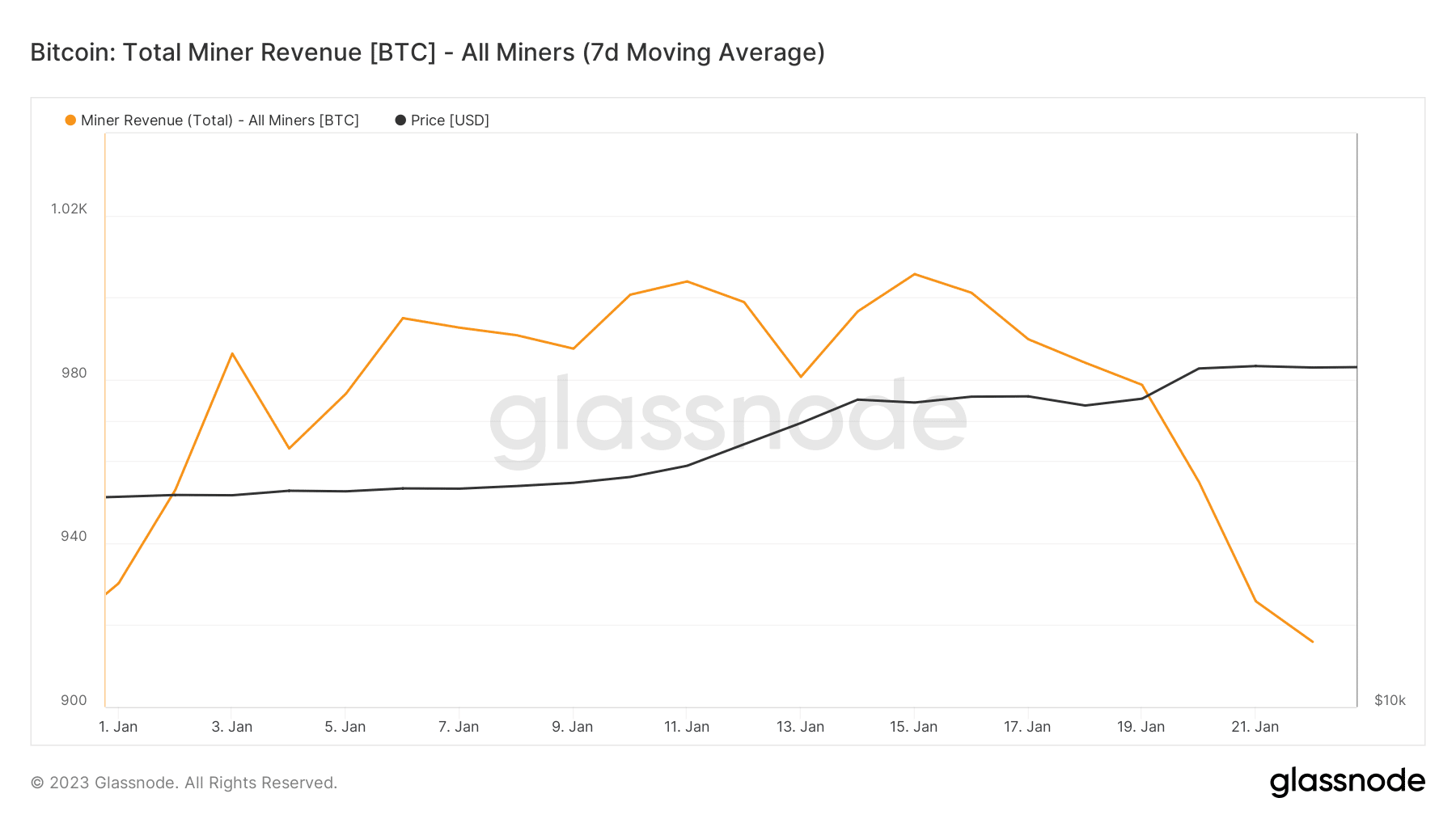

One of the reasons for the growing tension among Bitcoin miners is the decline in miner revenue. As the hashrate increases, the difficulty of mining new blocks also increases, making it harder for miners to earn rewards. This is further compounded by the decline in miner inflow, which suggests a decline in rewards received by miners.

How many are 1,10,100 BTC worth today

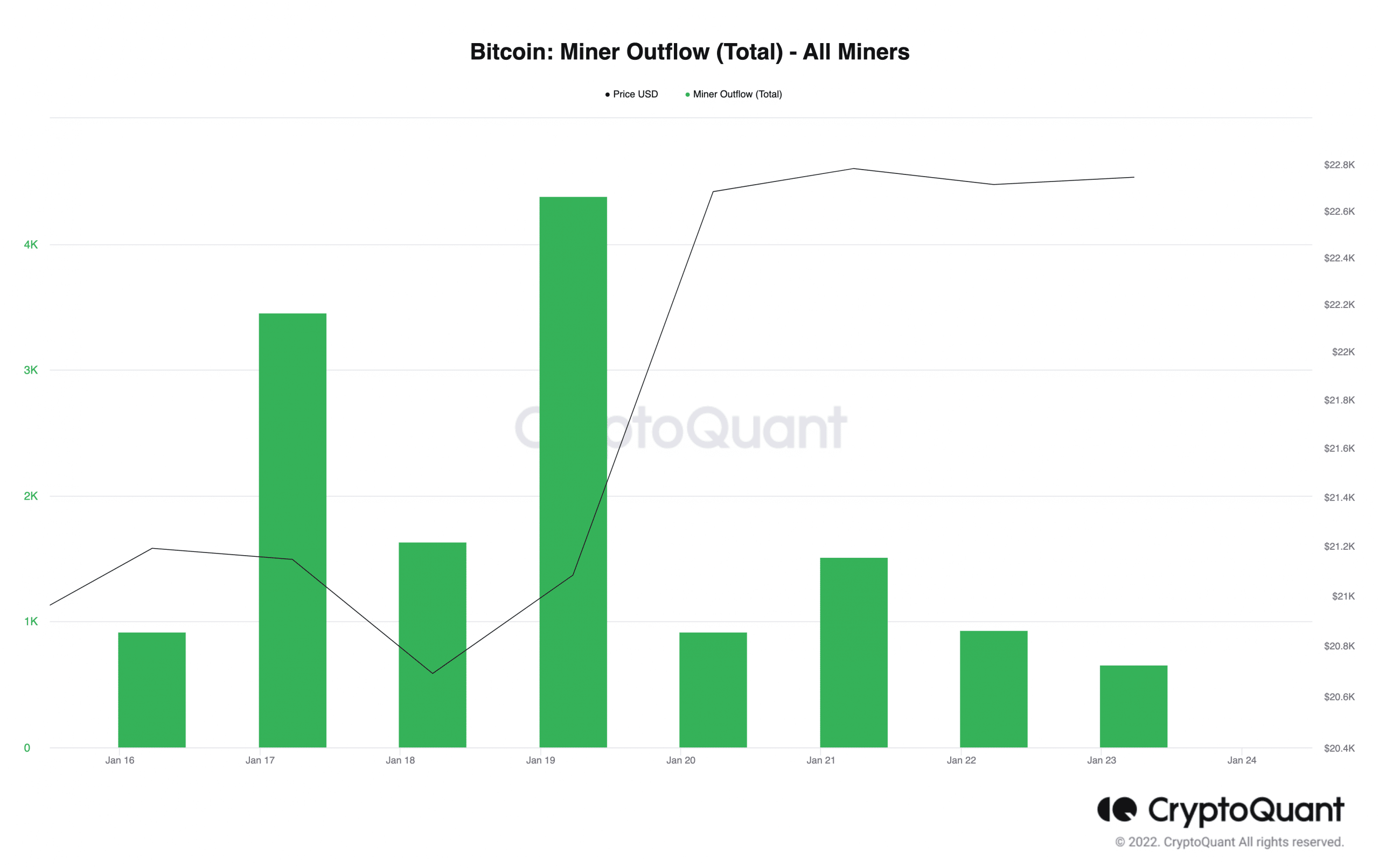

Miner outflow is another metric that could increase due to the above-mentioned factors. Thus, affecting Bitcoin’s prices in some way.

Well, miner outflow, primarily increases when miners sell their mined Bitcoin to cover expenses, pay off debts, or simply take profits. As miner revenues decline, more miners may choose to sell their holdings, further driving down the price of Bitcoin.

Calm under pressure

But it won’t be just miners who would be looking to sell their holdings. Many Bitcoin holders might as well participate in selling. This is because a large number of addresses holding Bitcoin were observed to be profitable. According to glassnode’s data, the percentage of Bitcoin addresses in profit reached an 8-month high of 67.287%.

Read Bitcoin’s Price Prediction 2023-2024

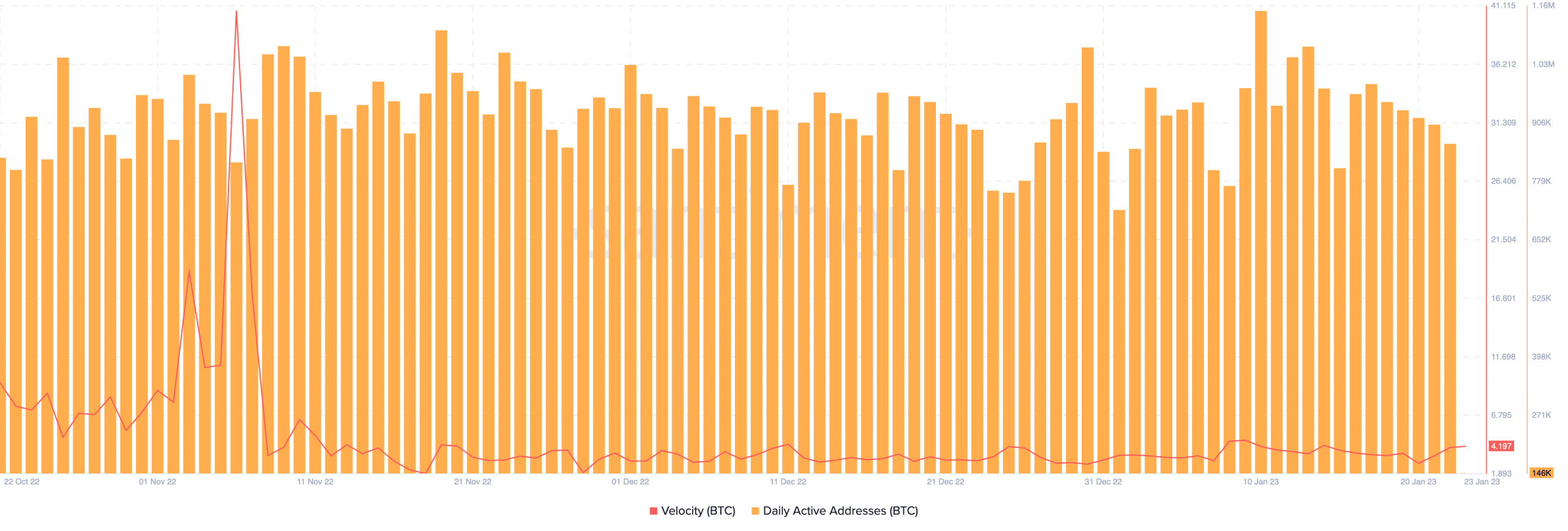

However, at the time of writing, it was observed that Bitcoin holders were not transferring any BTC. This was showcased by the decline in the velocity of BTC over the last month. The daily active addresses of Bitcoin also remained constant during this period.

That said, the price of Bitcoin at press time was $22,729.18 and it increased by 0.61% in the last 24 hours. Despite the growing tensions among miners and the decline in miner revenue, the price of Bitcoin continues to rise.

However, it remains to be seen how the mining industry will adapt to the changing landscape and how the ongoing tensions will affect the overall stability and security of the Bitcoin network.