Can Ethereum lead the next leg of the bull run?

With Ethereum’s price retesting its ATH levels, it is time to either blast-off or crash for the coin. Regardless of what happens, ETH seems to be setting itself up to come out on the top for a new leg of the rally. As bulls recuperate their momentum, it is a ‘make or break’ moment for ETH and by the looks of it, it just might lead the new bull run.

Here are some of the reasons why the next leg of the bull run with be Ethereum-driven.

Institutions

Before the start of the bull run, institutions noticed bitcoin’s performance during the pandemic and grew interested in the asset as an alternative form of investment. What followed next was a reaction to this interest, ie., the flow of capital. As this capital hit a tipping point, the price witnessed a surge. Although a portion of the capital went to Ethereum, it wasn’t enough.. 2020 was not just a time where BTC was noticed, it was also a time when institutions noticed the DeFi summer and the potential it holds. While bitcoin may be the ‘gateway drug’ of sorts, institutional investors will eventually want to divulge and invest in ETH and DeFi.

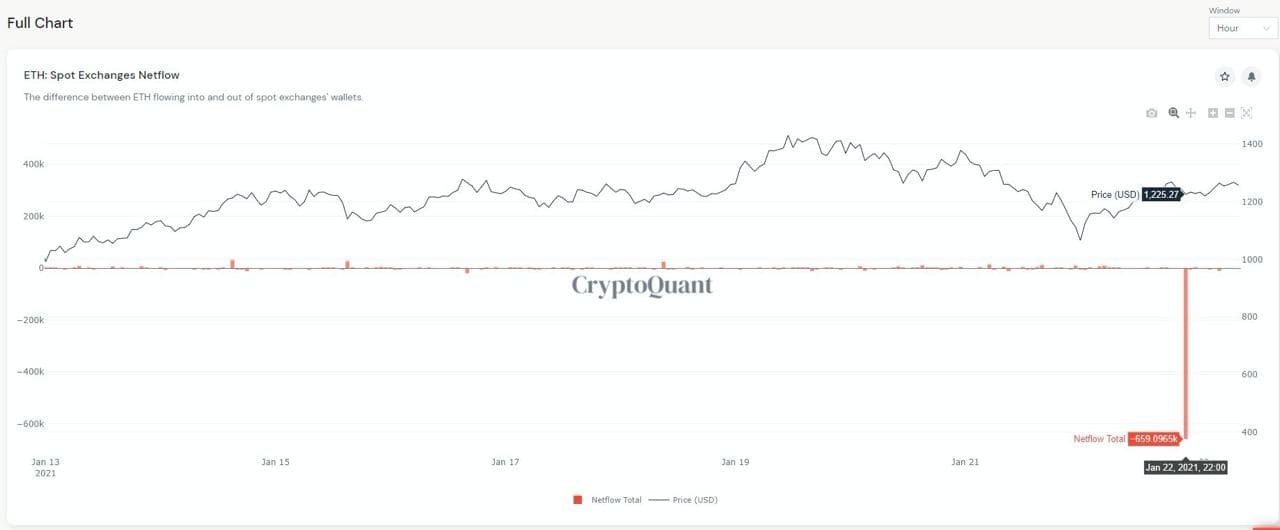

Source: CryptoQuant

In fact, this might already be happening as 659,000 ETH was withdrawn from spot exchanges on January 22.

This has also lead to a drop in ETH exchange holdings from 16.6 million ETH to 15.5 million ETH. With more ETH taken out of exchanges, the coin will either be held off for a sale at a later point in time or to stake in the consensus mechanism; either way, this is bullish for ETH.

The initial reaction to this was the price’s retest of its ATH. The more long-term reaction to this will be an investment from other institutions leading to a ETH’s blast-off and further price discovery.

Outlet for ETH

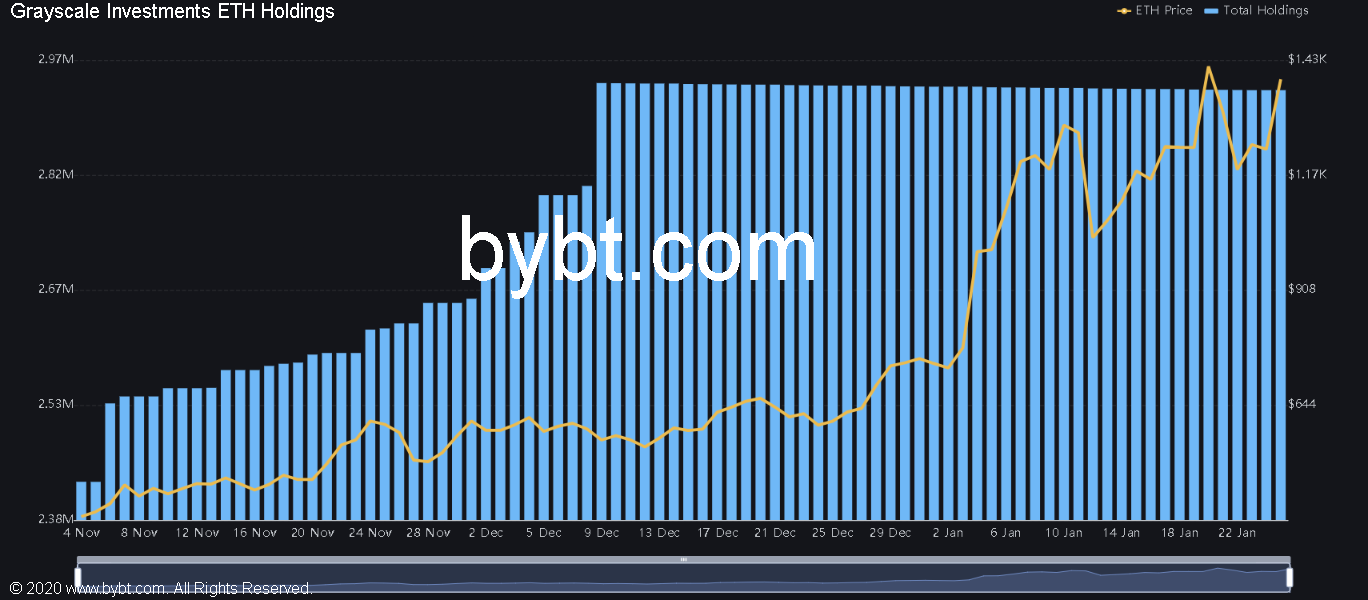

Grayscale is the main platform for US investors to buy ETH. However, the same isn’t true for BTC. CME is the main player from the traditional world that supports BTC investment. With CME planning to launch ETH futures on February 8, this just might change how institutions view ETH.

An uptick in retail interest?

Source: ByBt

Although retail ETH-interest is mainly via crypto exchanges, there are plenty who are investing via Grayscale. The ETHE premium can be a pseudo indicator of the retail demand. Hence, a list on CME will not only draw institutions to invest money in ETH, but this will also cause a FOMO pushing the price higher. These factors all add up for Ethereum and will determine how strong its next upward push is going to be.