Chainalysis report reveals this about centralized vs decentralized exchanges

Crypto exchanges are vital parts of the crypto ecosystem. And, to that end, both centralized and decentralized exchanges offer attractions of their own.

Chainalysis’ November research report on the crypto exchange showed what trends are taking shape, and where the industry is headed as a whole.

Exchanging blows

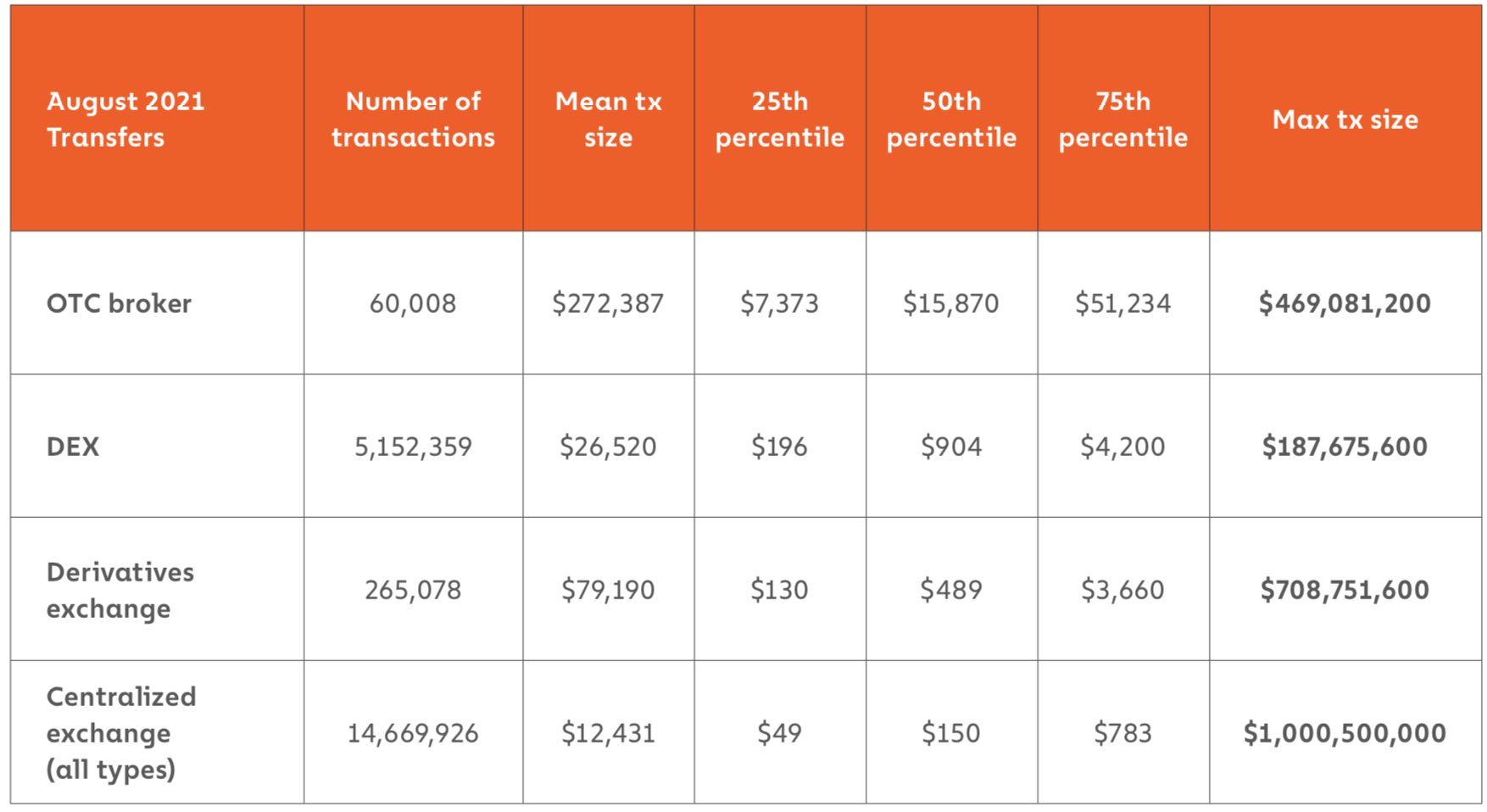

Comparing institutions such as centralized exchanges, DEXes, high-risk exchanges, OTC brokers, and derivatives exchanges, Chainalysis’ report stated,

“Large DEXes grew their transaction volume substantially during the time period studied, as did large OTC brokers and large centralized exchanges.”

It went on to add,

“On the other hand, nearly all small exchange categories regardless of business model saw a decrease in their cryptocurrency received.”

“Across all categories however, the number of small exchanges has dropped, suggesting the exchange market can no longer support niche players. The lesson? Exchanges need to reach a mass audience, or a small audience of large-scale traders, in order to stay in business.”

Source: Chainalysis

CeFi vs DeFi

Source: Chainalysis

“OTC brokers frequently help such users execute extremely large trades that would strain the liquidity of open exchanges or possibly affect prices — the growth of OTCs as a category suggests this may be a growing use case.”