High volumes put ProShares Bitcoin futures ETF among “top 2%” of all ETFs

ProShares Bitcoin Strategy ETF was listed with major excitement in the US as the first-ever crypto-ETF on 19 October. After its bumper listing, BITO recently experienced “25% turnover” in one day, as per Bloomberg’s senior analyst Eric Balchunas.

Balchunas noted that with trade volumes close to $400 million in one day, BITO entered the “top 2%” club in the entire ETF ecosystem.

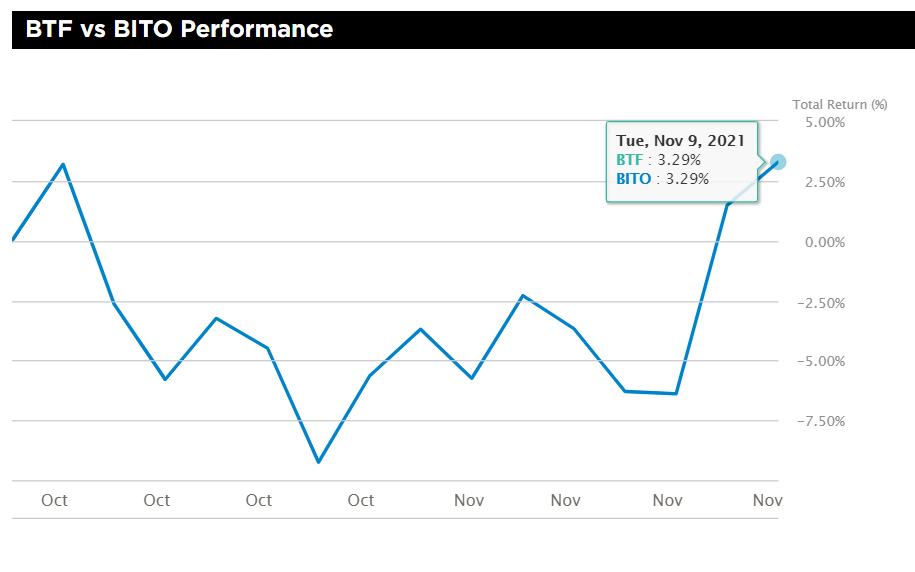

Having said that, Valkyrie Investments, the second U.S issuer of a Bitcoin Futures ETF, also saw some good trading. The analyst noted that both the ETFs had their “biggest volume days in about two weeks.”

Source: ETF.com

If we draw comparisons, BITO has an estimated asset under management of $1.38 billion. On the other hand, BTF’s AUM was calculated at $58.97 million, at press time. The latter has an average daily volume of close to $18 million.

However, Balchunas noted that the stellar trades still fail to compare to the launch volumes. In the context of BITO, he said,

“It just seems so meh compared to its insane first two days but this kind of consistent flow-age is highly rare for new launch.”

Additionally, the figures are noteworthy against gold as BITO is “already seeing about half the options volume as $GLD.”

At this point, it is also worth mentioning that the old player Grayscale reported some exploding numbers as well. The company reported that it had crossed $60 billion in AUM on 11 November. The Grayscale Bitcoin Trust (GBTC) did $473.7 million in notional volume, as per CEO Michael Sonnenshein.

With that, calls for spot crypto ETFs have grown louder.

Grayscale is hopeful on its BTC Spot ETF application, while BlockFi has recently applied for one as well. Meanwhile, there are many players awaiting SEC vetting including Bitwise. At this point, the closest application to an SEC decision is VanEck’s spot application due on 14 November.

Last week, Congressmen Tom Emmer and Darren Soto wrote a bipartisan letter to the chair of the Securities and Exchange Commission (SEC), Gary Gensler. They questioned the SEC’s disapproval for a spot Bitcoin ETF when two Bitcoin futures ETFs are already listed.

In a Tweet earlier today, Bitwise CIO Matt Hougan compared spot to futures ETF and stated,

“But we believe most long-term investors would be better served by spot exposure…”