Chainlink, Dash, DigiByte Price Analysis: 17 April

A comparison of correlation stats and recent altcoin price performances makes for interesting reading these days. While the past few trading sessions saw Bitcoin, the world’s largest cryptocurrency, trade below the $62k level after hitting its ATH just recently, market altcoins such as Chainlink, Dash, and DigiByte have surged lately. However, whether this would be a long-term trend going forward, especially with the alt season gaining steam, is uncertain at this time.

Chainlink [LINK]

Source: LINK/USD on TradingView

Chainlink has been one of the market’s best-performing cryptocurrencies over the past 6-10 months, with the alt enjoying a market cap of over $18 billion at the time of writing. Like for most alts, the month of April came at a good time for LINK since the crypto was threatening to continue trading within a tight channel. In the last 7 days alone, Chainlink hiked by over 37%, with the altcoin hitting an ATH of $44.15 just a few hours ago.

In fact, the said hike was accompanied by an uptick in trading volumes too.

LINK’s technical indicators backed the altcoin’s price action. While the Parabolic SAR’s dotted markers were under the price candles, the MACD line was climbing well above the signal line and the histogram to indicate that the alt’s market was heavily leaning towards the bulls.

Thanks to its ATH, many are expecting Chainlink to go on a long price run, with its rally predicted to make it one of the leaders of the altcoin market.

Dash [DASH]

Source: DASH/USD on TradingView

One of the market’s leading privacy coins, Dash, like Chainlink, has seen its value climb exponentially over the past week or so, with the alt appreciating by almost 50% in one week alone. The scale of the hike has been surprising, to say the least, especially since Bitcoin failed to capitalize on its latest ATH to consolidate its position higher on the charts.

At the time of writing, the alt’s technical indicators were all in favor of the market’s bulls. While the mouth of the Bollinger Bands was widening to highlight more near-term price volatility, the Relative Strength Index had flattened in the overbought zone. This suggested that there may not be any more upside, with a possible correction likely soon.

While the crypto remains popular among many in the community, privacy coins have often come under attack from governments and mainstream media. The Biden administration’s blacklisting of an address containing Dash as part of its sanctions against Russia was a case in point.

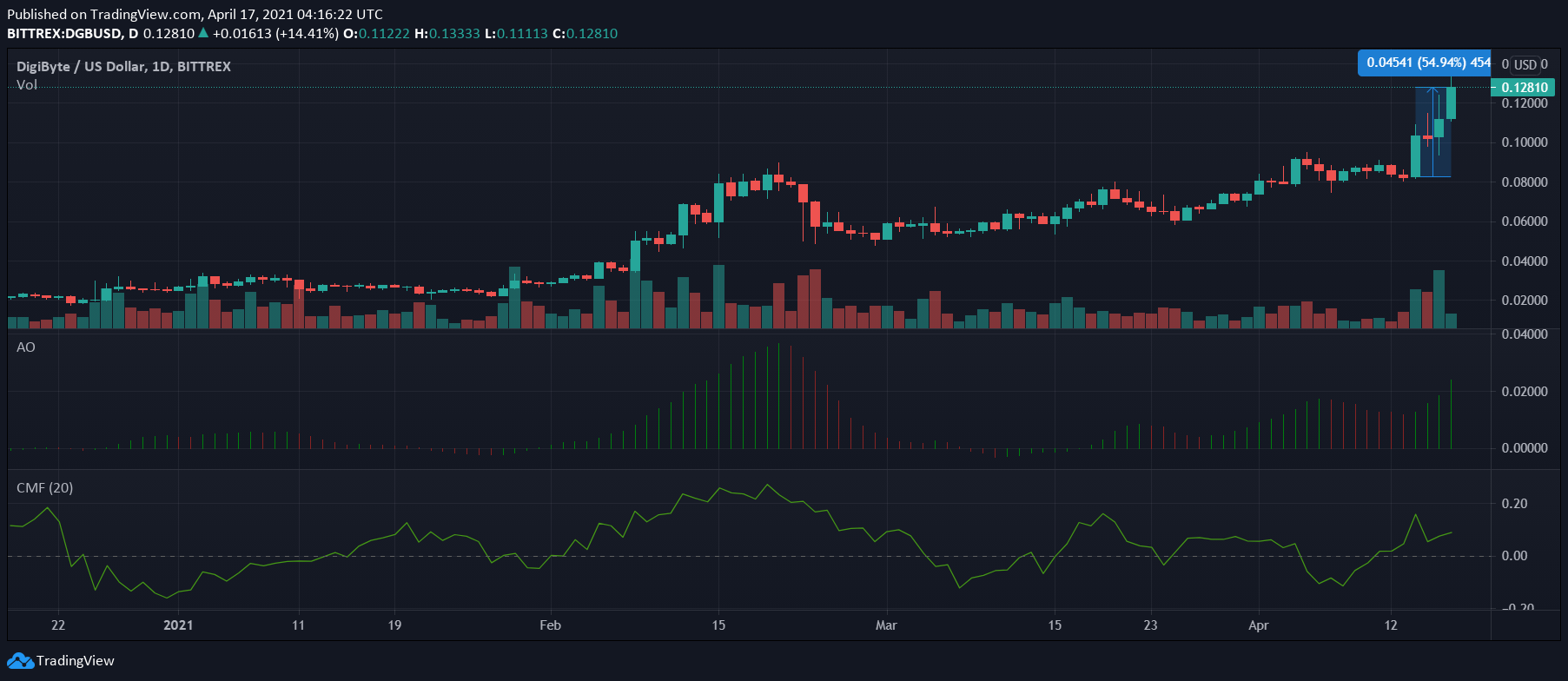

DigiByte [DGB]

Source: DGB/USD on TradingView

DigiByte has been on a gradual uptrend since the market-wide depreciation on the 25th of March, with the same punctuated by a series of brief corrections. The said uptrend, however, gathered a lot of pace over the past few days after DGB surged by 55% in just 4 days. On the back of healthy trading volumes and its steady price movement over the course of the past few weeks, it would seem that a trend reversal wasn’t likely anytime soon.

While the Awesome Oscillator’s histogram flashed bullish signals, the Chaikin Money Flow was climbing towards 0.20 and underlined the growing capital inflows in the market.