Coinbase gets hit with a sanction in the Netherlands, details inside

- Coinbase was sanctioned over $3 million for failing to register with Dutch authorities duly.

- The exchange was also listed as one of the creditors of FTX in the latest court filings.

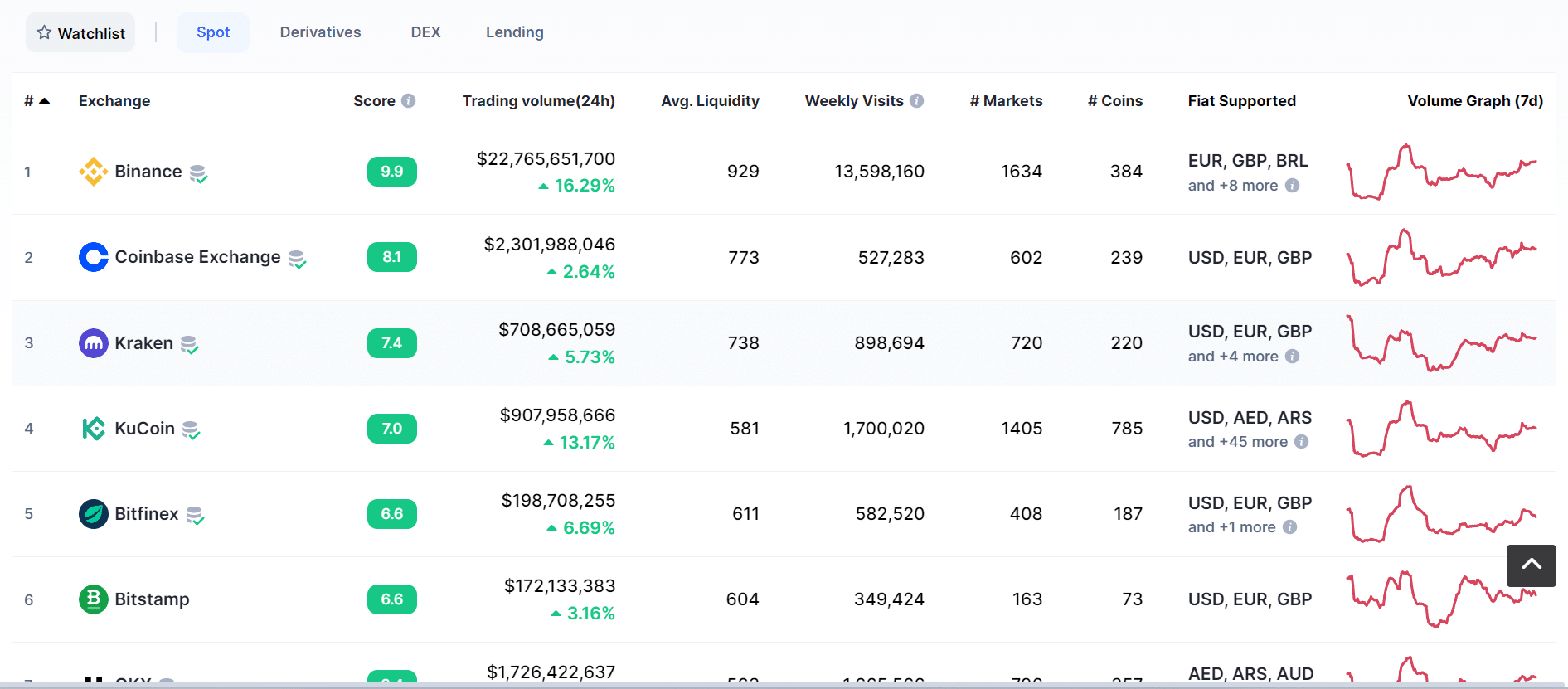

Following the FTX collapse, Coinbase rose to take over as the second-largest cryptocurrency exchange behind Binance. While attempting to broaden its users and services, it has been sanctioned by one of the countries it operates in. Is this most recent sanction sufficient to spark a FUD?

Coinbase falls victim to noncompliance sanction

The Dutch central bank has fined Coinbase $3.62 million, or 3,325,000 euros, for providing cryptocurrency services to Dutch users without duly registering with appropriate authorities. Dutch legislation mandates registration for crypto service providers as a means of combating money laundering and the financing of terrorism.

Between November 15, 2020, and August 24, 2022, Coinbase allegedly ran without proper registration from the relevant authorities. The DNB said that Coinbase had gained an unfair competitive advantage due to its failure to pay supervisory costs until September 22, 2022, when the company finally registered properly.

According to De Nederlandsche Bank, the penalty was enhanced from its original $2.18 million due to the seriousness of the noncompliance (DNB). The number of users that Coinbase has in the Netherlands and the fact that it is one of the top cryptocurrency exchanges in the world contributed to the fine increase.

However, this sum was decreased by 5% because it was understood that the company’s ultimate goal was to become registered. Coinbase has until March 2 to file an appeal.

Enough for FUD?

This new information is not reason enough to start spreading FUD about the exchange. While the fine will be appealed, it will not significantly impact the exchange’s finances. CoinMarketCap reports that the daily volume of trades on the platform is over $2 billion. At the time of writing, the volume was above 2.2 billion, an increase of more than 1% from the day before.

Meanwhile, last Friday (20 January), under Judge John Dorsey’s supervision, the FTX’s creditors list was officially accepted. Court filings previously revealed FTX owed its top 50 creditors $3.1 billion.

Based on the filing, it showed that FTX’s top ten creditors are owed an average of almost $100 million. It was recently revealed that Coinbase was among the FTX’s unsecured creditors.