Cosmos [ATOM] short traders stand to gain if BTC plies at this level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ATOM was in a price correction that could extend to $9.661.

- A move beyond $10.221 would invalidate the bearish forecast.

Cosmos [ATOM] rallied from mid-December 2022 to early January 2023, rising from $8.5 to about $10. It offered over 20% gains to investors in the same duration.

Read Cosmos’ [ATOM] Price Prediction 2023-24

However, the king coin, Bitcoin [BTC], turned bearish, forcing most of the altcoins into a correction. ATOM dropped below $10.038 soon after BTC fell below $16.81k. At press time, ATOM was trading at $9.955, and technical indicators suggested a further downtrend was likely.

ATOM on a free fall: Will the bulls find steady support?

On the 12-hour chart, the Relative Strength Index (RSI) had reached the overbought zone and retreated. Similarly, the Money Flow Index (MFI) had peaked accumulation, and some distribution had occurred.

Moreover, On Balance Volume (OBV) dipped, reinforcing the drop in trading volumes and limiting buying pressure. Therefore, the conditions were ripe for the price reversal that followed. However, the correction could extend, given the dip in the OBV.

If selling pressure intensified, ATOM could break below the $9.951 or 100-period EMA of $9.933. It could find new support at $9.825 or $9.661. Short traders can use these levels as short-selling targets.

However, a breakout above $10.221 would invalidate the above bearish bias, especially if BTC remains bullish. Therefore, investors should monitor BTC movements and any RSI rejection, especially at the midpoint of 50 units.

Cosmos saw a decline in trading volume and investors’ confidence

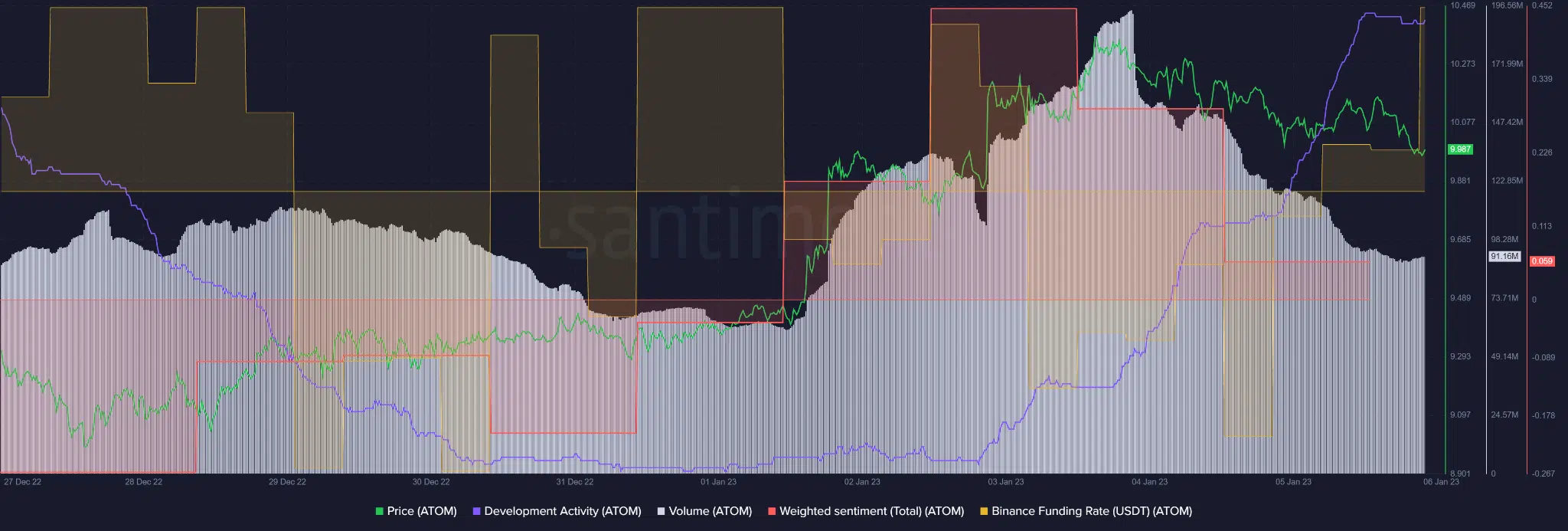

According to Santiment, ATOM’s development activity dipped by the end of December 2022, bottoming out on 31 December. However, it has increased gradually since 1 January, boosting investors’ confidence, as evidenced by improved sentiment in the same period.

However, weighted sentiment retreated toward the neutral level as prices dropped with the decline in trading volumes. At press time, development activity remained high, yet ATOM’s prices dropped lower.

How many ATOMs can you get for $1?

Nevertheless, there was an increase in demand in the derivatives market, as shown by the rise in Binance Funding Rate for the ATOM/USDT pair.

Although the rise in demand in the derivatives market could likely influence a price change, investors should track any uptick in volume and a bullish BTC to confirm a trend reversal.