Cosmos has these expansion plans in place for 2023, but does ATOM approve

- ATOM could witness significant demand from DEXes in the future

- ATOM traders could watch out for an upcoming bullish trend

The Cosmos blockchain maintained steady development in line with its long-term goal. The latest update from Informal Systems, one of the developers on the Cosmos network, reaffirmed its commitment towards development. Furthermore, it highlighted some of the biggest upcoming developments to look forward to.

Read Cosmos’ [ATOM] price prediction 2023-2024

According to the Informal Systems announcement, the first major development will be the Interchain Security rollout. This will take place early next year, as soon as January 2023. This development will pave the way for the launch of consumer chains.

1/ At Informal, we’ve been heads down preparing for Interchain Security launch in January 2023!

Over the coming months, we will welcome the first few consumer chains to the @cosmoshub – all of which will provide valuable services to @cosmos.

Who are they? Let’s dig in! ✨✨ pic.twitter.com/ai2BpzVS0Z

— Informal Systems ? (@informalinc) November 21, 2022

The consumer chains will facilitate other key launches such as Neutrol which will enable smart contract development on Cosmos. These developments are critical for the Cosmos ecosystem because they will fast-track adoption and utility.

Informal Systems also revealed that the Interchain Security launch will also come with a roll out of the Duality XYZ DEX.

It’s all about ATOM…

The consumer focus will likely trigger more demand for ATOM. We will likely see an increase in demand from the DEX side. Liquid staking will be a feature in Interchain Security. These are just some of the potential demand drivers that the Cosmos ecosystem will create in the next few months.

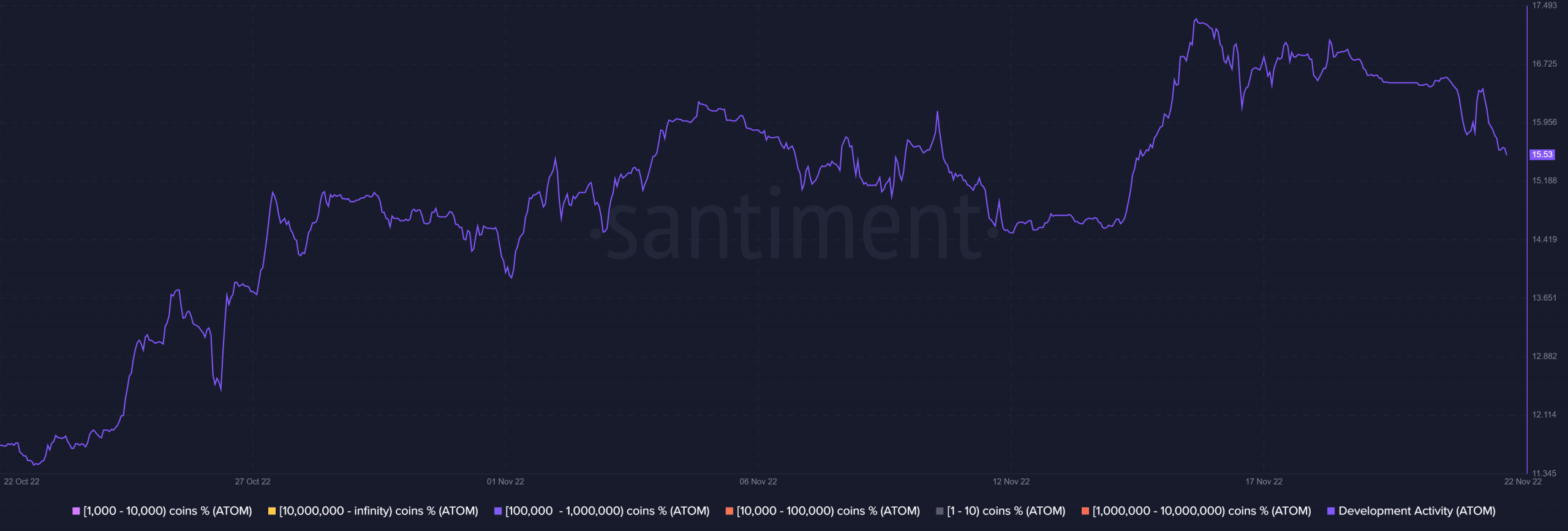

Cosmos has already seen an upsurge in its development activity metric. This was confirmation that the network developers have been busy working on the upcoming upgrades.

Healthy development activity is one of the metric that determines investor confidence. But, ATOM’s price action leaned towards the bearish side especially in the last two weeks. Its $8.85 press time price represented a 42% drop from its current monthly high.

ATOM hovered above the oversold zone at the time of writing. This meant it will be oversold if the drop extended below its current level. Furthermore, traders could also observe a return of bullish momentum if buyers start to trickle in.

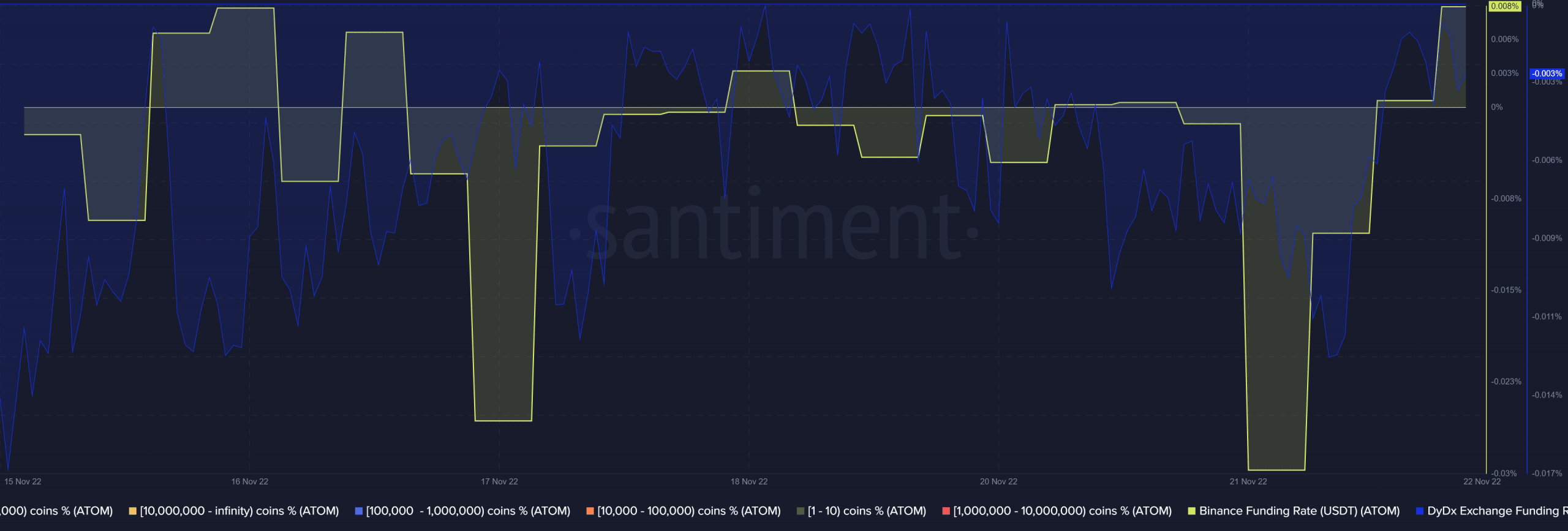

There have been some changes at ATOM’s current price level that indicated a potential bullish pivot ahead. For example, the Binance and DYDX funding rates registered an uptick in the last 24 hours. This was a sign that demand in the derivatives market was recovering.

ATOM investors can also expect a mid-week bullish bounce if the altcoin manages to secure enough bullish volume. Especially, if we factor in its heavy discount. Despite this expectation, investors should still consider the possibility of more downside. The latest bearish conditions have seen ATOM drop below previous support levels.