Crypto-regulations and the question of another ‘Snowden’ showdown in the making

Anti-money laundering laws came under the spotlight following the 11 September 2001 attacks. However, money laundering has been a major crime in the U.S since 1986. But, that’s not all. In fact, money laundering cases have been a major concern across the cryptocurrency sector too.

In fact, CipherTrace’s 2020 cryptocurrency crime and anti-money laundering report revealed that in 2020, major crypto-thefts, hacks, and frauds totaled $1.9 billion — The second-highest annual value in crypto-crimes yet recorded.

Money laundering and the 9/11 attacks?

Well, many countries enacted money laundering laws in the 20th century. But, it was only in the period following 9/11 that the whole world began to recognize the need to eliminate the funding sources of international criminal organizations. Under precautions, the U.S. government adopted the Patriot Act which made it easier for the government to collect communication records.

Well, peradventure, as some educators believe, this is exactly where the problem lies. The freedom of governments to collect communication records has granted law enforcement too much power it could easily abuse.

Consider this – Everyone remembers the whistleblower Edward Snowden. To recollect, law’s misuse became a national focus in 2013 when a former National Security Agency (NSA) contractor exposed the government’s use of its powers to establish a surveillance system that sucked in the telephone, the Internet, and location records of the entire population across the globe.

In this regard, it is also to be noted here that according to documents obtained by The Guardian, PRISM would appear to allow the GCHQ to circumvent the formal legal process required in Britain. This, in order to seek personal material such as emails, photos, and videos from an Internet company based outside of the country.

Here is the crypto-connection

Now, here was a thing called cryptocurrency which was completely decentralized and it massively attracted people’s attention. Regulators came to firmly believe that cryptocurrency was mainly being used for illicit activities. However, the overall impact of Bitcoin and other cryptocurrencies on money laundering and other crimes is sparse in comparison to cash transactions.

Meanwhile, over the years, Bitcoin and other new cryptocurrencies have further made it difficult for law enforcement to trace illicit transactions. There is, thus, a great need for education so as to safeguard investors’ interests. In fact, according to crypto-experts, regulations are also required in order to keep money laundering and other illicit crypto-crimes at bay.

Notably, there have been many reports where criminals used crypto money laundering to hide the illicit origin of funds, using a variety of methods. The most simplified form of Bitcoin money laundering leans hard on the fact that transactions made in cryptocurrencies are pseudonymous.

In fact, not so long ago, India’s S Jaishankar claimed that Bitcoin was being used as an instrument in the terror outfit’s continuing fund flows.

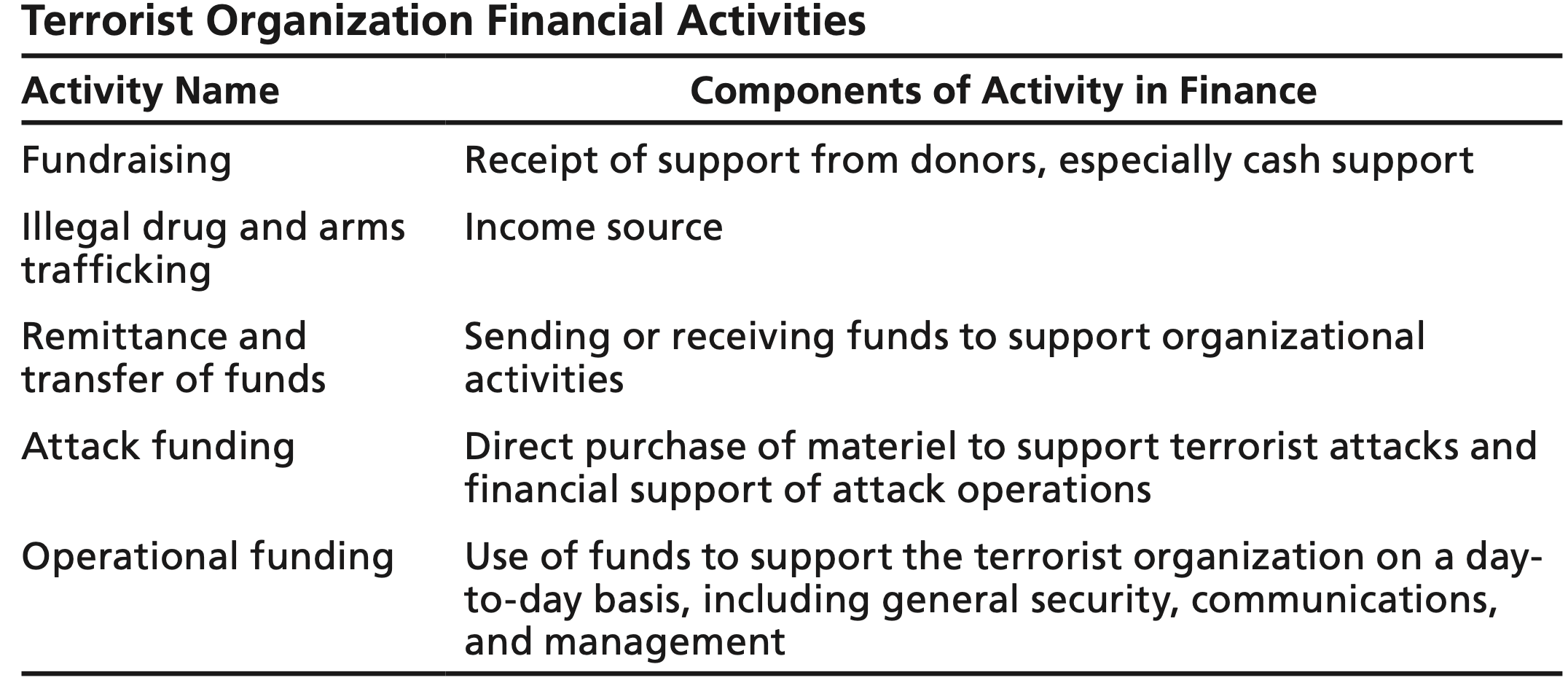

According to a published report, here are outlined subcategories for terrorist use of money,

Source: Rand.org

These categories pose significant challenges to terrorist organizations’ use of cryptocurrencies. Even so, the speculations still exist. There’s a fear that cryptocurrency cash is being used to finance terrorism or funnel money from illegal activities.

Speculation all around

It is widely known that different crypto techniques are used to carry out illicit activities. As a result, major cryptocurrency exchanges have laid down AML measures to offset frauds, hacks. Crypto-exchanges such as Binance, Robinhood-even, and stablecoin platforms such as Tether have incorporated this to fit in the description set out by the regulators.

Even traders and investors now are looking for regulated exchanges with AML compliance technology that can secure their assets from financial crime and fraud. According to data from Finance Magnates, willingness to share personal information for verification procedures actually rose by 65%.

Consider an example, for instance. One of the latest firms to join this party is Matrix.

Matrix, a global virtual asset trading platform, has announced a partnership with Elliptic, the leading provider of virtual asset risk management and blockchain analytics solutions, to protect traders on its platform as the industry expands. The official press release stated,

“Through the partnership, Matrix brings Elliptic’s reliable analytics solutions to protect all traders on its platform with its anti-money laundering (AML) compliance and risk-monitoring operations.”

In fact, different regions across the globe have acknowledged the same. But, most have also welcomed regulations to keep a strict eye on the massive gains. Interestingly, Abu Dhabi witnessed a significant surge in the crypto-space owing to a robust legal framework.

Financial Services Regulatory Authority Chief Executive Emmanuel Givanakis expressed optimism for the same. That being said, not all countries welcomed tokens with optimism. While the U.S seems to be in an ambiguous situation, countries like China and Pakistan, among others, have separated themselves from these “speculative” assets.

Important thread

It should come as no surprise that governments and regulators have been scrutinizing cryptocurrencies from the outset. It was just a matter of time before they found a line of attack worth pursuing. Well, AML, KYC, 2FA, all echo one thing – Add confidential details.

Moreover, the question here is – Could the rise in the need of sharing information to meet AML standards lead to yet another crypto “Snowden” showdown?

Surprisingly or not, even “crypto-executives” and influencers are now more than happy to oblige to these regulations. For instance, India ranks second in the global crypto-adoption index and its crypto-platform owners have expressed the same sentiments concerning incoming regulations.

But, sharing personal information remains one of the biggest concerns. For example, in a worst-case scenario, any hack or fraud on a platform might possibly lead to an “unknown” central authority possessing some crucial information.

Moreover, it could damage crypto-innovation as well. The cryptocurrency industry has thrived in recent years, in part because blockchain technology promises to disrupt various industries, particularly finance.

On the question of fundraising too, cryptocurrency companies have been able to raise money quickly without having to follow complex security laws. Retail investors have been able to put money into projects they otherwise would not have been able to access.

More headaches?

Even if regulations are incorporated for law-abiding cryptocurrency users, getting verified to trade on an exchange is a painstaking process. They must give out a wealth of personal data, including their home addresses, scans of government-issued IDs, and photo or video selfies.

However, for criminals, it’s easier. All one needs to do is pay as little as $150 in the black market for a ready-to-use, verified account. Thus, bypassing the mandatory requirements of regulatory aches yet benefitting from crypto-gains.

To be clear, “verified” in this context does not mean legitimate. Underground vendors create these accounts with other people’s identities or under made-up names, tricking the exchanges into verifying them as valid users. They then advertise these verified accounts for sale on Internet forums and on Telegram.

Surprisingly, as far as money laundering is concerned, there was a job posting as well. It was well explained by a recent dialogue on the CCCC.sb forum.

“Looking for a job as a money launderer. Send offers to my DM,” one user wrote in July.

“Of a drop,” corrected another user in a reply before describing the role,

“Only your face is needed. To pass video verification via WhatsApp. From 1,500 to 2,000 rubles [$20-$28] for a pass, you can do several passes a day.”

Overall, eight to ten years down the line, we might discover another “Snowden” breaking out from behind-the-curtain crypto-activities that go on within this “centralized” cryptocurrency ecosystem.

Furthermore, cryptocurrency is still a nascent industry with only basic mandatory measures in place. Imagine when it reaches a market capitalization of $10T. The regulations, at that point in time, would be even stricter.