DAI stablecoin holders need to be cautious now- Here’s why

The U.S. Treasury Department imposed sanctions on virtual currency mixer Tornado Cash. Subsequently, Circle, the issuer of the USD Coin (USDC), froze over 75,000 USDC linked to the sanctioned Tornado Cash addresses.

Indeed, a move that stirred up fears of stablecoin censorship in the crypto community. Well, undoubtedly, this might just start another debacle for yet another stablecoin.

Looking for stability?

DAI is the fourth largest stablecoin in the cryptocurrency market. And, the fifteenth largest asset by market capitalization. The Ethereum-based stablecoin DAI had major on-chain movement, particularly during ETH‘s rebound back to $2,000.

The movements can be observed in Santiment’s graph below. Herein, DAI’s circulation hit an all-time high (ATH) of 888 million, whereas supply on exchanges slid to 5.2%. Thereby, marking the lowest figure since February.

The fall of DAI’s supply on exchanges underlines a decline in the interest of institutional and retail investors to enter the markets. This doesn’t come as a total surprise given DAI’s relation with the ‘already-troubled’ stablecoin- USDC.

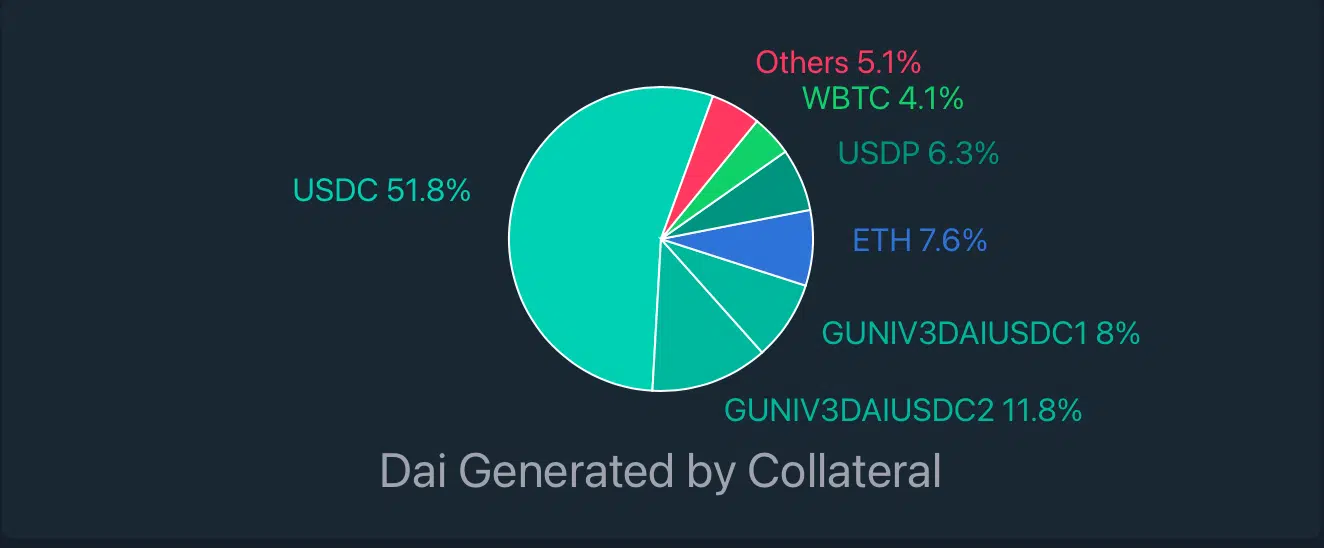

More than 50% of MakerDAO’s DAI is collateralized by USDC, according to Dai Stats. As per the pie chart here, the percentage stood at 51.8%.

Source: Dai Stats

Needless to say, following the USDC fiasco, renowned crypto enthusiasts censured the dependence here.

For instance, MakerDAO founder Rune Christensen raised concerns over the asset’s heavy reliance on a centralized asset in USDC.

In fact, he even urged members of the decentralized autonomous organization (DAO) to “seriously consider” preparing for the depeg of DAI from USD.

This move could offset any risks relating to Circle’s recent freezing of sanctioned USD Coin (USDC) addresses. In this regard, Christensen on a Discord channel opined,

“I think we should seriously consider preparing to depeg from USD. It is almost inevitable it will happen and it is only realistic to do with huge amounts of preparation.”

This certainly caused a stir within the crypto community. Yearn.finance core developer banteg suggested that MakerDAO was considering converting all its USDC from its peg stability module into $3.5 billion in Ether.

If they really do this, I suggest writing something similar to this contract. Then you can DCA at a certain rate and buy at the current oracle price. The buys will be automatically filled by the MEV bots, which just add it as another possible trade leg.https://t.co/epkHtPQITx

— banteg (@bantg) August 11, 2022

Theoretically, converting USDC reserves into ETH could remove the risk of MakerDAO’s assets being frozen by Circle.

However, not everyone agreed with the stated initiative. Ethereum co-founder Vitalik Buterin tweeted,

Errr this seems like a risky and terrible idea. If ETH drops a lot, value of collateral would go way down but CDPs would not get liquidated, so the whole system would risk becoming a fractional reserve.

— vitalik.eth (@VitalikButerin) August 11, 2022

Overall, 2022 has been the year of broken stablecoins as a myriad of dollar-pegged crypto assets depegged from their dollar value.

On 14 August, the Polkadot-based stablecoin alpaca usd (AUSD) dropped below a U.S. penny in value. Later, it bounced back to the $0.95 region hours later.