DEXs see increase in trading volume as investors tread carefully around CEXes

- With the recent events in the crypto space, investors seem to be putting more faith in DEXes

- DEXes has seen recently seen an increase in trading volume and TVL in recent time

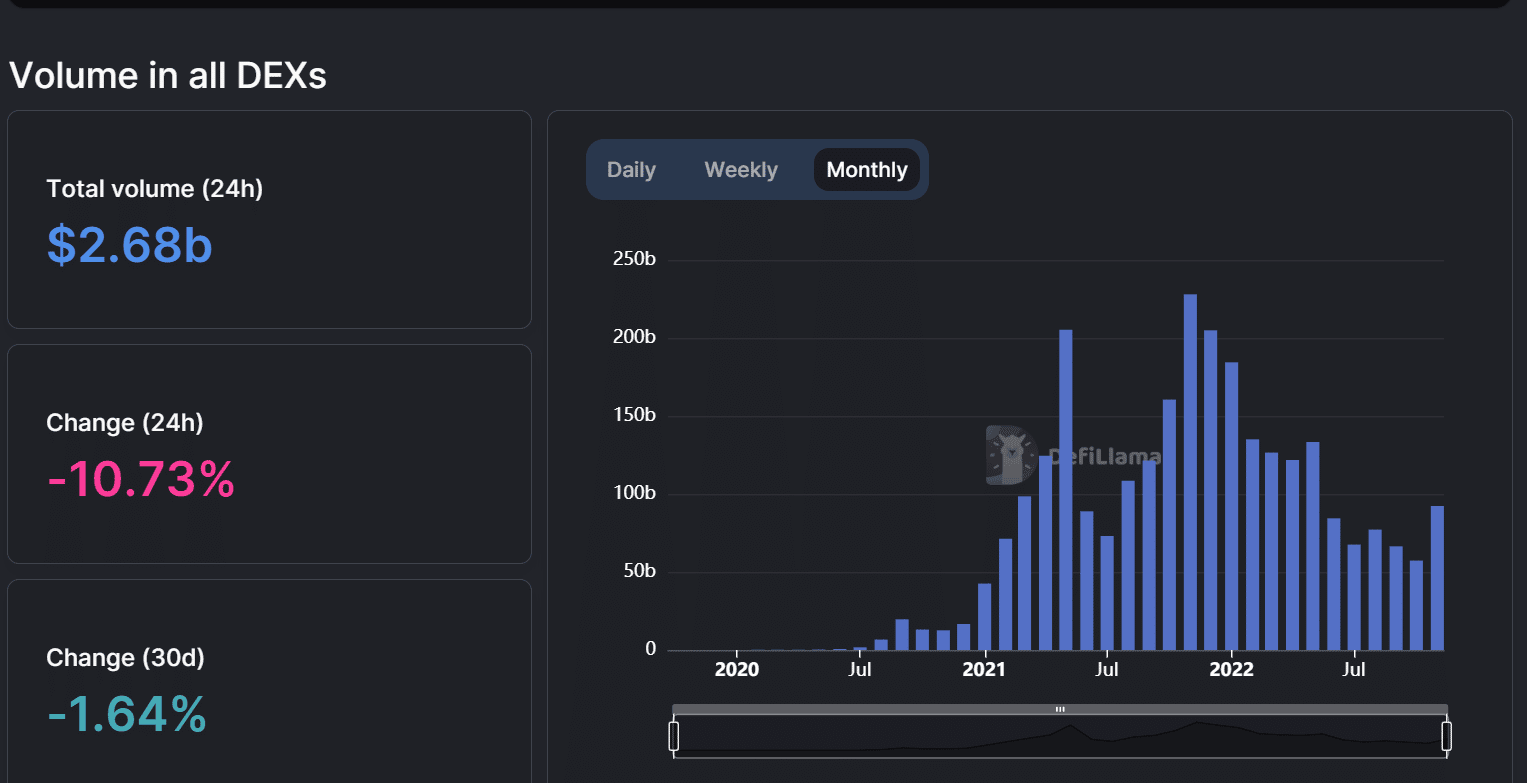

Investors have started viewing centralized exchanges (CEXes) with skepticism as fear and uncertainty have engulfed the cryptocurrency market. However, despite the current state of CEXes, their decentralized equivalent seems to be thriving. According to data by Messari, decentralized exchanges (DEXes) have recently experienced a significant spike in volume. But how significant have these spikes been?

DEXes trade volume surge

Messari’s statistics revealed that the top three DEXes, Uniswap, Balancer, and Sushiswap had a combined transaction volume of nearly $7 billion over the previous 30 days. However, a closer look at each one showed how much growth had occurred.

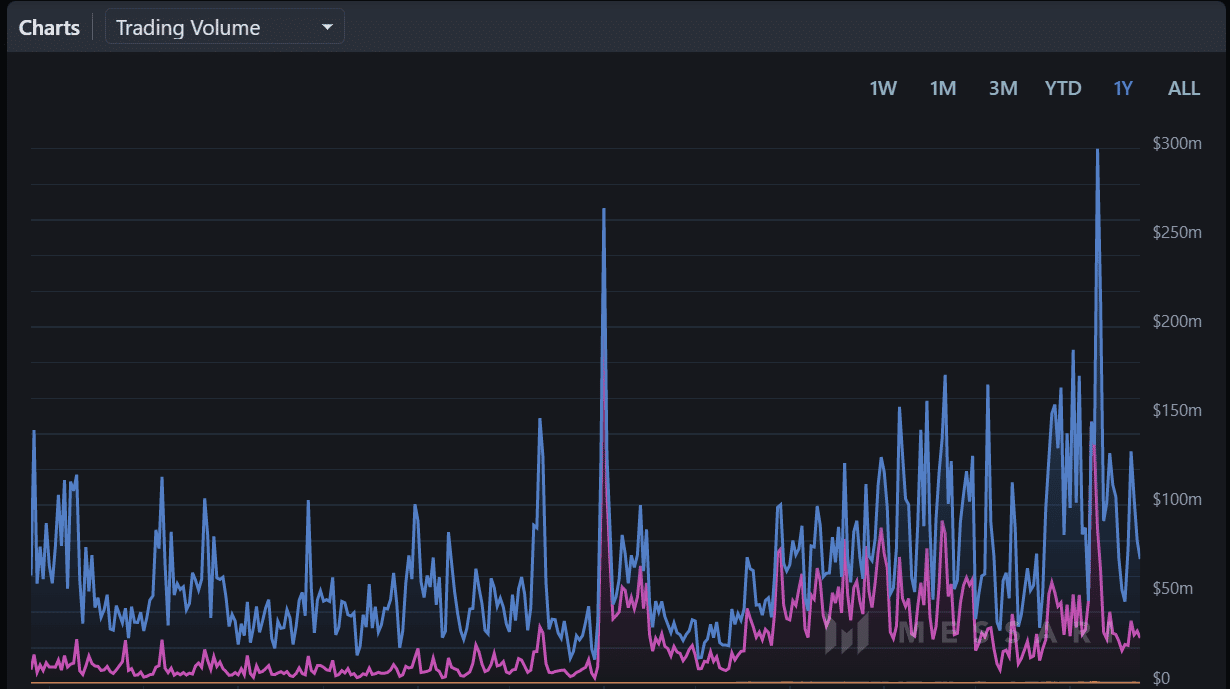

In terms of transaction volume and TVL, Uniswap was ranked first among all DEXes. The trading volume for Uniswap revealed that there had been noticeable rises in recent weeks. This demonstrates the platform’s increased trading activity.

The trading volume for the DEX reached approximately $300 million, which was a record for the year so far, according to the trade volume chart.

It had experienced $3.57 billion in trade volume over the previous 30 days, a rise of 65.32%. Although the TVL showed a modest dip, it still had $2.6 billion, at the time of writing.

In the previous 30 days, its revenue had likewise climbed by over 64%.

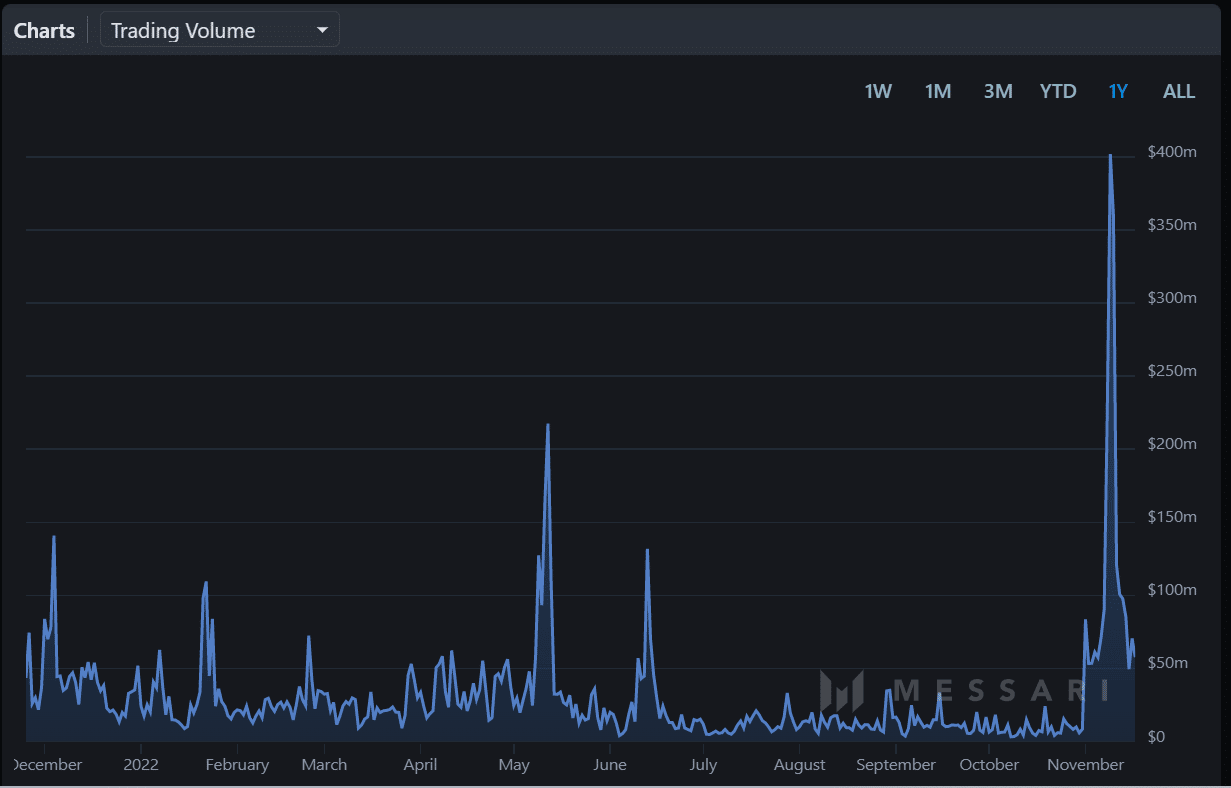

Additionally, a glance at Balancer revealed that the DEX experienced a sharp increase in trade volume. Trading volume reached its all-time high during this time, rising by a staggering 730.38% in the past 30 days to reach $2.09 billion.

The overall revenue climbed by 40.68% and was $1.09 million during the same time frame. Also, TVL had grown by almost 600% and was worth $699 million, as of this writing.

Overall TVL sees an uptrend

It was also evident that there had been a rise in total TVL during November, according to DefiLlama data. From the statistics, it was clear that there had been a reduction in recent months. Starting from $57 billion in October, the TVL observed at the time of this writing was above $92 billion.

The obvious increase in these DEXes’ trading volumes is evidence of how recently that area has come to receive a lot more attention. The increased interest could lead to a more balanced crypto economy and encourage participation outside of centralized exchanges.

This is not meant to minimize or overlook the significance of centralized exchanges within the ecosystem; rather, DEXes provide investors with different options.