Ethereum: Number of new smart contracts surge to highest 2022 level, but…

The rate of smart contract and dApp development on Ethereum dropped in the last few months. This is unsurprising because of the bearish market condition that prevailed during the same period.

Here’s AMBCrypto’s price prediction for Ethereum (ETH)

Developers are aware that their dApps are less likely to get traction during a bear market. Given these observations, the latest spike in Ethereum smart contracts indicates that developers are becoming more optimistic.

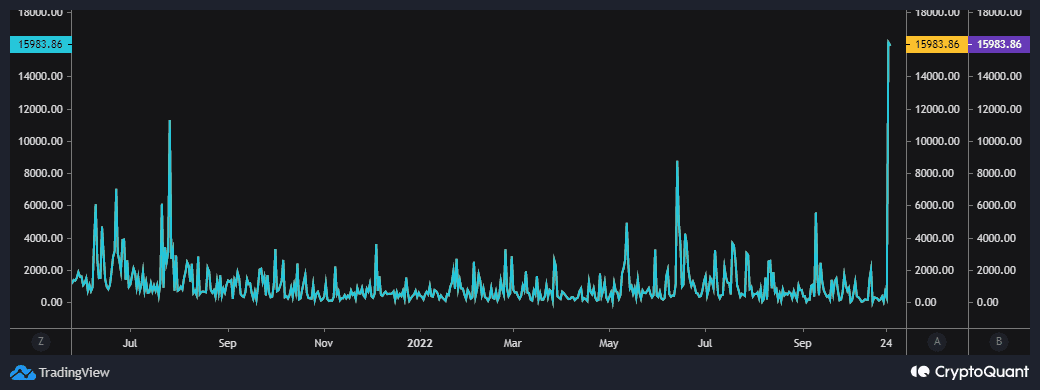

To put it into perspective, the number of new smart contracts on Ethereum surged to the highest 2022 levels in the last three days.

Ethereum developers have historically opted to roll out smart contracts during bullish times. This is because they are likely to capture more utility when there is a lot of activity in the market and that is often during a bull run.

It is thus no surprise that the latest smart contract spike occurred during a bullish rally. An increase in smart contracts, coupled with healthy usage of said contract should result in more transactions.

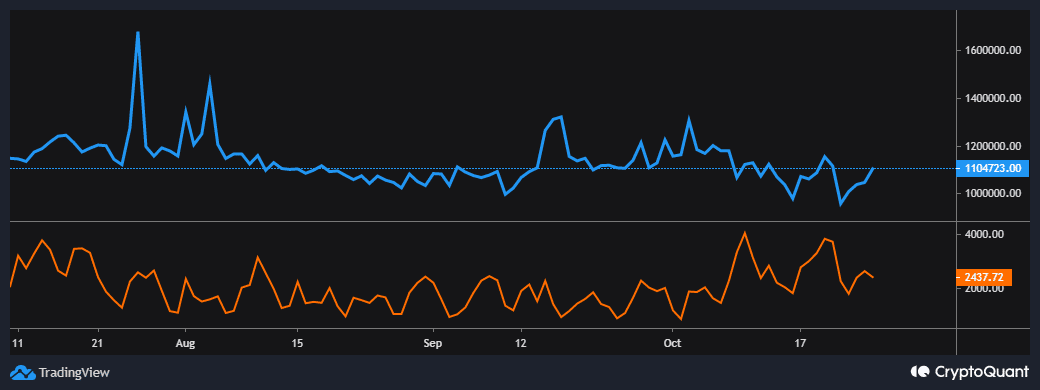

As expected, Ethereum’s transaction count also registered an uptick since 22 October.

Network fees were up marginally and not proportional to the smart contract spike. This might be because the new smart contract usage is still low, hence they have not captured much value so far.

Ethereum’s current level of readiness

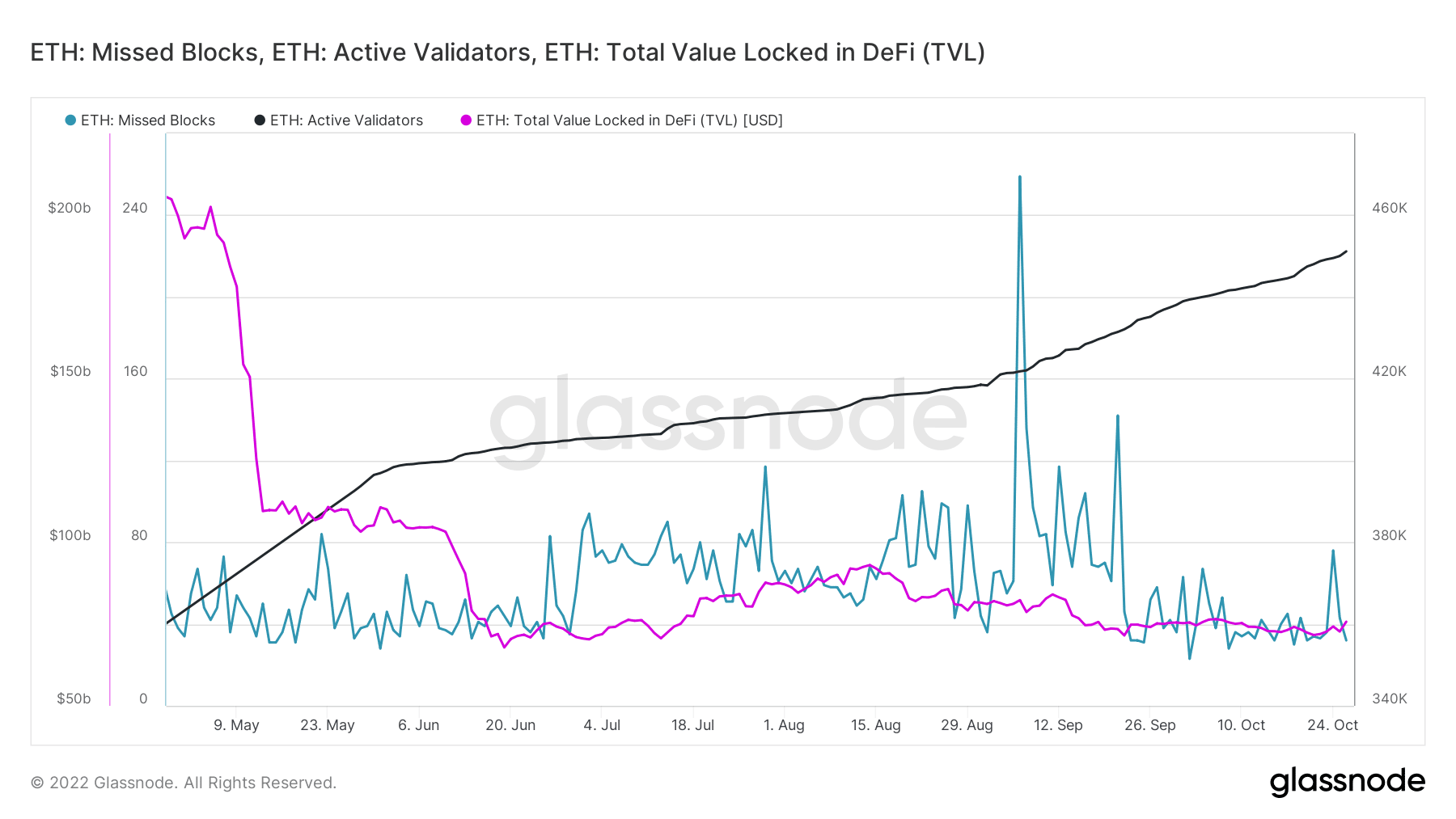

A potential reason for the low level of fees despite the return of the bulls could be the relatively lower value locked in DeFi. The bearish conditions in the last six months saw a large number of outflows from the network as investors panicked. However, the total value locked in DeFi increased slightly from its October lows this week.

The surge in smart contracts on Ethereum is already a sign that developers are ready to take advantage of potential value during the bull run.

Other network participants are also in position. For example, the number of active validators is currently at a 6-month high. Meanwhile, the number of missed blocks did spike earlier in the week.

We can conclude from the above information that Ethereum is well prepared to handle a surge in network demand. The bullish action we saw this week suggests that ETH may continue to experience revitalized demand.

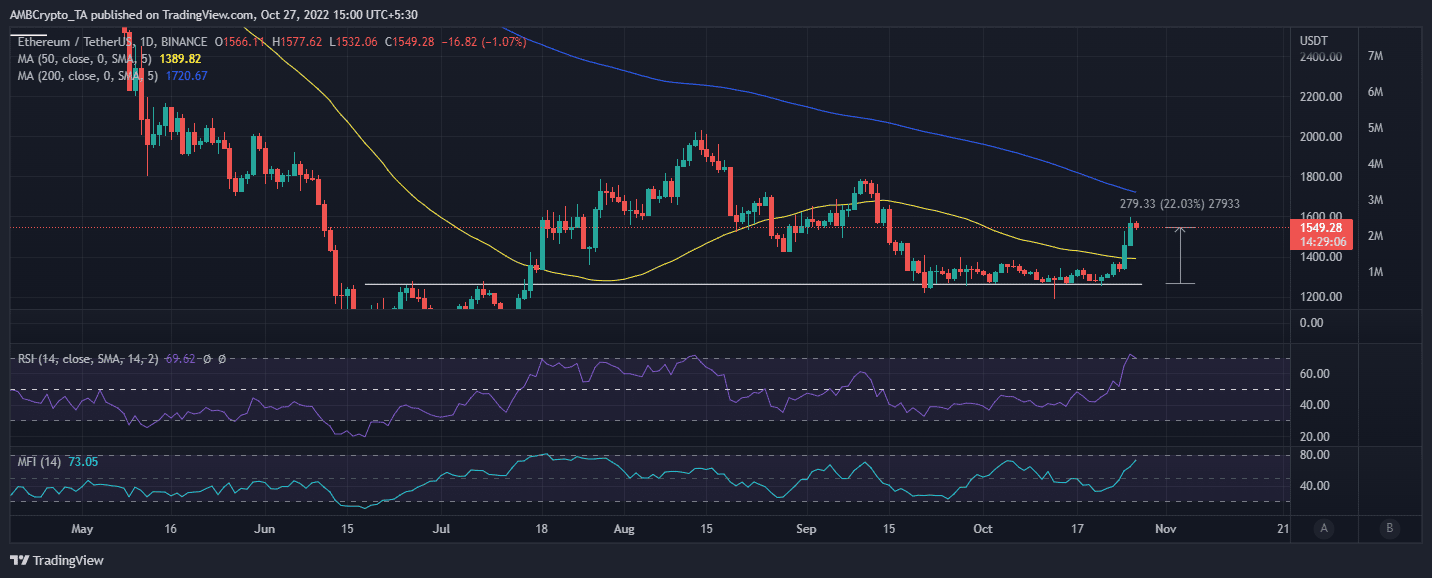

It managed to reclaim the $1,500 price level and traded at $1,547 at the time of writing. This was after a 22% upside in the last seven days.

ETH investors should however note that the demand has slowed down in the last 24 hours. This is likely due to the fact that ETH is now overbought according to the RSI. It still remains to be seen whether the cryptocurrency will manage to exit its lower range.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)