Ethereum sees increase in this set of holders; should you anticipate a rally?

- According to data from glassnode, addresses holding 32 ETH and above had increased to an all-time high

- An increase in this metric did not however reflect on the daily active address and 7-day active address metrics

In recent weeks and months, the price of Ethereum (ETH) has not been very spectacular. Not just ETH’s low price action, but that of other cryptocurrencies in the market has been heavily attributed to the general situation of the market.

That, however, does not appear to have had a negative impact on its accumulation. Recent research suggests that investors holding a specific amount of ETH were increasing.

32 ETH holder hits All-time High

Despite the decline and volatility in the price of Ethereum (ETH), glassnode showed an increase in the number of addresses holding 32 ETH or more.

According to the chart that could be seen at the time of this writing, there were over 127,000 addresses that had been registered. Furthermore, it was clear that the number of addresses at this time had reached an all-time high in recent years, not only increased.

Divergence with active addresses

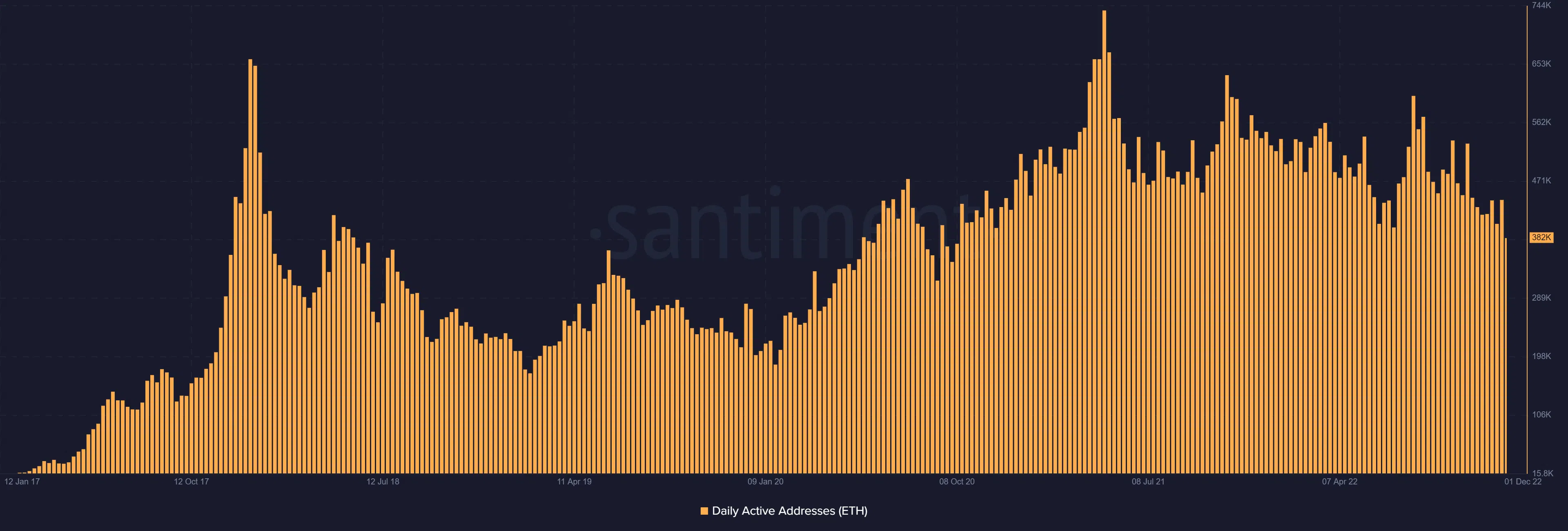

Although there appeared to be a rise in the number of these ETH owners, the daily active address statistic did not correspond.

Santiment’s daily active address metric had declined, as seen by a look at it. There were about 382,000 active addresses that could be seen. The total was less than what was seen in July when there were over 500,000 individuals.

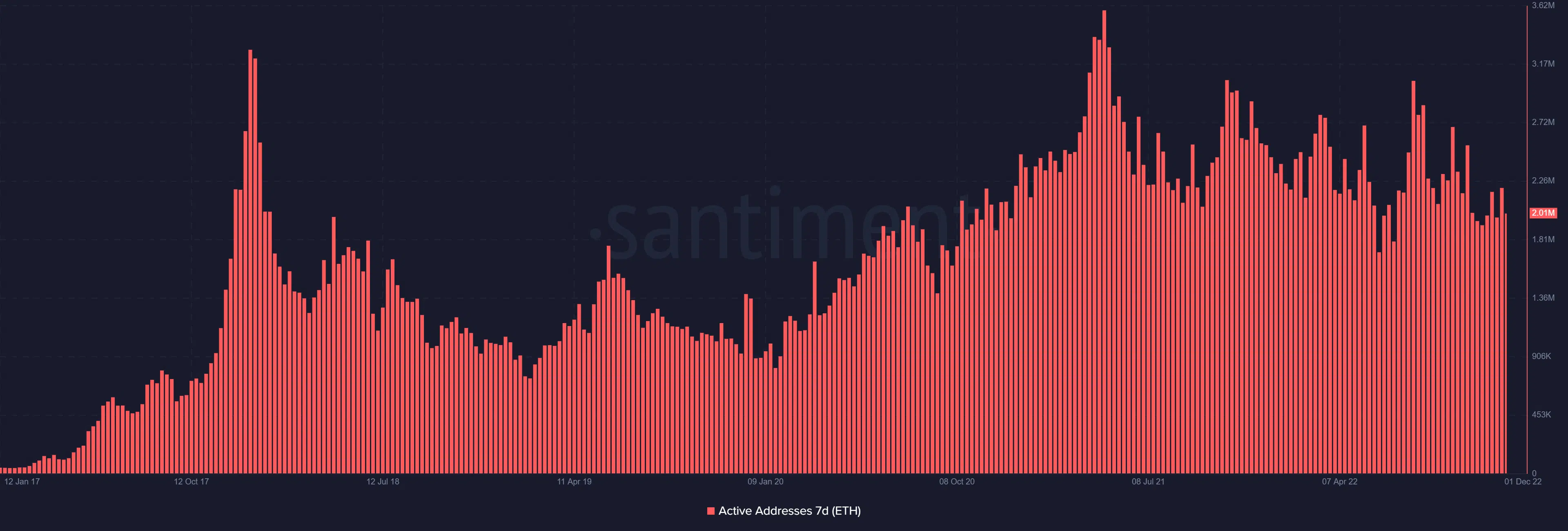

A review of active addresses throughout the previous week also revealed a decline. About two million active addresses were visible on the chart that was observed. A closer inspection also revealed that this number had decreased from what had previously been available in previous months.

Could ETH price move be the trigger?

In recent months, the asset had been volatile, according to a check at ETH in a daily timeframe. Despite the value’s drop, historical data showed it was still above its lowest point.

As of the time of writing, the price had fallen to almost $1,200. The drop represented a decrease of more than 3% from the previous trading session. A further examination of the chart in the daily timeframe showed that since the downtrend started in April, ETH had dropped by more than 50%.

According to the Relative Strength Index (RSI), ETH was slightly in a bearish trend despite its recent fall. A faint bear trend could be seen by looking at the RSI line slightly below the neutral line.

At the peak of the price movement, the 50 and 200 Moving Averages (yellow and blue lines) could be seen. The yellow and blue lines also acted as resistance, given their locations. If ETH can overcome this resistance level, a rise to $2,000 is feasible, given its previous pricing.

According to these measures, the present price and the anticipated increase may have been the driving force behind these addresses’ accumulation of ETH. If it can reclaim its April level, ETH investors will see over a 50% increase in the value of their holdings.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)