Even a week after launch of LUNA, it appears Do Kwon’s problems are far from over

Following the forking of the Terra chain and the subsequent launch of Terra’s Luna 2.0, the token has since suffered extreme volatility. For example, following the listing on cryptocurrency exchange Binance, the price per LUNA token grew by 39.41% last Tuesday. This was however soon followed by a severe decline that plunged the token below the $10 price index.

Also, when the newly minted token was first listed on Bybit, it registered a high of $30. This was soon followed by a price reversal that led the token to lose over 80% of its value in less than two hours.

Down by over 50% since it was first listed just seven days ago, the token appears to be off to a rocky start. Let’s take a closer look at the performance of this token vis-a-vis that of the now collapsed Terra Classic( LUNC) in the last seven days.

Birds of a Feather

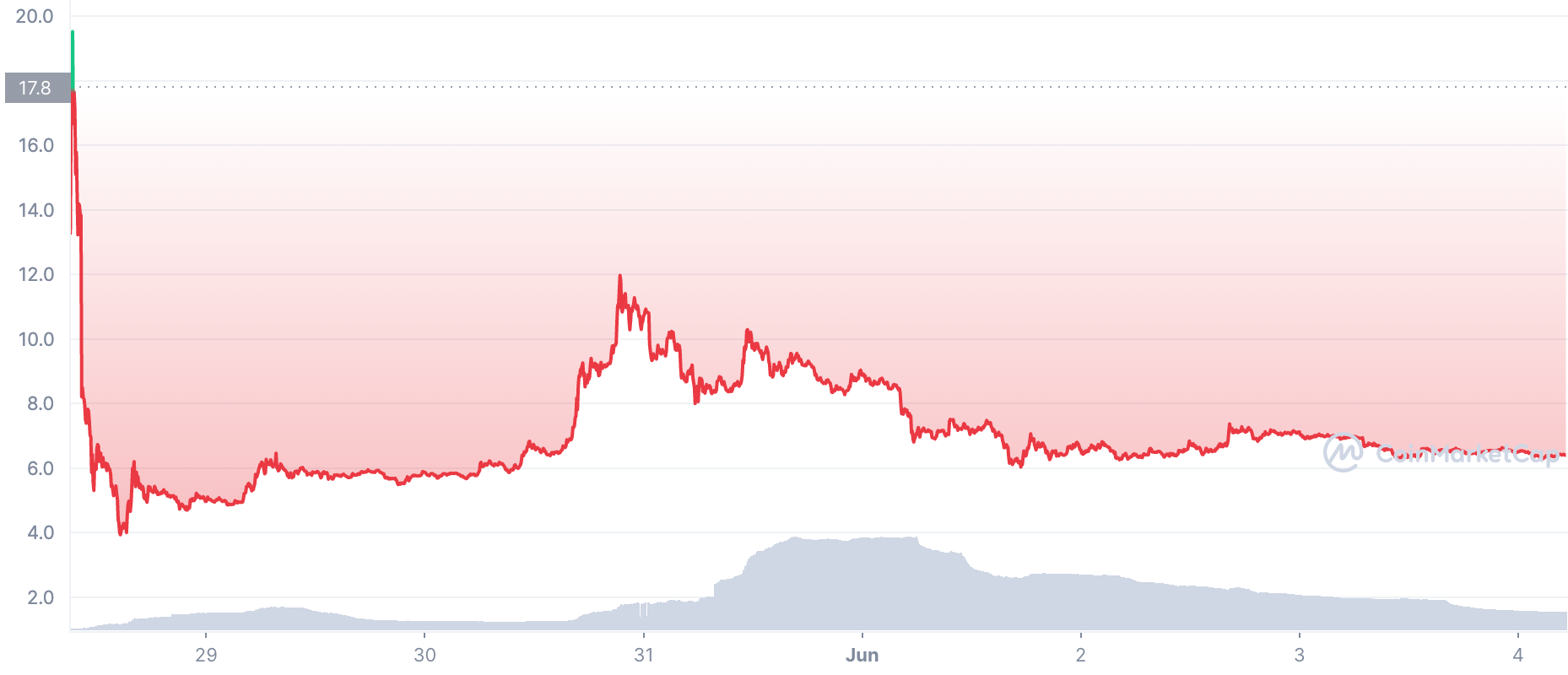

First listed seven days ago with the hopes of reviving the failed LUNC token, Terra’s Luna 2.0 token has struggled to keep the bears away. Data from Coinmarketcap showed that the token hit the cryptocurrency exchanges with an index price of $17.8. The token hit both sides of the price spectrum as it marked an ATH of $19.54 on the day of its launch and hit an ATL of $3.63 on the same day. At the time of press, the price per Luna token stood at $6.38, registering a 64% decline since it launched and a 9% loss in the last 24 hours.

The LUNC token was no different. This token also saw a 22% price decimation in the last seven days.

At the time of writing, the market capitalization of the Luna token remained unknown. However, CoinMarketCap reported that according to the promoters of the project, the self-reported CS of the token stood at 210,000,000 LUNA with a self-reported market cap of $1,343,354,760.

On the other hand, the market capitalization of the LUNC token at press time stood at $613.56m, a 24% decline from the $808.44 marked seven days ago.

Price Movements

Since launch, the Relative Strength Index (RSI) and the Money Flow Index (MFI) for the Luna token have been positioned deeply in the oversold regions. At the time of press, the RSI stood at 22.16. Also deep in the oversold region, the MFI at the time of writing, stood at 0.41.

It is worthy of note to point out that while the RSI for the LUNC token maintained a position below the 15 index for the last seven days, the MFI on the other hand embarked on an upward curve. With a steady movement towards the 50 neutral region over the course of the last seven days, the MFI was stationed at 56.62 at the time of press. With a decline in price within the period under review, a rising MFI generally indicates an impending bullish run.

No Place for Kwon to Hide

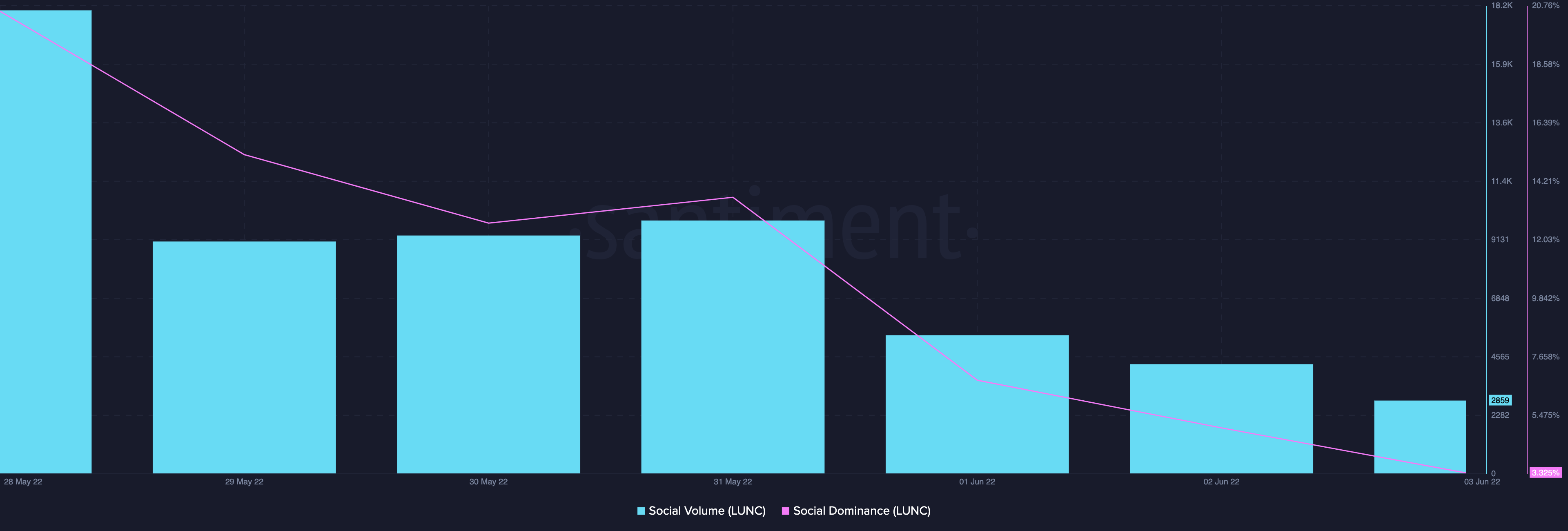

On-Chain data showed that on a social front, the LUNC suffered a decline in the last seven days. Social Dominance saw an 84% decline. The Social Volume also went down by 84% during the course of the last seven days.

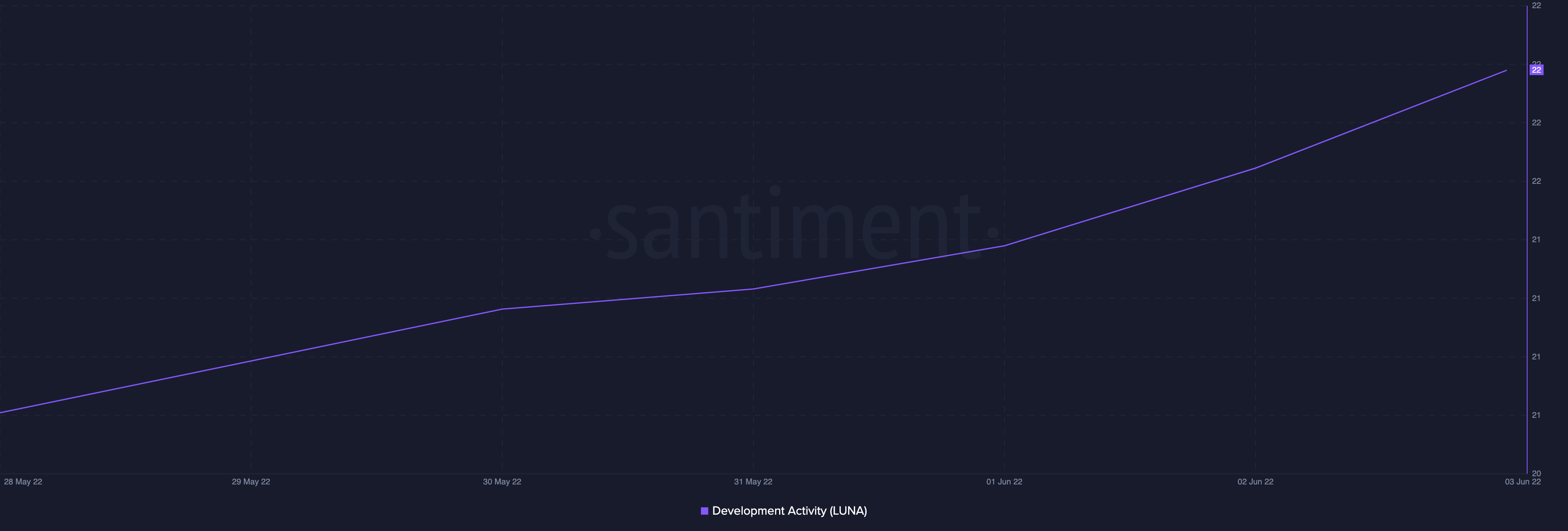

Worthy of note are the indexes for the development activity of both tokens. With increased activity within the Terra Ecosystem to save the project, the development activity for both Luna and LUNC tokens recorded a gradual spike in the last seven days. At press time, development activity for the Luna and LUNC tokens stood at 22 and 31 respectively.