Has AAVE’s price rally run its course or is there more on the way

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- The shorter timeframe structure was bullish for AAVE

- AAVE at high timeframe resistance and a sharp rejection could see another leg downward

AAVE has performed well in the markets over the last ten days. From the swing low at $64.7 to the swing high at $90.1, the altcoin has registered gains of nearly 40% in a relatively short span of time.

Here’s AMBCrypto’s Price Prediction for Aave [AAVE] in 2022

This was remarkable for a $1.2 billion market cap asset because Bitcoin did not possess a strong trend over the past week. In fact, it has only bounced within the $19k-$19.6k levels. Despite this development, AAVE bulls were able to push prices higher.

$90-$97 range poses a severe test, a move back to support looks likely

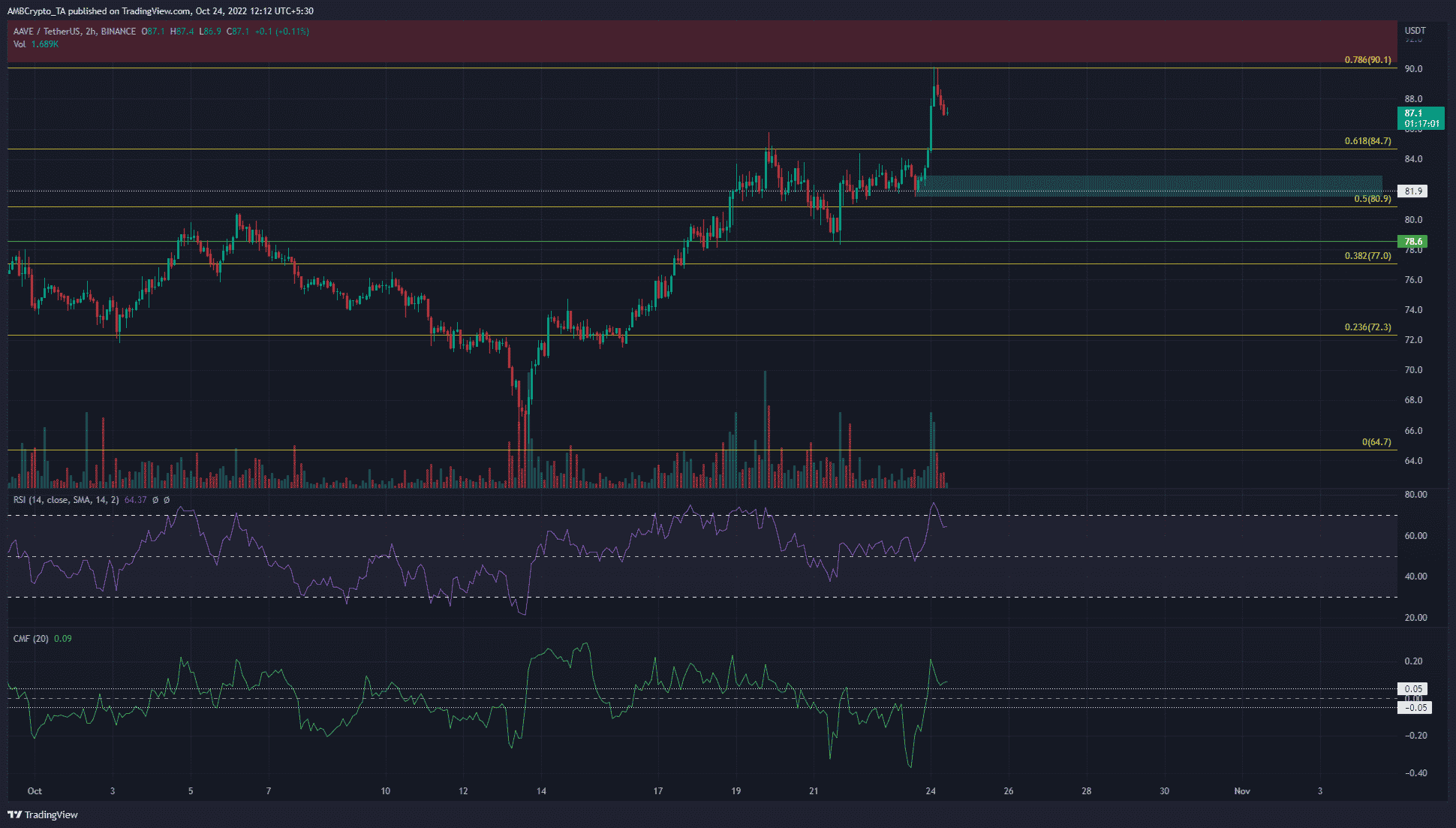

In yellow are some Fibonacci retracement levels plotted based on a drop from $97 to $64.7 in September and October. In the past ten days, AAVE has managed to retrace most of these losses, which evidenced strong short-term bullish sentiment.

The RSI was at 64 and has been above the neutral 50-level over the past few days. At the same time, the price charts showed AAVE formed a series of higher lows since mid-October. Therefore, both the price action and the momentum indicator were in agreement about the lower timeframe trend.

The CMF also climbed back above the +0.05 mark recently to show significant capital inflows into the market. The surge from $81 to $90 the previous day occurred on the back of heavy trading volume as well. This showed buyer conviction.

And yet, the $90-$97 zone was a higher timeframe bearish order block. This zone had confluence with the 78.6% retracement level at $90.1. Hence, short-term bulls would need to exercise caution as the time to buy AAVE has passed. A revisit to the lower timeframe bullish order block at $81 (cyan) can be a buying opportunity.

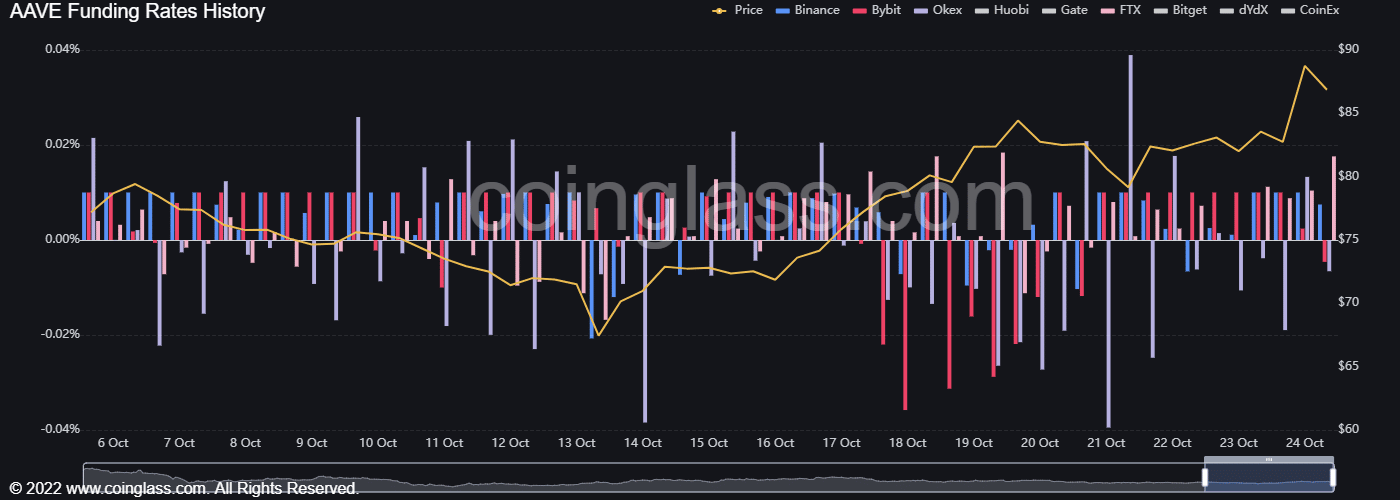

Funding rates back in positive territory

Source: Coinglass

To showcase the strong bullish sentiment behind AAVE, the funding rates went from negative to positive values over the past three days on many major exchanges. A positive funding rate showed longs paid funding to the shorts, which meant longs had the upper hand in the market. Speculator sentiment was bullish, a fact highlighted by the Long/Short ratio as well. For AAVE, the 24 hours preceding the time of writing saw 53.2% of the contracts to be long.

Despite the strong northward momentum, bulls can look to take-profit on their longs around the $90-region. Until the altcoin can break above $97 and retest the same as support, a buying opportunity would not be imminent.