How did Lido Finance [LDO] do, before and after Ethereum’s Merge

Prior to the Ethereum mainnet Merge, the majority of all Ether (ETH) staked ahead of the transition of the Ethereum network to a proof-of-consensus mechanism was done on Lido Finance.

Interestingly, data from Dune Analytics revealed that at press time, with 4,170,811 ETH staked with the liquid staking platform, it still holds over 30% of the total ETH staked in the market.

Ahead of the Shanghai Upgrade in 2023, when all pre-merge staked Ether will be unlocked and to encourage even more staking on the platform, Lido Finance has taken to re-staking the MEV rewards accrued in its Execution Layer Vault to boost ETH staking yield by 5.5%.

Lido MEV rewards (incl priority fees) for the past 24 hours total 244.44 ETH.

These were restaked at 12.30 UTC, resulting in an updated ETH staking yield of 5.5%. pic.twitter.com/7tJi3RsCCW

— Lido (@LidoFinance) September 16, 2022

In fact, Dune Analytics went on to point out that since the Merge, the total amount of post-merge MEV rewards for Lido stakers stood at 503.74 ETH.

How has Lido done this month?

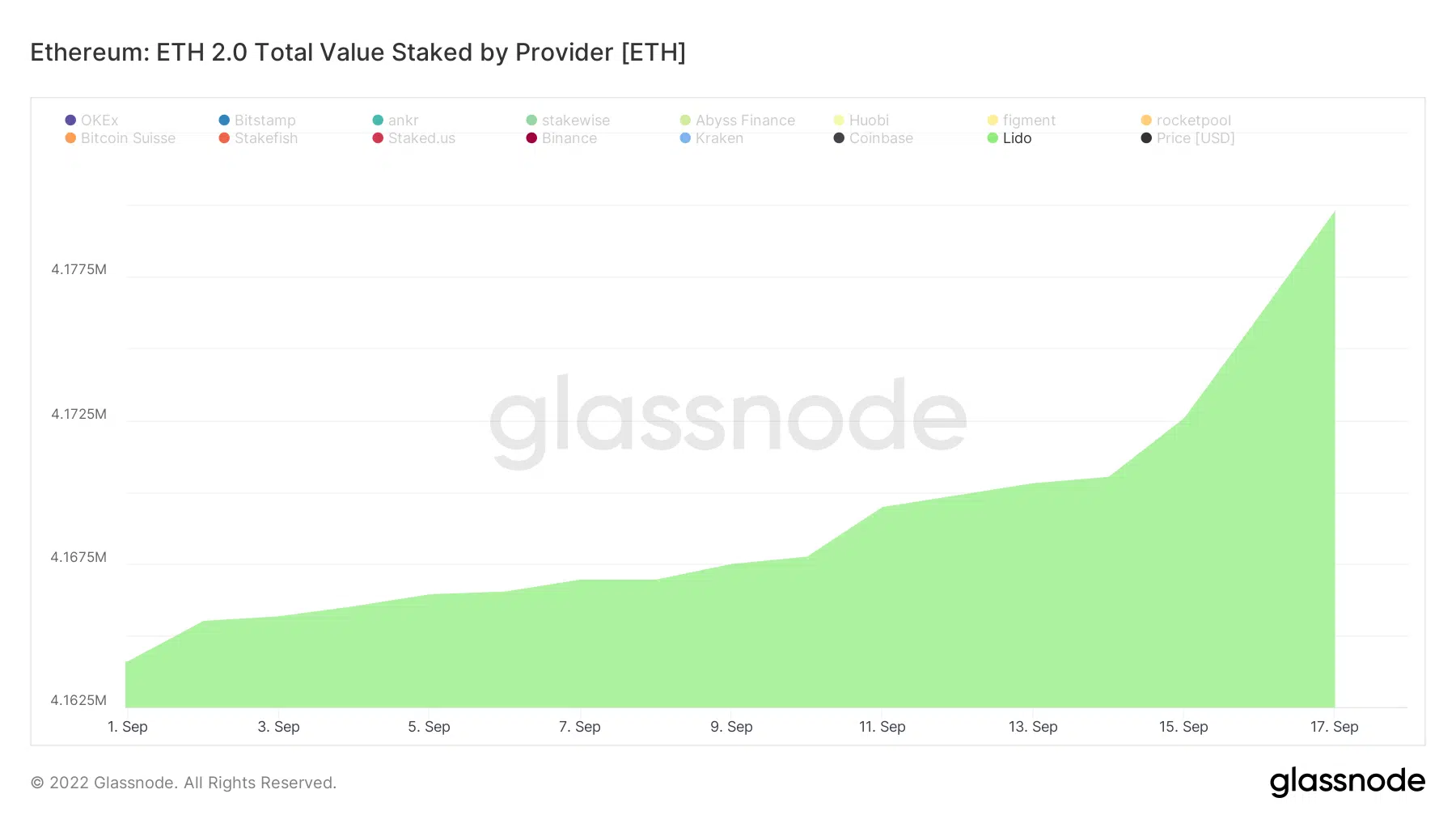

According to data from Glassnode, ETH staking on Lido has rallied since the beginning of the month. The liquid staking platform registered just a 0.15% uptick in total ETH staked in the days leading up to the Merge.

However, since the Merge, there has been a more pronounced hike in Ether staking on the protocol.

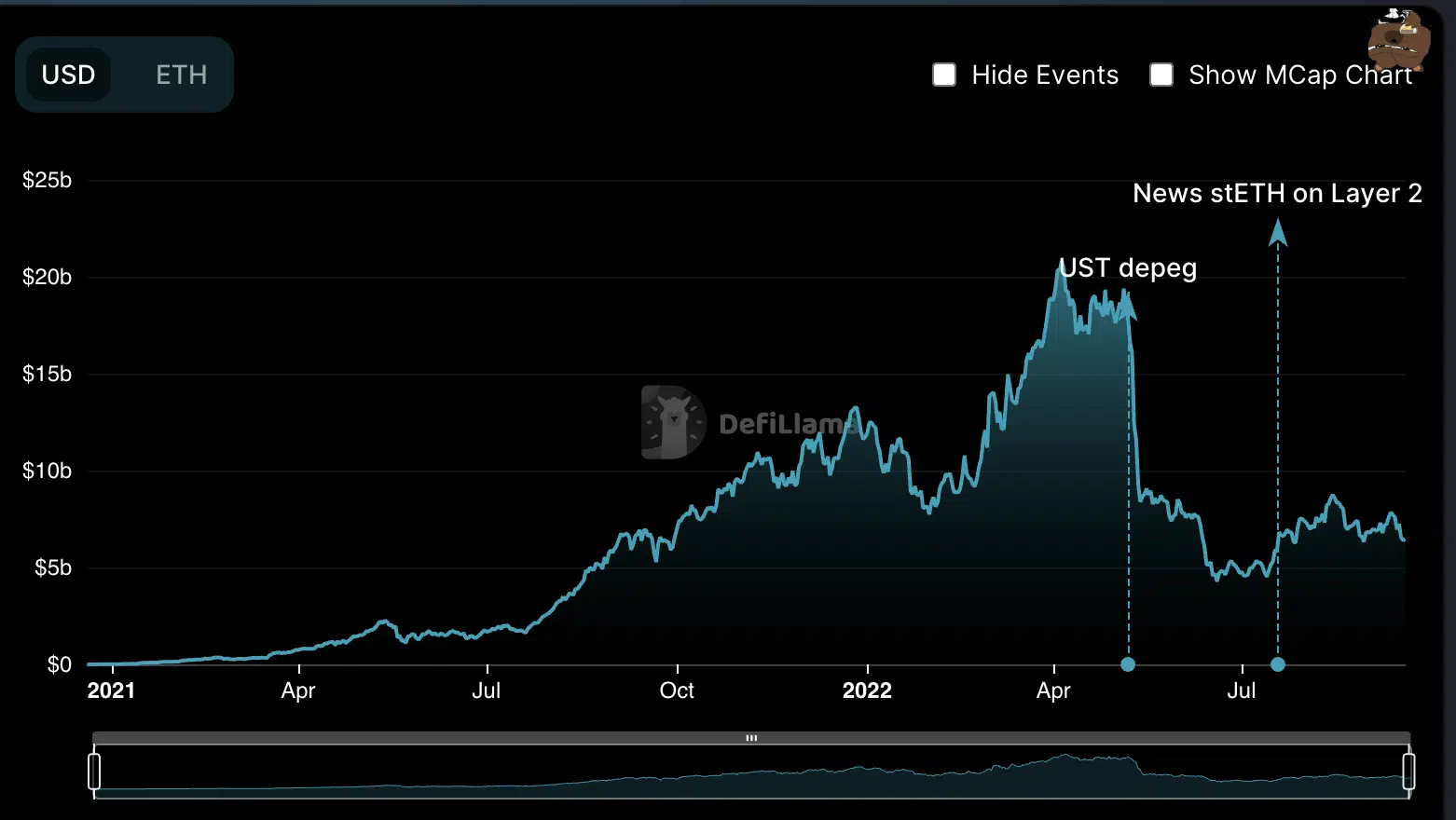

Curiously, despite the cumulative growth in ETH staking on the platform, data from DefiLlama revealed a decline in total value locked (TVL) on Lido. At the time of writing, figures for the same stood at $6.47 billion.

Over the last 17 days, this had dropped by 5%. At its press time level, however, Lido’s TVL stood at its October 2021 level.

Although a leading ETH staking platform, TVL on the protocol has declined consistently over the past few months. For context, Lido’s TVL has dropped by 62% since UST de-pegged in May.

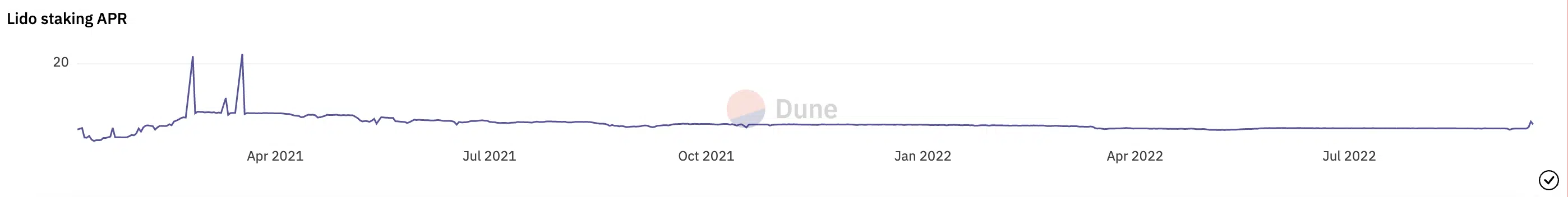

In light of concerted efforts to keep stakers returning, APR for staking with Lido has risen significantly since the month began. Towards the beginning, Lido staking APR stood at 4.02. At press time, it was pegged at 5.00.

Furthermore, unique deposits on Lido have gone up by 5% since 1 September, Dune Analytics revealed.

LDO toys with investors’ feelings

According to CoinMarketCap, LDO was exchanging hands at $1.91, at press time, having declined by 5% in the last 17 days.

Moments after the Merge, the native token of the liquid staking platform rallied by 18% as it traded at $2.155. The bulls, however, failed to sustain this momentum, causing the bears to initiate a downtrend.

With key indicators positioned below their respective neutral regions, investors should expect stagnancy with waning buying pressure on the charts.