MakerDAO’s portfolio gets riskier, what does it mean for the investors

In a recent development, it was discovered that MakerDAO‘s portfolio’s exposure to risk had grown quite a bit, even though it had declined steadily over the past six months.

Here’s AMBCrypto’s Price Prediction for MakerDAO for 2022-2023

No risk, no reward

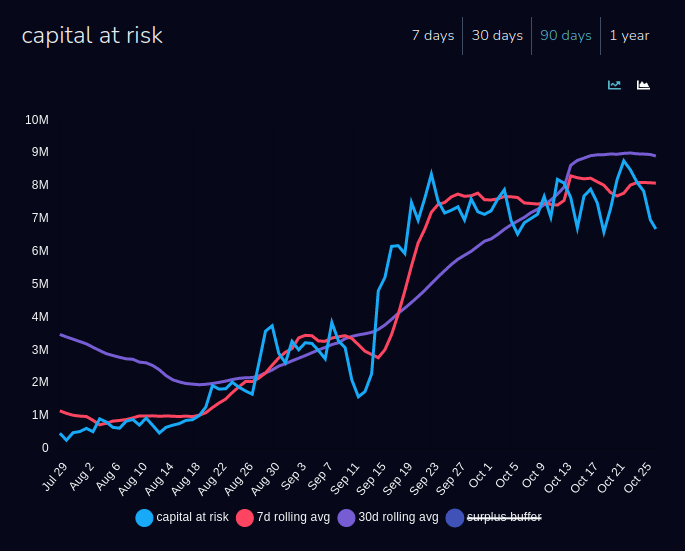

This portfolio risk, which is a measure of exposure collateralized by volatile crypto assets, is called Capital at Risk. As can be seen from the image below, the Capital at Risk was growing over the past few months. About half of the current Capital at Risk (currently at $9M) came from MANA-A ($4.46M).

Even though this risk may not pose a massive threat to MakerDAO, it was stated that the team at MakerDAO was working on mitigating this risk to avoid future problems.

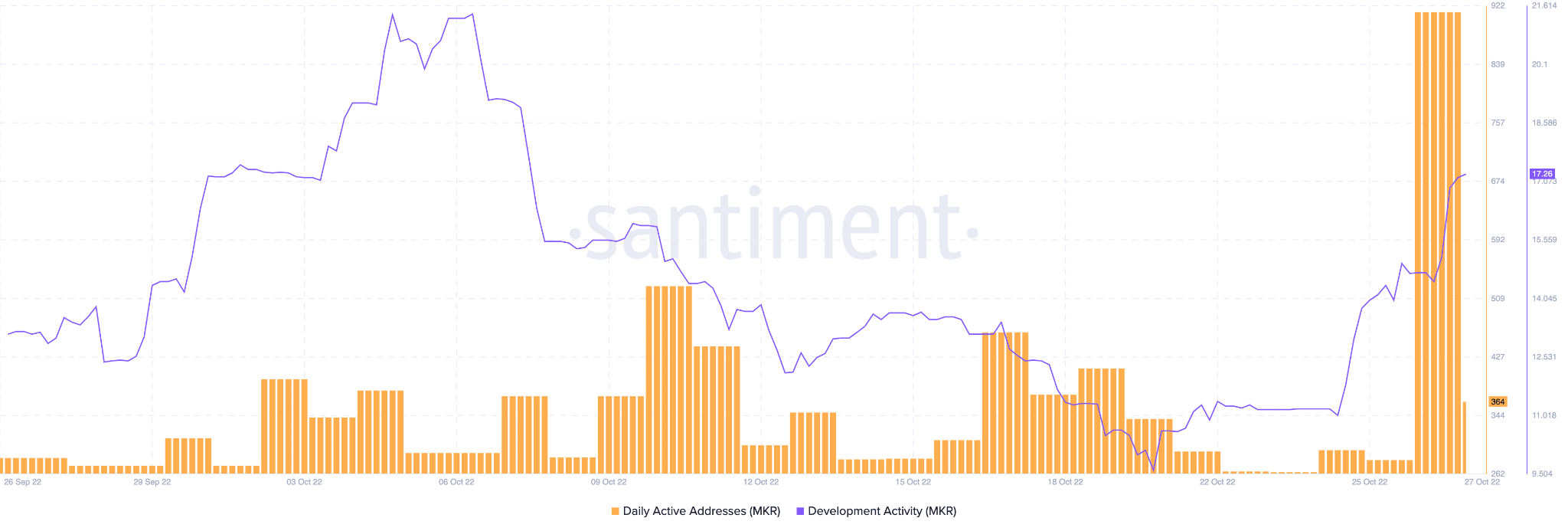

Despite the risks detected, users didn’t shy away from being active on the MakerDAO network. As can be seen from the image below, the number of daily active addresses witnessed an immense spike over the past few days.

In fact, MakerDAO’s development activity too witnessed a spike. This meant that developers on the MakerDAO team had been increasing their contributions on GitHub. And, it simply indicates that new updates/upgrades are on the way.

Another positive signal for MakerDAO was the consistent whale interest directed toward MKR. According to a tweet by WhaleStats, an organization dedicated to tracking crypto whales, the top 500 ETH whales were holding $75 million worth of MKR at the time of press.

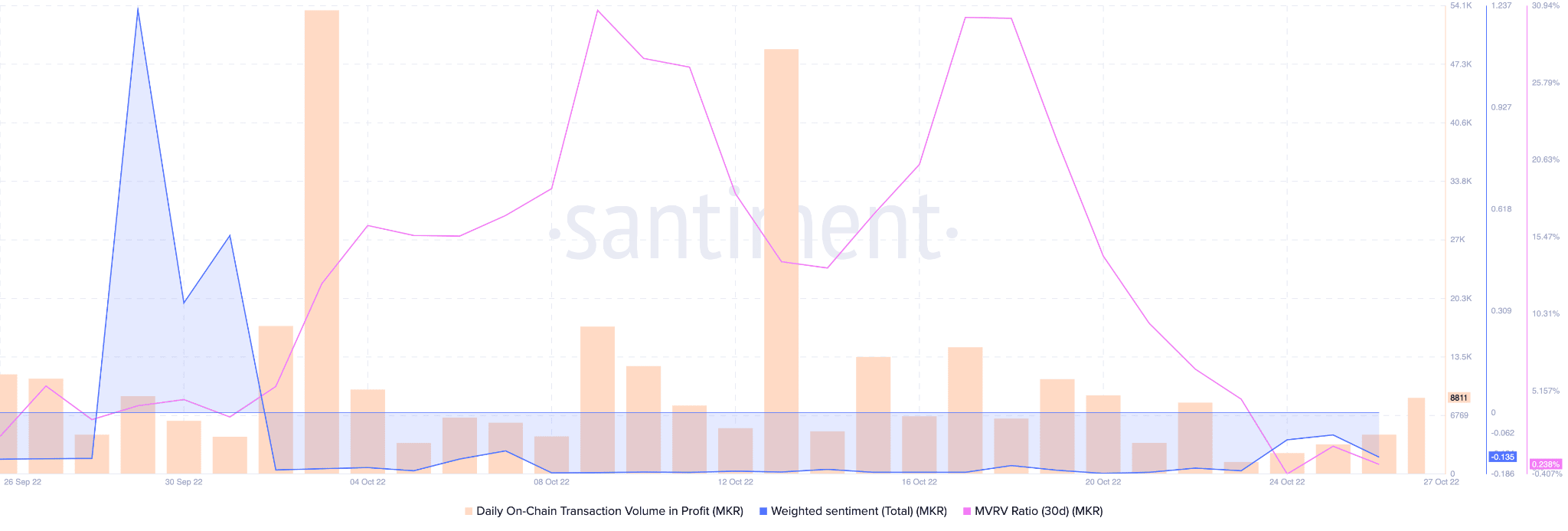

Despite the overwhelming interest from whales, the general sentiment of the crypto community, for MakerDAO remained negative.

As evidenced by the image below, the weighted sentiment around MakerDAO continued to decline over the past 30 days. Thus, indicating that the crypto space was not having the most positive outlook on MakerDAO.

Along with this development, the MVRV ratio and the volume of transactions in profit continued to decline.

However, MakerDAO’s TVL remained unfazed amidst all the FUD. According to data provided by DeFiLama, the TVL remained flat throughout the past few months. It stood at $8.21 billion, during press time.

That said, at the time of writing, MKR was trading at $945.97. It depreciated in value by 1.56% in the last 24 hours. Furthermore, during the same period, its volume declined by 3.88%.

![Ethereum's [ETH] short-term price targets - Is the $2,300 resistance too strong?](https://ambcrypto.com/wp-content/uploads/2025/03/Evans-1-min-400x240.png)