MakerDAO’s revenue stats can help you decide if you should invest in MKR

MakerDAO dominated the DeFi space in terms of market cap. At press time, it was ranked number one when compared to other protocols. In spite of that, it wasn’t able to generate a profitable quarter in terms of income.

Here’s AMBCrypto’s Price Prediction for MakerDAO for 2022-2023

According to Messari, a crypto analytics firm, MakerDAO witnessed its first negative quarter since 2020.

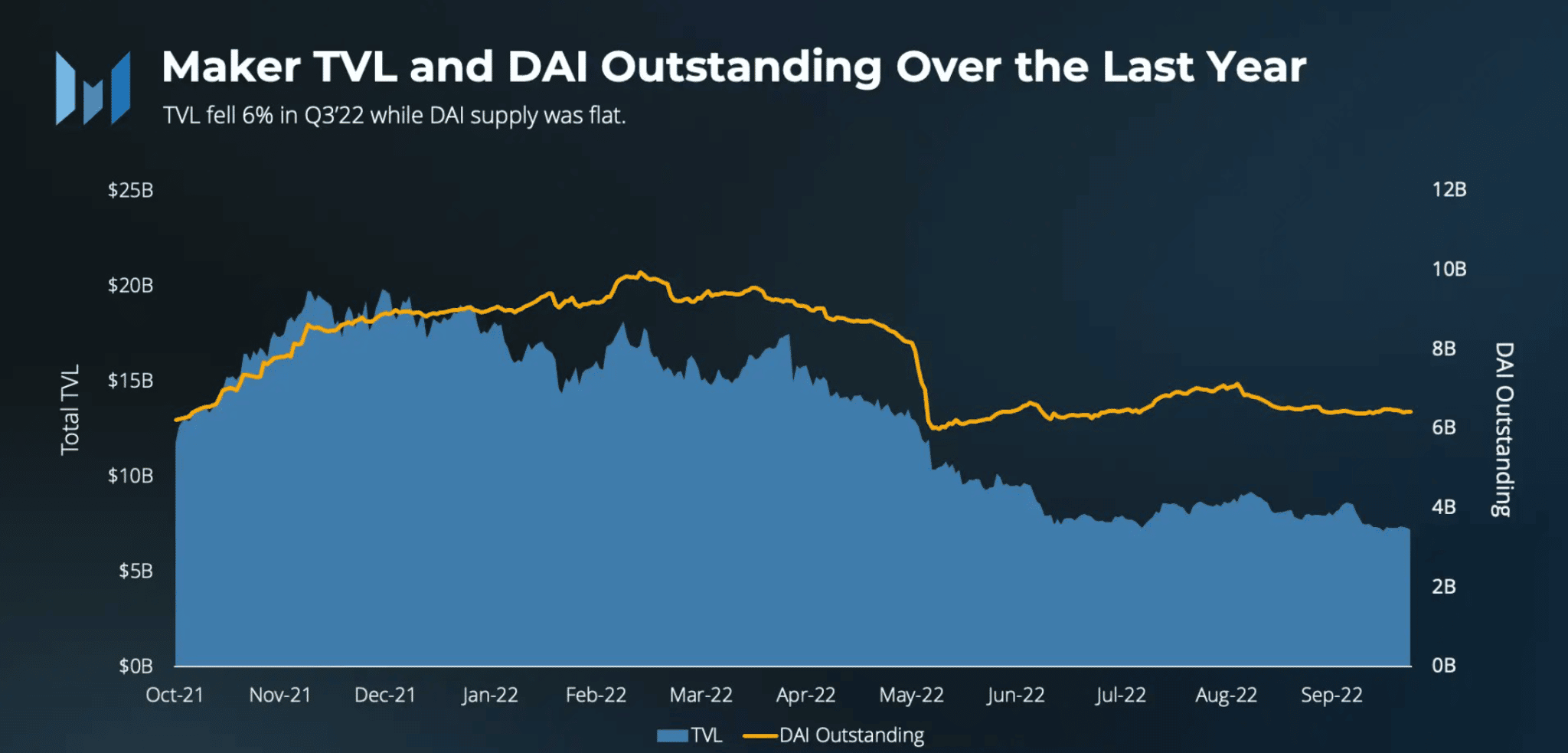

One of the reasons for the decline in revenue could be attributed to the depreciation in its Total Value Locked (TVL) in terms of Ethereum borrowing.

As can be observed from the chart below, the TVL depreciated by over 6% in the last quarter. One of the reasons for the decline in MakerDAO’s revenue could be DAI supply, which remained flat over the last quarter.

The decline in revenue factor could also be attributed to MakerDAO’s overexposure to Bitcoin and Ethereum.

Most of MakerDAO’s revenue is generated by Ethereum or Bitcoin-based assets. Now, since both these assets performed poorly in the past quarter, it did have an impact on MakerDAO as well.

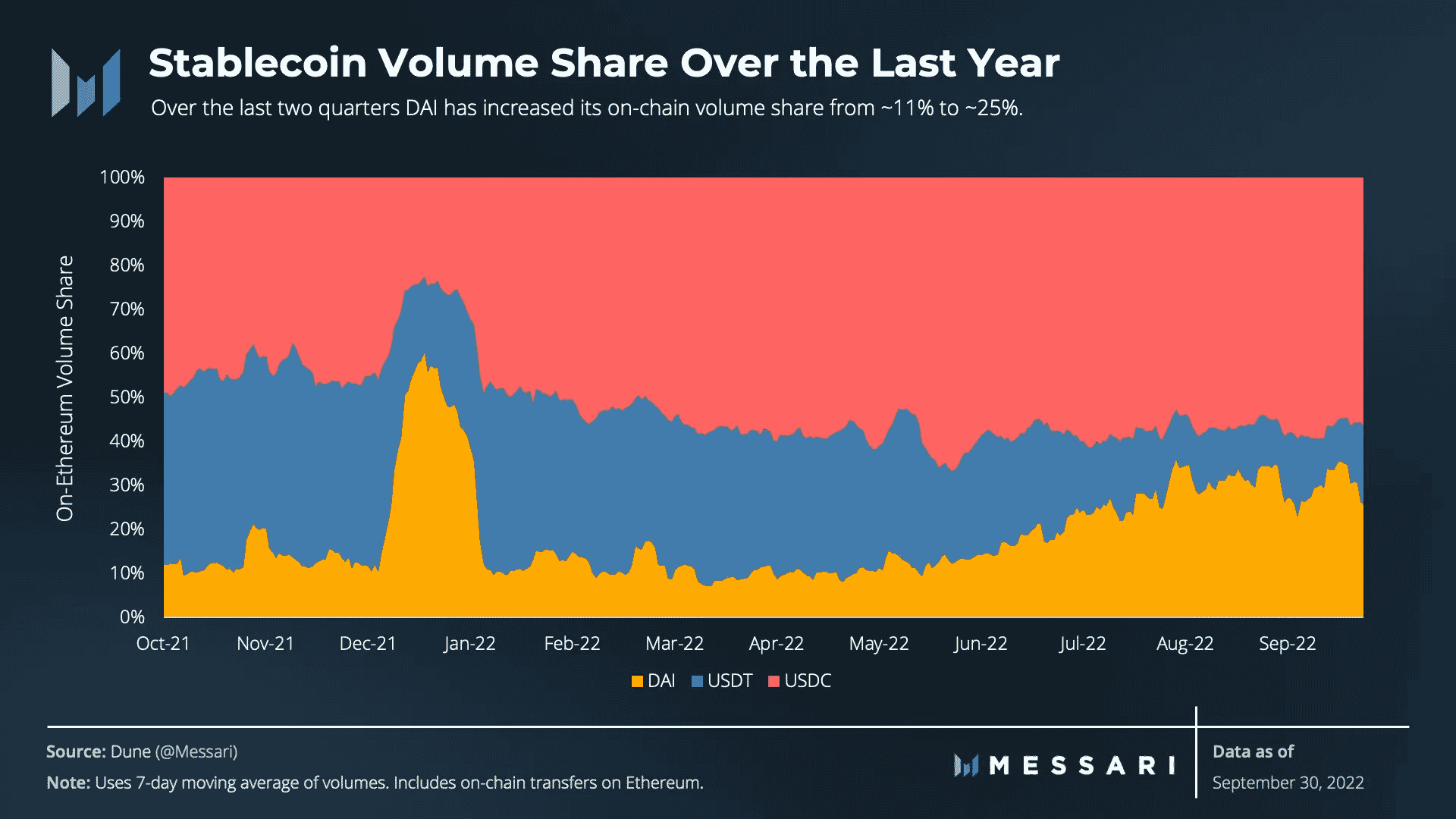

It’s here to be noted that MakerDAO’s stablecoin DAI, showed tremendous growth

No time to DAI

DAI’s volume was up by 149% over the last quarter. In fact, DAI took a massive share of USDT in terms of on-chain volume. This signifies DAI’s continued growth.

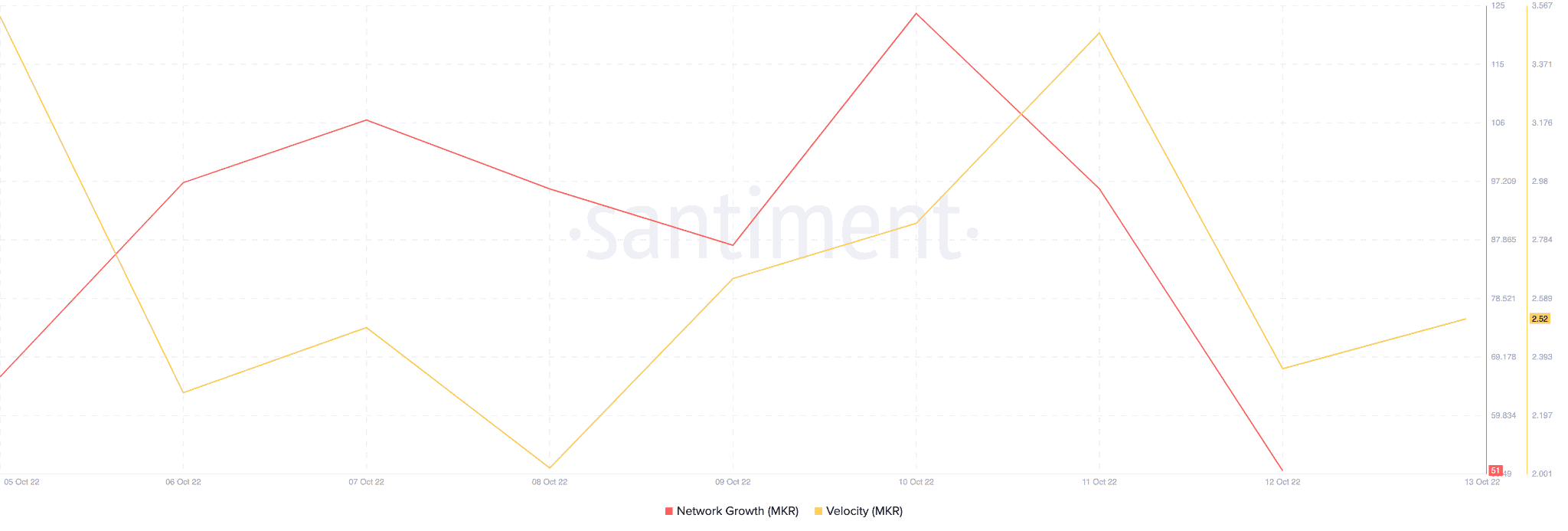

Source: MessariEven so, there was a decline in MakerDAO’s network growth, which indicates that the number of new addresses that transferred a given MakerDAO token for the first time decreased.

Along with that, there was a slight decline in velocity for MakerDAO over the past week which was followed by an uptick observed in the last few days. An uptick in velocity indicates that the frequency at which the tokens change addresses has increased.