Mysteriously high Bitcoin transaction fee sparks speculations, details here

- Bitcoin saw a single transaction fee of 19 BTC, worth over $500,000.

- Fee to be distributed to miners if not claimed in three days.

A noteworthy Bitcoin [BTC] transaction fee has surfaced recently, garnering significant attention due to its unprecedented high value. This remarkable fee has sparked numerous inquiries and discussions within the community.

Read Bitcoin (BTC) Price Prediction 2023-24

Bitcoin sees historical transaction fee

On 10 September, a Whale Alert post highlighted an extraordinary Bitcoin transaction fee paid for a single transaction. According to data from the Whale Alert site, the fee amounted to a staggering 19 BTC, equivalent to approximately $509,563.

Comparatively, data from Y Chart showed that Bitcoin’s Average Transaction Fee has surged to 2.176, up from 1.410 on 9 September and significantly higher than the 1.098 recorded one year ago. This represented a substantial increase of 54.37% from 9 September and a remarkable 98.21% growth compared to a year ago.

The unusually high fee reported by Whale Alert has triggered speculation within the community, with some suggesting it may be a mistake or the result of a transaction software misconfiguration. The exact cause behind this unusually high fee remains unclear as of this writing.

Bitcoin fees see an impact

As speculation continues regarding the factors contributing to the exceptionally high Bitcoin transaction fee, the broader network fees have witnessed a notable impact. According to data from Crypto Fees, total transaction fees surged to surpass $1 million on 10 September.

As of this writing, the observed fee had exceeded $1.2 million. This marked the highest fee recorded on the network since the peak of over $1.3 million observed around 22 July.

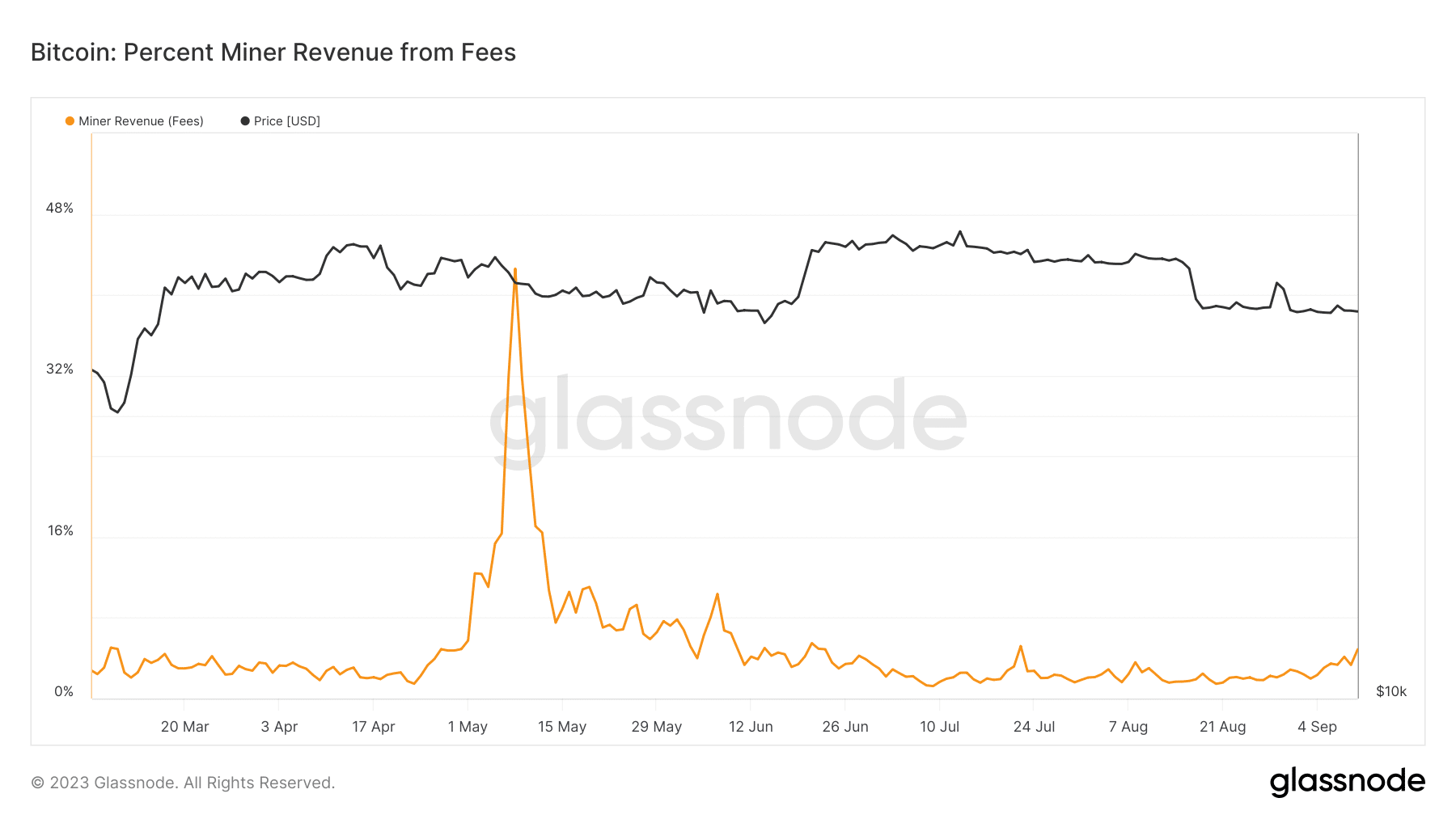

Furthermore, insights from Glassnode indicated a slight uptick in the Bitcoin miner revenue fee as of 10 September. The chart reflected an increase in this metric to over 4.8%. Before this recent rise, the metric typically ranged between 2% and 3.3%.

Fee to be returned?

Nevertheless, as outlined in a post by Chun from F2Pool that the unusually high transaction fee will be temporarily held. Chun also mentioned that if, after three days, no claimant steps forward to retrieve the fee, it will be reallocated to Bitcoin miners.

BTC decline continues

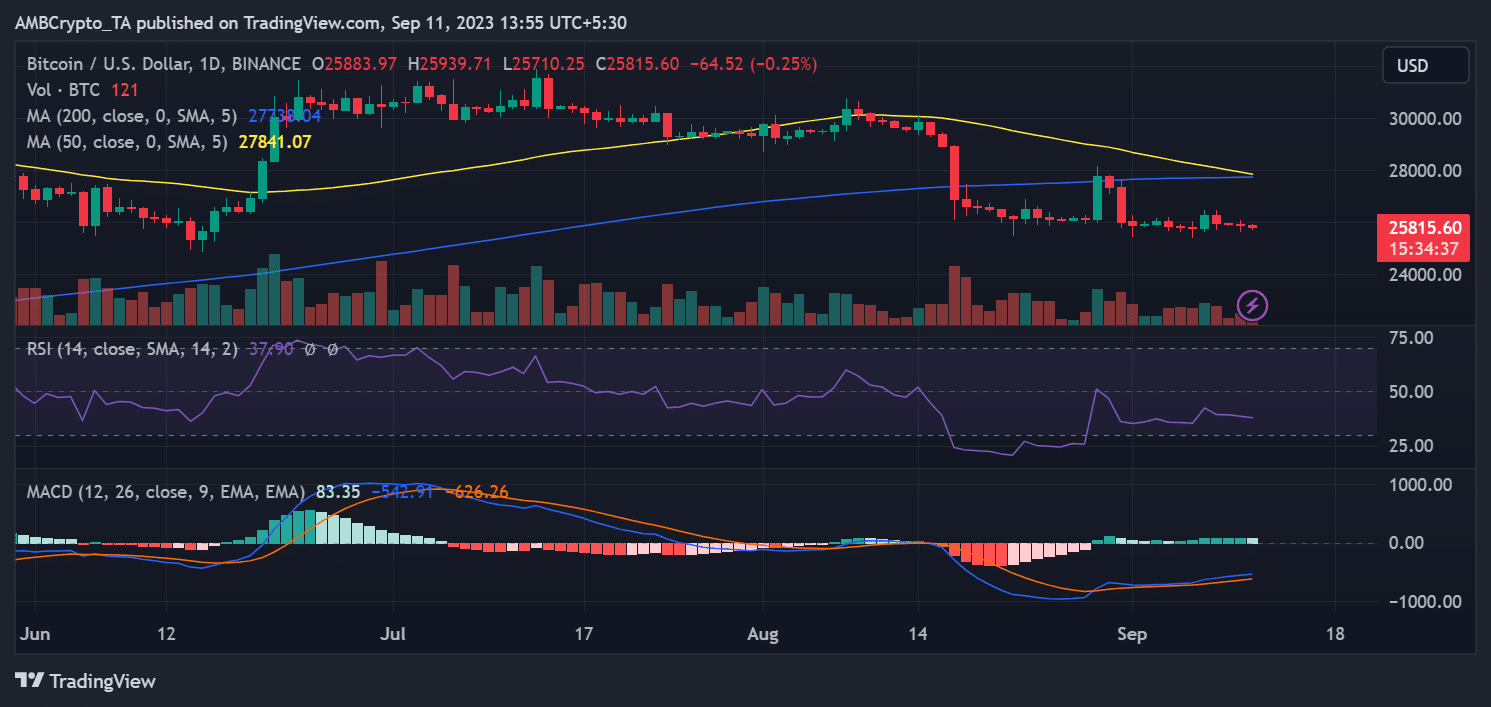

As of this writing, Bitcoin’s performance on its daily timeframe chart had not been particularly favorable. It was trading at approximately $25,800, experiencing a modest decrease of less than 1%. This decline marked the third consecutive day of relatively minor decreases in BTC’s value, albeit insignificant.