Polkadot investors can expect marvels in 2023 only if DOT can cross these hurdles

- Polkadot’s market cap witnessed a massive surge in the last two days

- DOT’s short-term outlook starts shifting in favor of the bulls, but a rally remains at bay

The Polkadot network seems to be concluding November on an interesting note courtesy of its Sub0 conference. The network released an update highlighting some developments that may lay the foundation for its 2023 progress.

Read Polkadot’s [DOT] price prediction 2023-24

Notably, Polkadot intends to focus heavily on smart contract development through Substrate. This underscores the network’s intention to facilitate more utility. The network also intends to pursue a deeper focus in the NFT segment. The latter was among the key growth drivers for many top blockchain networks.

1/ It’s a wrap for day 1 of #sub0!

Check this ? for insights into exciting developments happening across the Polkadot ecosystem and beyond, and see some highlights from the busy day. pic.twitter.com/XSI0zEoI5C

— Polkadot (@Polkadot) November 28, 2022

Polkadot was also seen encouraging platforms native to its ecosystem to develop more user-friendly UIs. Such efforts may make the Polkadot ecosystem preferable to its competition. The key theme of the highlight is the deep focus on growth.

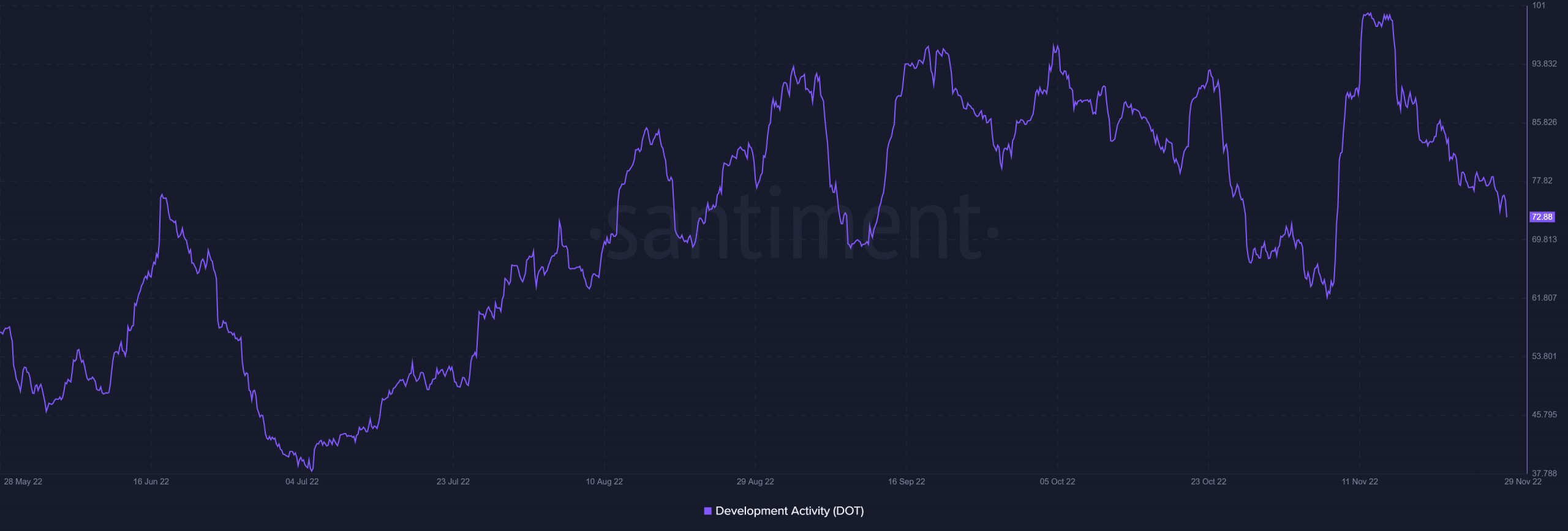

Polkadot’s update also confirmed that the network will have a healthy development activity taking place next year. This was good for the network not only in terms of growth but also to boost investor confidence. Polkadot maintained a healthy development activity in the last six months.

Unfortunately, the network’s native cryptocurrency, DOT, continued to seek more downside despite the healthy development activity. This was because it remained heavily influenced by the bearish market conditions in the last six months.

Can Polkadot’s price action benefit?

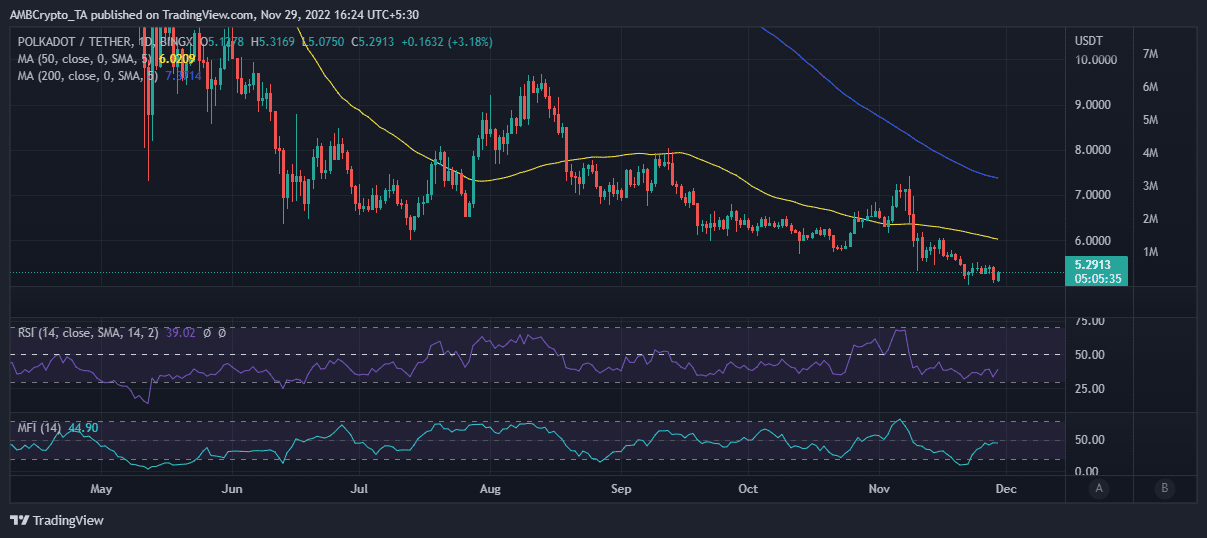

DOT traded at $5.29 at the time of writing, which was close to its 2022 low. However, its short-term price action might be about to experience a rally as sell pressure dissipates.

DOT’s money flow indicator already witnessed some upside, thus, indicating that there was significant accumulation taking place at press time. Investors could thus, expect a sizable price uptick if DOT secured enough bullish demand.

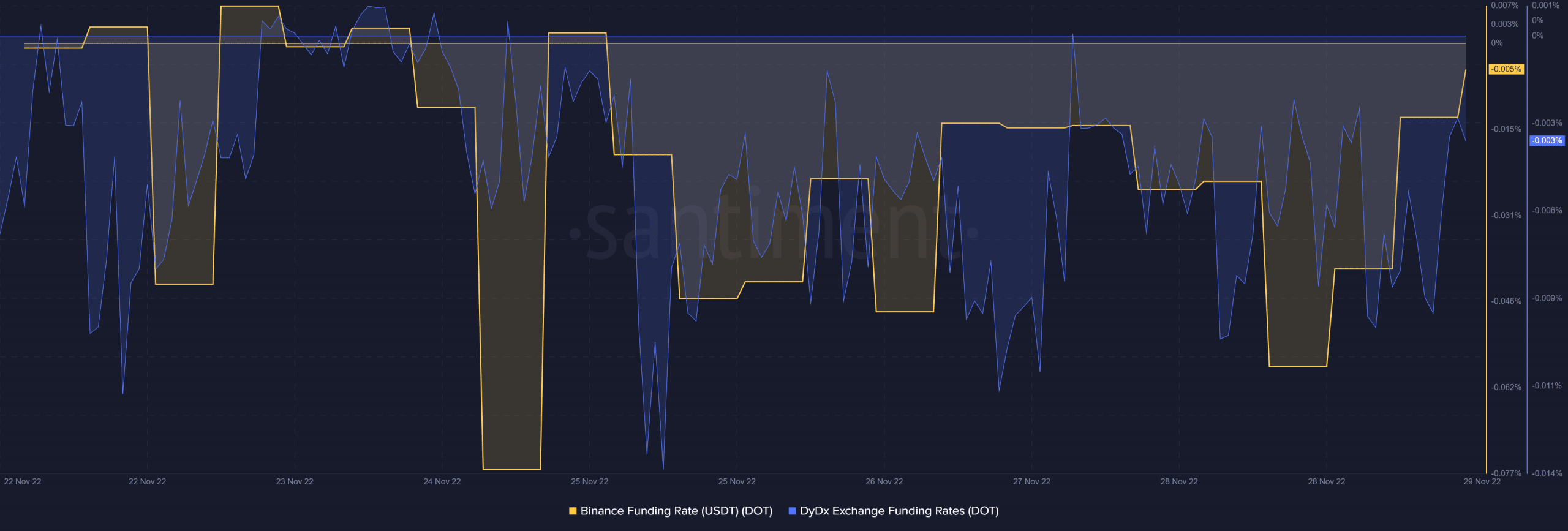

Speaking of demand, DOT’s demand in the derivatives market improved as both the Binance and DYDX funding rates achieved some upside in the last two days.

The return of derivatives demand should reflect the outcome in the spot market. However, the price didn’t register significant upside so far. This meant that there still wasn’t not enough demand to support a sizable rally.

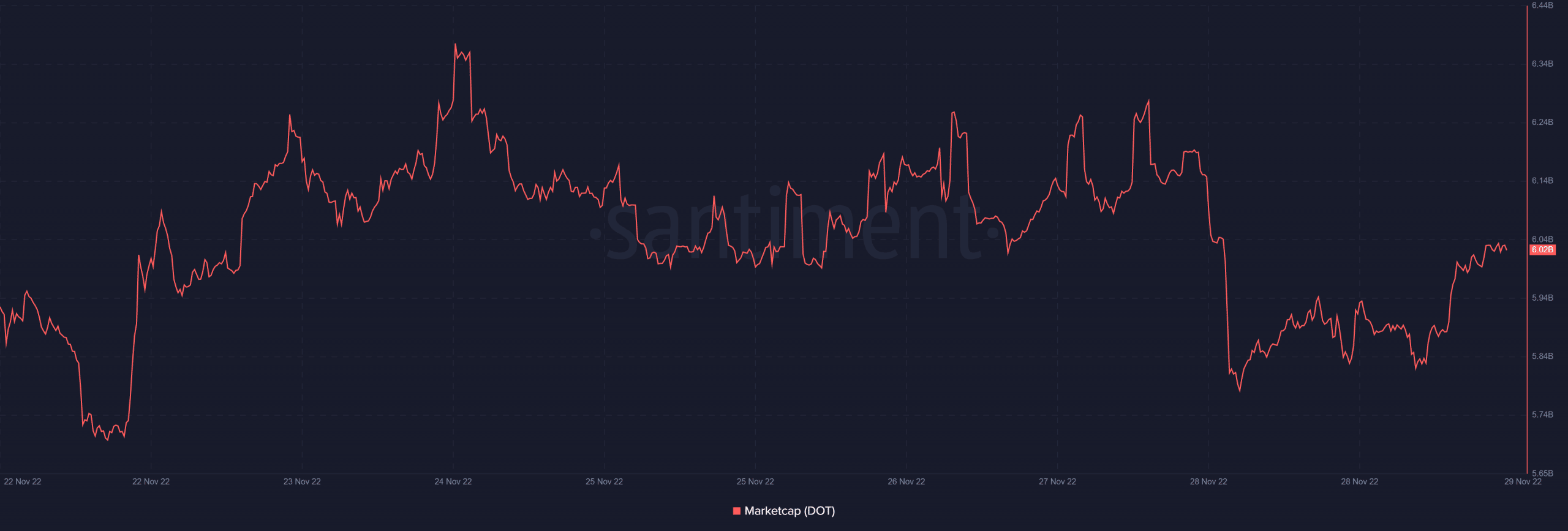

Polkadot’s market cap improved by roughly 240 million in the last two days. This confirmed that there was significant accumulation at its latest weekly low. Such a large inflow may reflect the gradual return of investor confidence.

Additionally, even though buying pressure started to manifest, it was clear that FUD and low investor confidence held the market back. If DOT can overcome these hurdles, then it might deliver a solid performance in the short and long term.