Reasons Tron investors can expect some chaos from TRX in the last weeks of 2022

- TRON’s Galaxy Score looked optimistic

- TRX’s Relative Strength Index (RSI) was oversold, which was bullish

According to a report by LunarCrush, TRON [TRX] had made it on the list of cryptos that had the highest Galaxy score. This was optimistic for TRX, as it indicated a price pump in the coming days.

Top 10 coins by 1-week Galaxy Score™$btc #bitcoin$eth #ethereum$xrp #xrp$ltc #litecoin$bch #bitcoincash$bnb #binancecoin$usdt #tether$xlm #stellar$ada #cardano$trx #tronhttps://t.co/Gjsp6UpP6J

— Cuopnuiok (@cuopnuiok) November 21, 2022

Read TRON’s [TRX] Price Prediction 2023-2024

Though this development did not have any effect on TRX’s chart, it was interesting to see what might be ahead for TRX in the last weeks of 2022. At the time of writing, TRX had registered a negative 1.6% growth in the last 24 hours and was trading at $0.05065 with a market capitalization of more than $4.6 billion.

Interestingly, TRON also updated its weekly statistics, which had some notable information about its ecosystem. For instance, the platform recently successfully completed its ‘Hacker House’ event at Harvard University and finished its project submission for TRON Hackathon 2022 season 3.

While these developments looked pretty promising for TRX, let’s have a look at TRON’s on-chain metrics to better understand the current market.

Is a TRX revival possible?

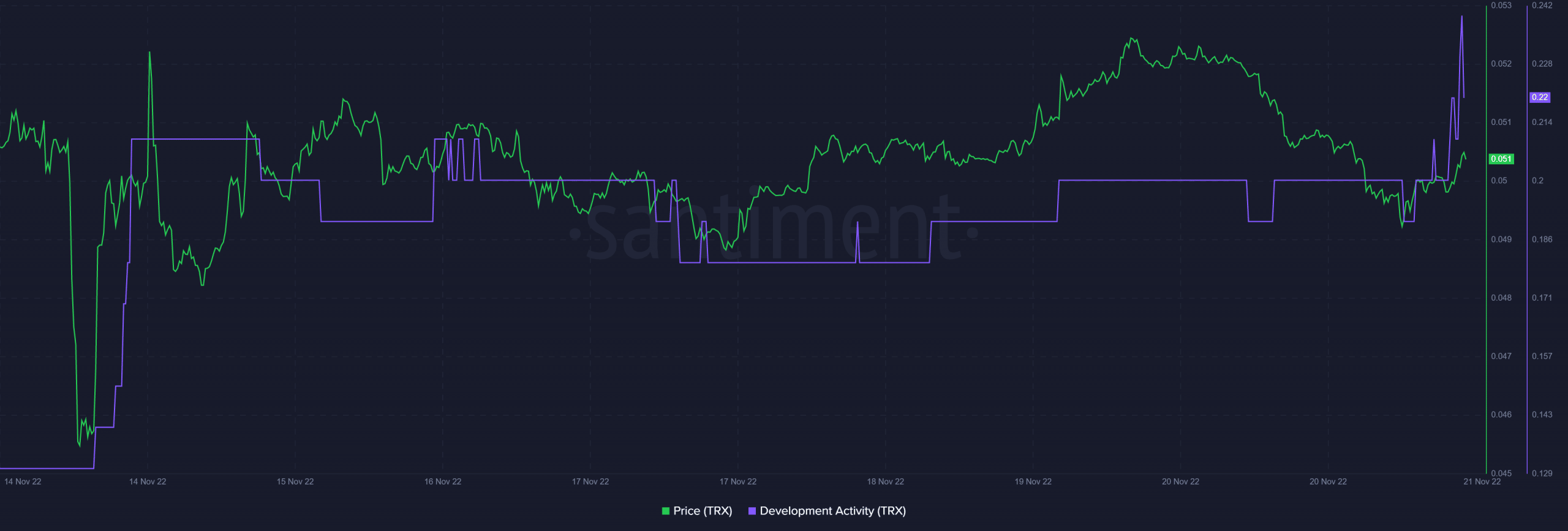

CryptoQuant’s data revealed that TRX’s Relative Strength Index (RSI) was in an oversold position, which looked bullish. This painted a positive image for TRX as it indicated a trend reversal in the near future. Moreover, TRON’s development activity also went up over the last week, which was by itself a positive signal for the blockchain.

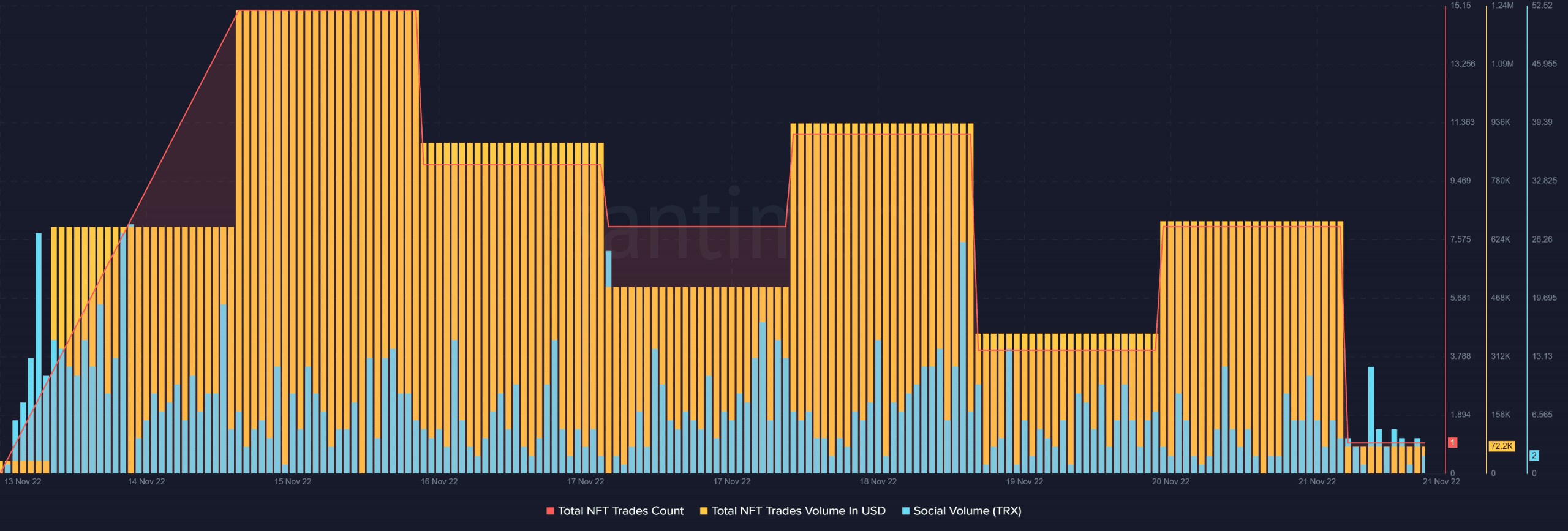

Nonetheless, the rest of the metrics were against a price surge. TRON’s NFT ecosystem witnessed a decline over the last week as its total NFT trade count and trade volume in USD, after spiking, registered a decline.

Furthermore, TRX also failed to maintain its popularity in the crypto community as its social volume decreased over the last few days.

Proceed with caution!

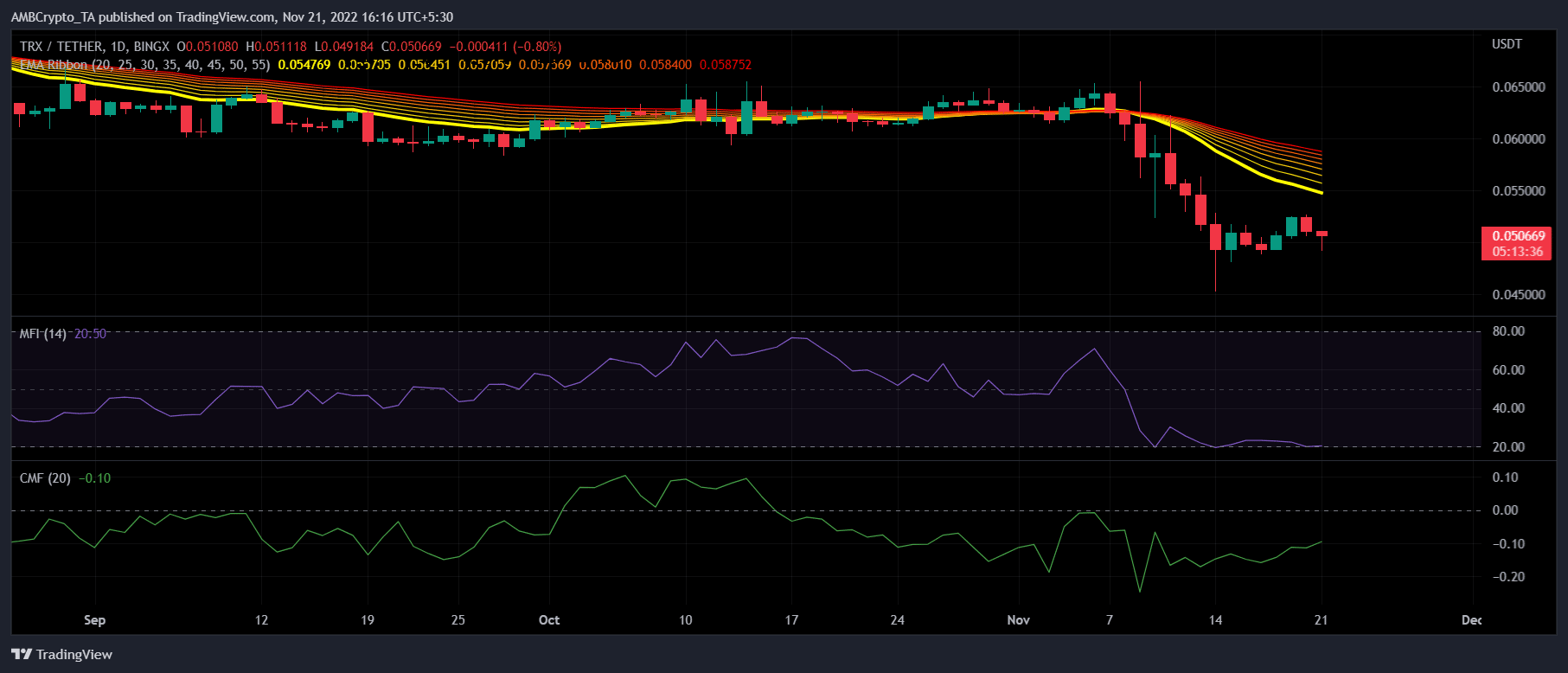

TRX’s market indicators showed a sign of revival, but caution was still suggested as the readings flashed mixed signals. The Exponential Moving Average (EMA) Ribbon revealed that the bears had an edge.

On the contrary, the Money Flow Index (MFI) was resting just below the oversold zone, thus increasing the chances of a northbound price movement. The Chaikin Money Flow (CMF) also registered an uptick, which looked promising for TRX.