SAND joins the list of most purchased tokens by top 100 ETH whales

- SAND’s demand soared among ETH whales despite the price being overbought.

- Low sell pressure for SAND as holders switch to a longer-term outlook.

The Sandbox’s native token SAND just made its way into the top 10 list of most purchased tokens by the top 100 ETH whales. This is according to the latest WhaleStats report and here’s why SAND holders might want to take note.

Realistic or not, here’s SAND’s market cap in BTC’s terms

If you have been holding SAND in your crypto bag, you are probably pleased with its performance since the start of January. You might also be glad to find out that the latest WhaleStats alert revealed that there is still strong demand for SAND despite its current price level.

According to the announcement, the demand from ETH whales in the last 24 hours was enough to put SAND into the 10 most purchased list.

JUST IN: $SAND @TheSandboxGame now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs ?

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#SAND #whalestats #babywhale #BBW pic.twitter.com/nWQoR6vWNX

— WhaleStats (tracking crypto whales) (@WhaleStats) January 15, 2023

Still digging SAND

A look at SAND’s current position reveals why this observation is rather surprising. The token traded at $0.67 at the time of writing, which represents an 80% upside from its current monthly high.

However, it is now deep in the RSI’s overbought zone and has extended its rally well above the 50-day moving average.

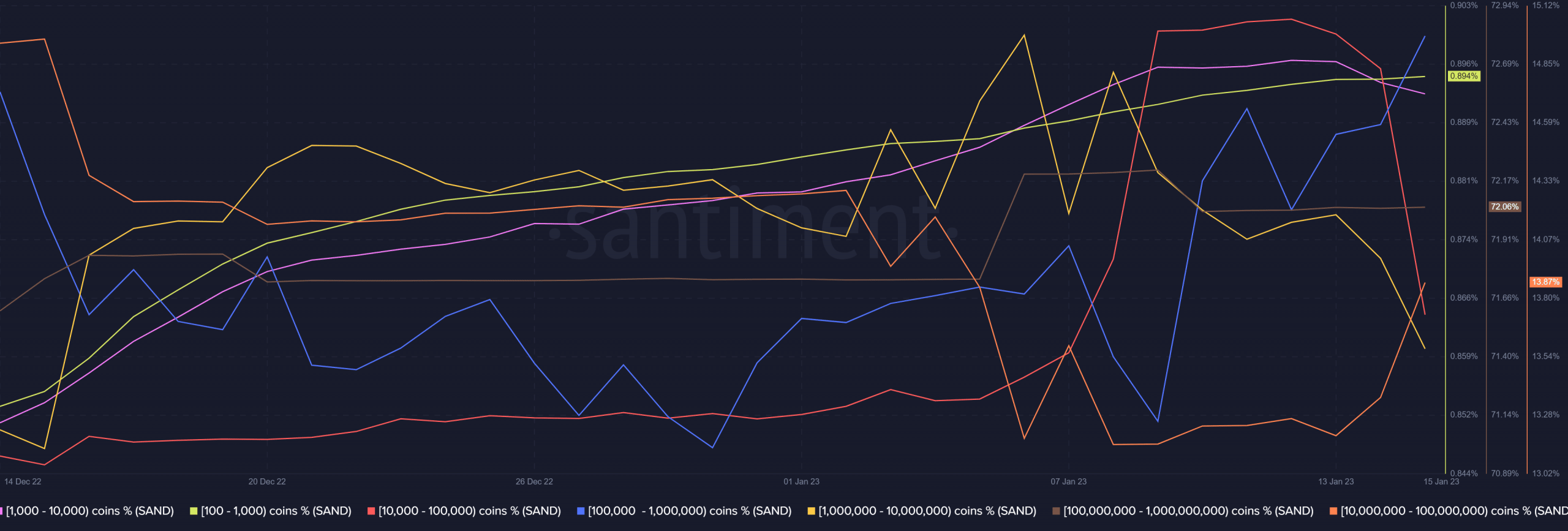

Based on the overbought conditions, the market should anticipate an increase in sell pressure but it is contrary to the WhaleStats observation. This may explain why we see weak bearish attempts so far. The supply distribution metric confirms that whales are indeed buying.

Addresses holding more than 10 million SAND increased their holdings by a sizable margin in the last three days. This is the second largest whale category holding 13.87% of the total circulating supply at the time of writing.

At the same time, some whale categories are indeed selling. This is especially the case for those in the one million to 10 million and 10,000 to 100,000 SAND bracket.

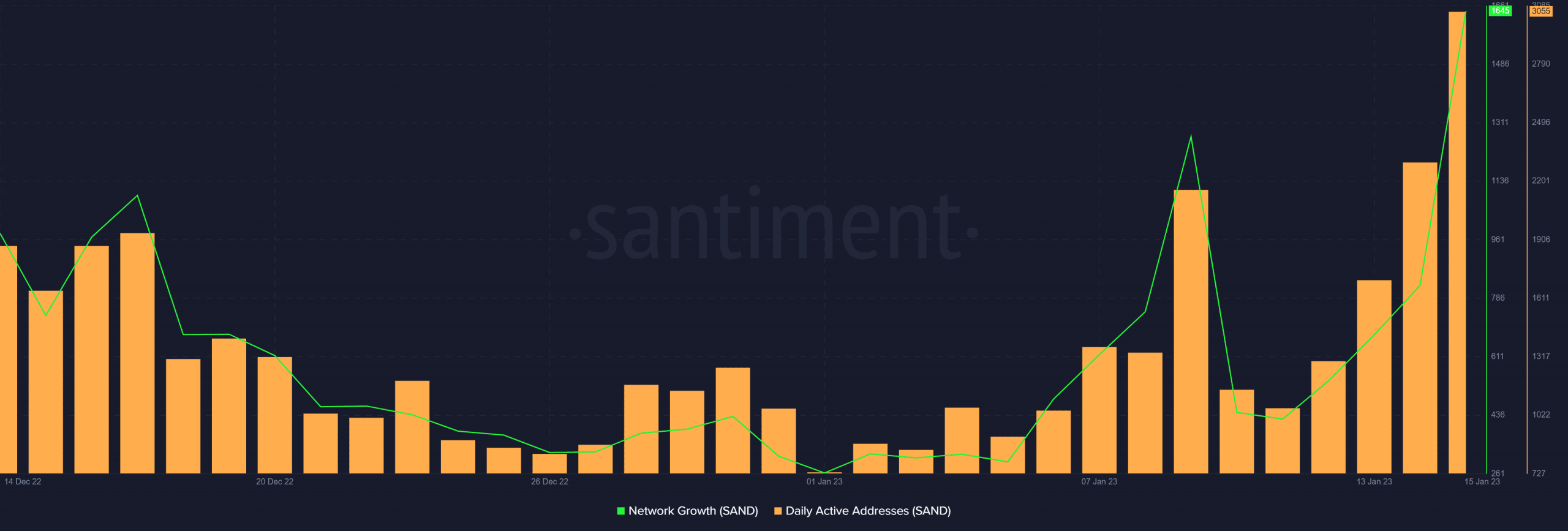

There are a few other metrics that suggest that the bulls may not have enough strength to take over. This includes the positive network growth that The Sandbox has achieved in the last few days. In fact, network growth was at a weekly peak at the time of writing.

Is your portfolio green? Check out the SAND Profit Calculator

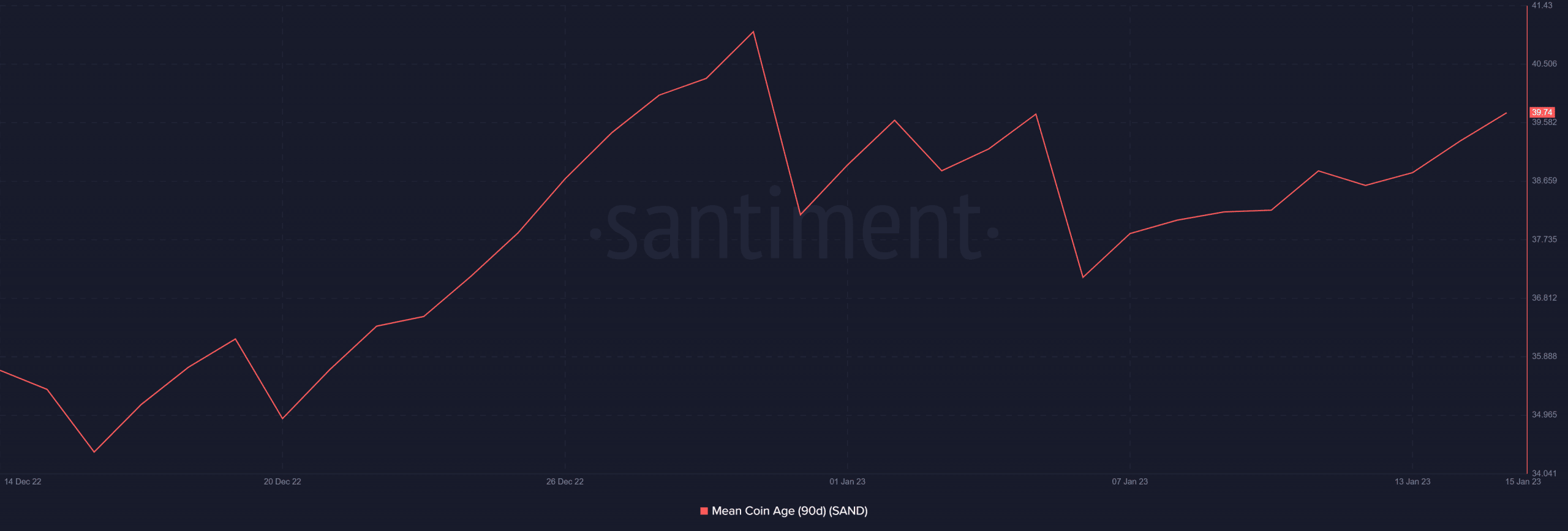

This increase in network addresses was backed by a surge in daily active addresses. Also, the mean coin age is up substantially in the last few days. This means most of the SAND accumulated in the past few days is yet to change addresses.

SAND’s observations highlighted above look like the makings of a trap for potential short sellers. The lack of enough selling pressure, backed by accumulation by ETH whales may lead to the more potential upside.