SOL rockets skyward as it doubles in value within two weeks — more to follow?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The short-term market structure and the trend were heavily bullish

- There was actual demand behind Solana’s move upward, but will this be enough to initiate a higher timeframe recovery?

Bitcoin [BTC] has steadily worked its way upward over the past ten days. The drop to $16.4k was followed by a slow but steady march upward. Recent trading hours saw BTC climb past the $17k mark, but $17.3k and $17.6k remain significant bearish outposts.

Are your holdings flashing green? Check the SOL Profit Calculator

The Solana network on-chain metrics have improved in recent days. The active wallet count has gone up by a substantial margin and development activity also noted an uptick. Yet, the lack of capital flowing into the market as per Open Interest could give bulls a pause.

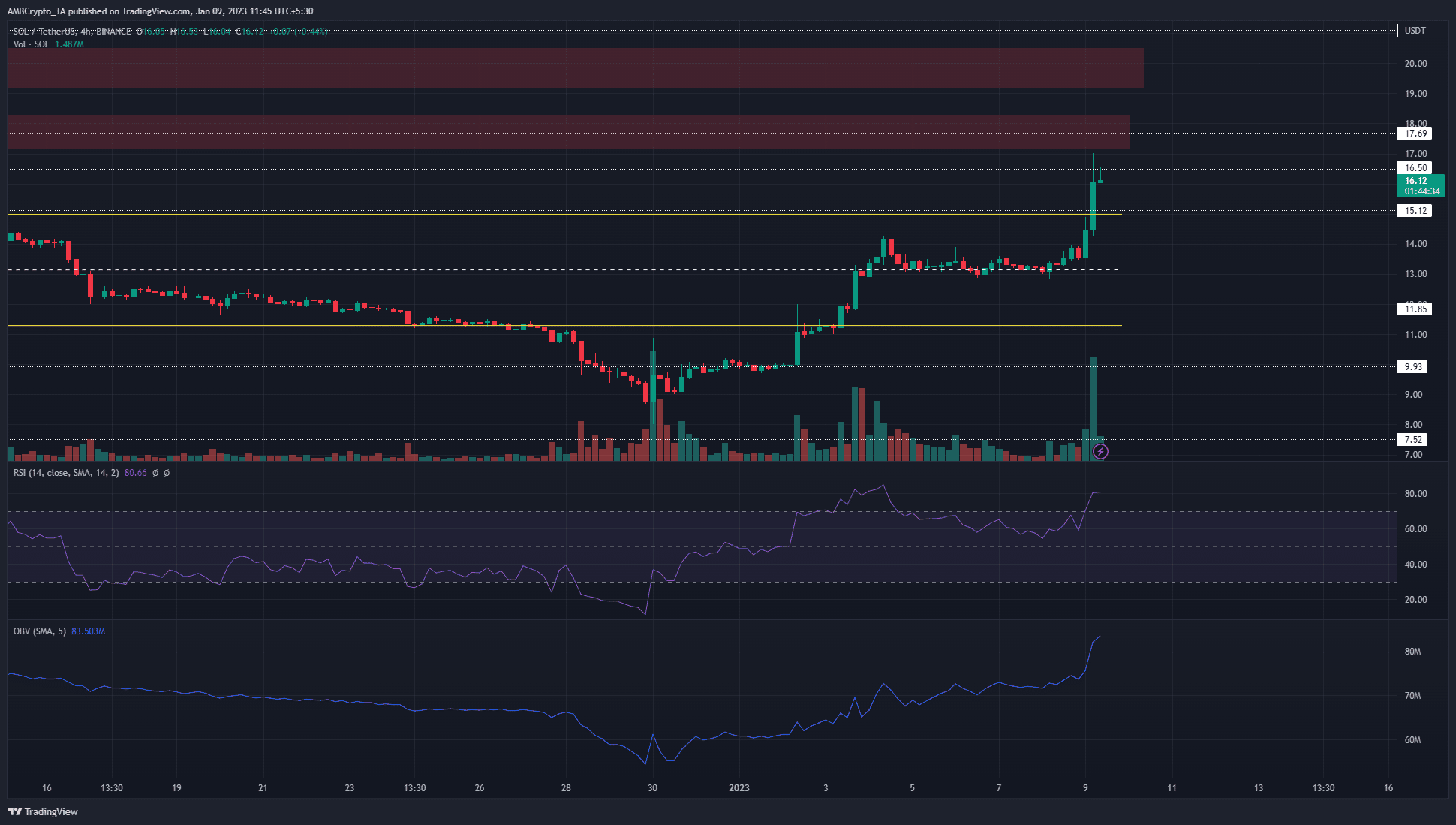

Solana breaks past the highs of the previous range and momentum remains firmly upward

Solana has made impressive gains since the drop to $8 on 30 December. It shifted its lower timeframe structure from bearish to bullish when it jumped past the resistance at $11.85 on 3 January. The recent move past $14 saw SOL gain close to 32% within a day.

How many SOLs can you get for $1?

Yet, these gains do not represent a long-term trend. Instead, it could be the violent reaction to months of bearish pressure. The market is attracted to liquidity, and the enormous number of short sellers in the weeks leading up to December meant that liquidity in the north could be hunted.

The On-Balance Volume (OBV) has been rising over the past ten days. This was indicative of genuine demand for the asset. Furthermore, the Relative Strength Index (RSI) also showed strong bullish momentum. Therefore, it was likely that prices could go higher still. The imminent areas of interest for Solana lie are the $16.1-$16.5 region and the $17.7-$18.2 resistance region.

A 4-hour bearish order lay at $17.15, but the short-term trend favors the bulls. Hence traders can wait for a pullback into the $14-$15 area, and look for a bullish reaction before buying SOL in that zone.

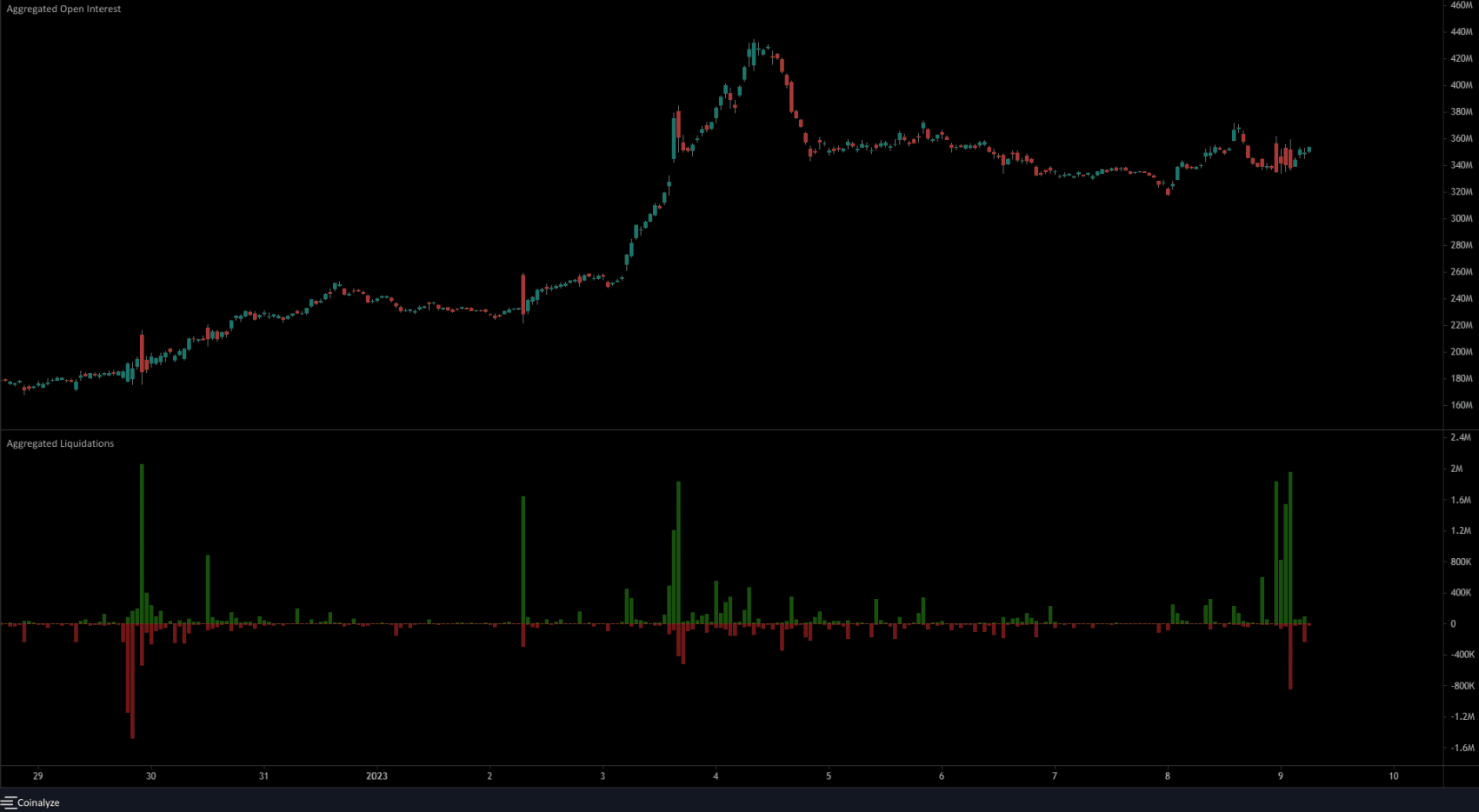

Open Interest notes almost no gains in the past couple of days despite the price shooting upward

Source: Coinalyze

The price surge earlier in January from $9.8 to $14 saw a hefty spike in the Open Interest. This suggested money flowing into the market, but at that time the spot CVD was not in an uptrend. This changed over the past couple of days.

The OI was stagnant while the price continued to climb in the past 12 hours. This could be a warning that the asset could reach a near-term top. The previous day of trading saw close to $6 million worth of short positions liquidated. Together, it suggested the possibility of a short squeeze.