Solana’s latest update could do wonders for SOL but not with this obstacle around

- Metaplex paves the way for higher demand for SOL NFTs in 2023

- SOL investors could keep a close eye on indicators to check for selling opportunities

Things might be about to get a lot more interesting for Solana [SOL] and its NFTs. This is thanks to a recent announcement from its NFT platform Metaplex. The latter announced a new upgrade that will enable the enforcement of royalties.

Read Solana’s [SOL] price prediction 2023-2024

The Metaplex announcement means Solana might become more appealing to NFT creators in 2023 and here’s why. NFT creators can earn a share of the profits every time an NFT created finds a new buyer. Metaplex plans on introducing the same feature for Solana NFTs.

1/ Big Friday update on royalties ?

Creators will be able to start upgrading existing NFT collections starting next week and enable royalties enforcement

Here’s what you need to know to prepare ? pic.twitter.com/A2MZALiwHB

— Metaplex (@metaplex) December 30, 2022

According to the announcement, NFT creators can implement the upgrade from 6 January. Doing this will allow them to implement royalties and even implement optional rule sets for their royalties.

One of the potential benefits of this move is that it will allow creators to earn more from their NFTs. This move may also encourage more creators to adopt the Solana blockchain as their go-to network for deploying their NFTs.

If the above happens, then we might witness an increase in NFT trade volumes in 2023. Solana’s NFT trade volumes were severely affected by the bearish market conditions.

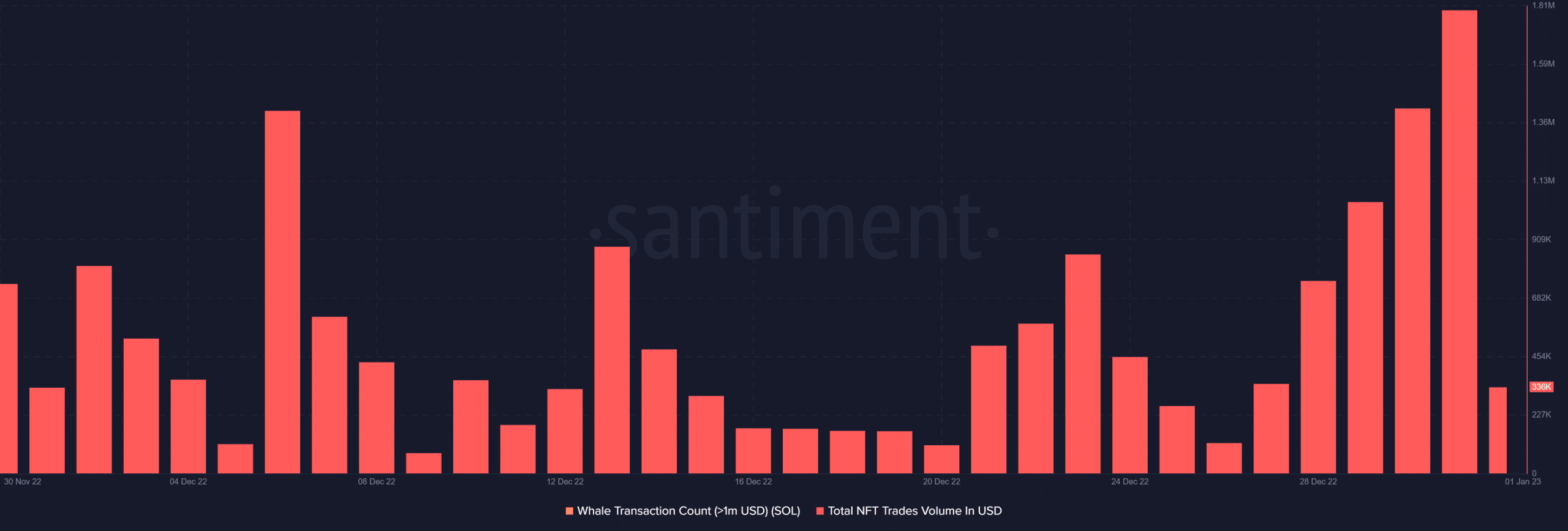

Zooming in at its performance in December reveals a bit of an uptick in the last five days of December.

It remains to be seen whether this move will actually have a positive impact on Solana NFT trades volumes but it should in theory.

The same goes for the impact on SOL’s demand. Speaking of, SOL delivered an unenthusiastic performance for the last six weeks. We have seen a drop in price volatility but what can investors expect in 2023?

SOL flirts with the bulls

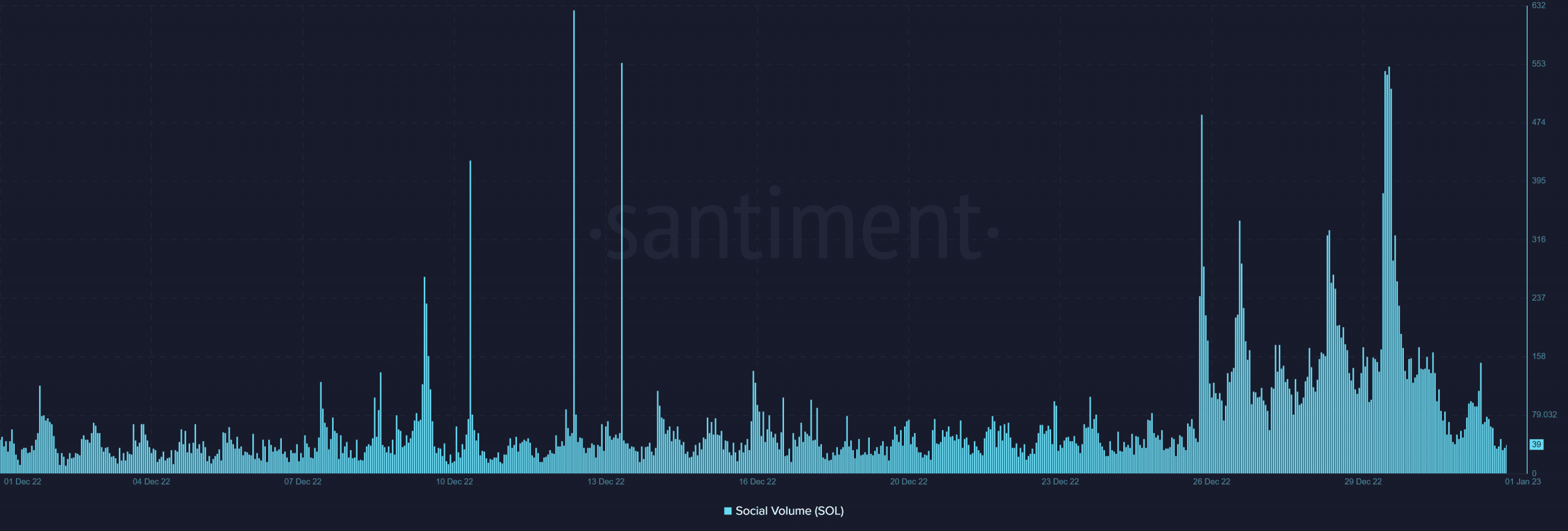

Solana experienced a surge in social volume towards the end of December. This means SOL might be exposed to more visibility as social volume surges.

Also worth noting is the timing of this social volume surge. It occurred at around the same time that SOL dipped into oversold territory.

SOL’s price action has so far struggled to exit oversold territory, meaning the existing demand was not enough to support a substantial pivot.

We do see a surge in money inflow as indicated by the Money Flow Index (MFI). Perhaps this accumulation has curtailed the previously existing bearish momentum. We may see a bit of an uptick if SOL can attract significant bullish volumes in the next few days.

Are your SOL holdings flashing green? Check the profit calculator.

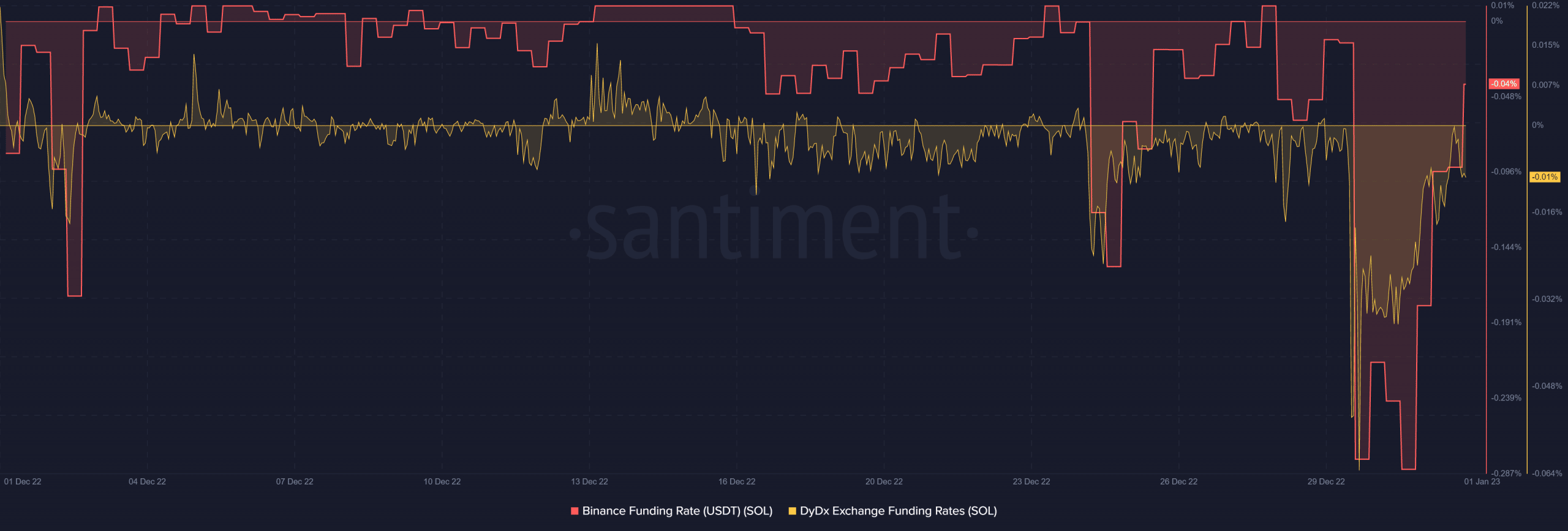

Fortunately, there are already signs that SOL’s demand is recovering. Both the Binance and DYDX funding rates experienced their sharpest dip at the end of December.

Nevertheless, a sharp uptick was witnessed in the last 24 hours.

Furthermore, the above chart indicated that demand in the derivatives market was recovering as investors could be seen taking advantage of the discount.

SOL investors should keep an eye out for metrics that may indicate a resurgence in spot demand and bullish volumes.