Bitcoin: Separating fact from fiction

In the first part of this article, we discussed the difference between the power consumption of Bitcoin v. Visa transfers. We also introduced the idea of how much of BTC’s energy is actually coming from coal-powered sources and renewable energy.

Is Bitcoin in the way of other energy processes?

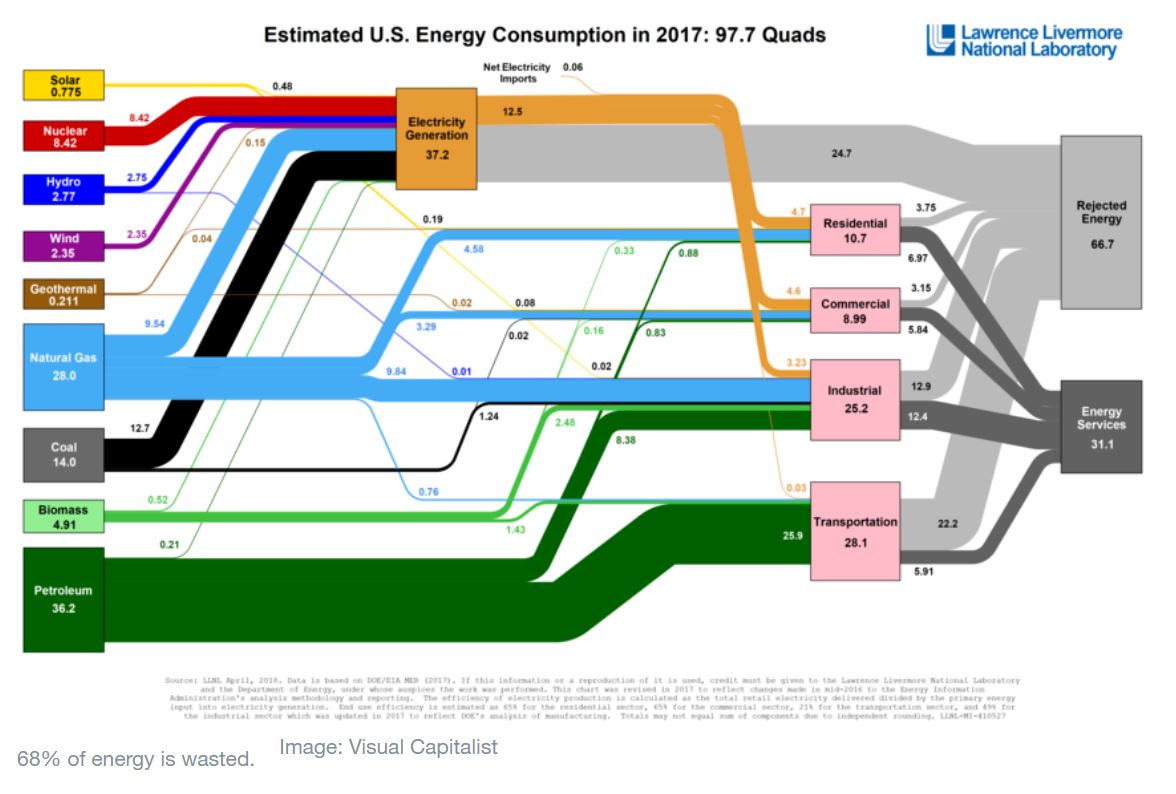

Most critics jump the gun on Bitcoin’s energy usage and claim that its power intake can be better used. However, the levels of electricity wasted on Earth each year gives a clearer picture.

A recent report by the World Economic Forum found that the amount of energy consumed in 2018 was less than the amount rejected or wasted. For instance, the transportation sector wasted 22.2 quads of energy (one quad is equivalent to 8,007,000,000 gallons of gasoline).

On the contrary, Bitcoin miners usually position themselves in geographically strategic positions to reduce power wastage. Many mining operations are located next to hydroelectric facilities in Canadian ghost towns or in Norway where renewable energy is in surplus.

Now, China’s Xinjiang provinces were flagged for their coal-powered sources. However, China also produced 17 TWh of wind energy in 2015. This, according to some accounts, may have been enough to power the entire Bitcoin network.

Additionally, the total curtailment of Chinese electricity generated from solar and wind for 2019 was around 4.6 TWh and 16.9 TWh, respectively. Taken together, wasted wind and solar energy from China alone could have contributed 28% of the total energy required for Bitcoin.

Hence, enough power is being produced around the world for Bitcoin’s network. It is not taking a lion’s share of power away from any industrial setup either.

In fact, according to Sergi Gerasymovych, EZ Blockchain’s Founder and CEO,

“I strongly believe that Bitcoin mining’s huge power consumption can be used as a tool to solve the global waste energy problem with solutions like utilizing flared gas for mining or stranded natural gas. This area has to have more coverage and research.”

The hook in the case? Bitcoin-Xinjiang power outrage

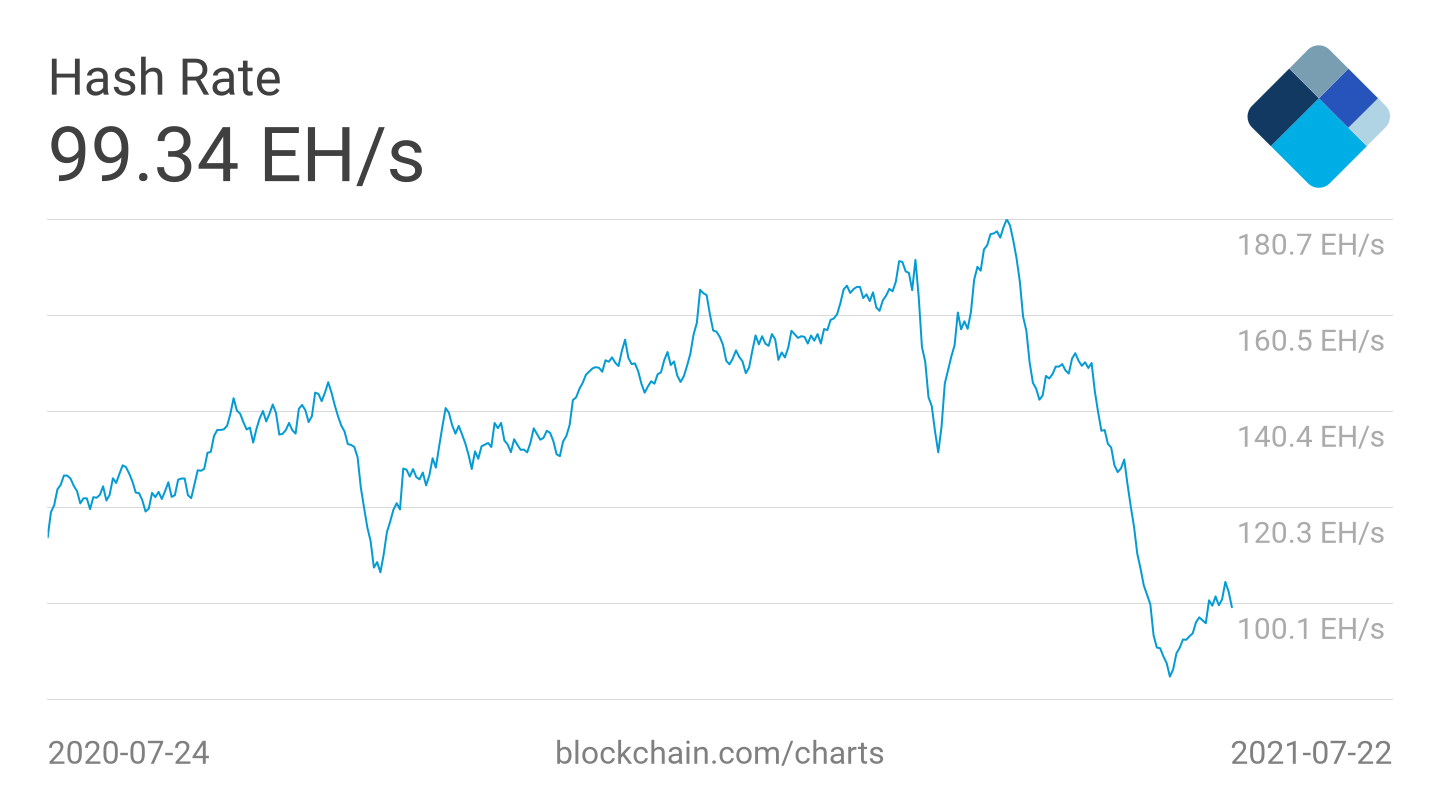

When Bitcoin’s hash rate dropped during the flooding of a Xinjiang coal mine, it fell from ~20 ETH/s to ~10.5 ETH/s. The ensuing dump even fueled the likelihood of a vector attack on Bitcoin.

While no such incident transpired, critics were eager to jump the bandwagon yet again. By looking at Xinjiang sourcing most of its electricity from fossil fuels, they assumed the network’s environmental impact.

However, solar and wind energy facilities have been operating there since 2015. In fact, Xinjiang-generated renewables-derived power made up “a significant part” of the region’s 24% contribution to China’s total generated electricity in 2020.

Castle Island Ventures’ Nic Carter shared a similar sentiment, stating,

“The takeaway for me is that Xinjiang is most likely smaller in terms of its contribution to hash rate than we thought. That’s unequivocally positive. Second, it seems to me that China is harassing miners, and making sure they know who is in control. Inner Mongolia already banned mining, and this seems like an early move at potentially banning mining in Xinjiang too.”

According to Carter, this “would obviously be very positive for Bitcoin, especially for U.S.-based miners.”

Greener mining is possibly the future

Regardless of this debate, it is clear that greener mining needs to be established. Curiously, one can argue that the situation has already improved.

According to the Bitcoin Mining Council, 56% of the mining power during the end of June quarter came from renewable resources. The report also claimed that the U.S. wastes 65% of all energy used to generate and distribute power. On the contrary, Bitcoin mining wastes only 2.8%.

It is time to call out facts from fiction when the issue of Bitcoin mining and power consumption is raised. Every industry is equally utilizing power so, it is unfair that the spotlight always falls on the digital assets’ mining market.