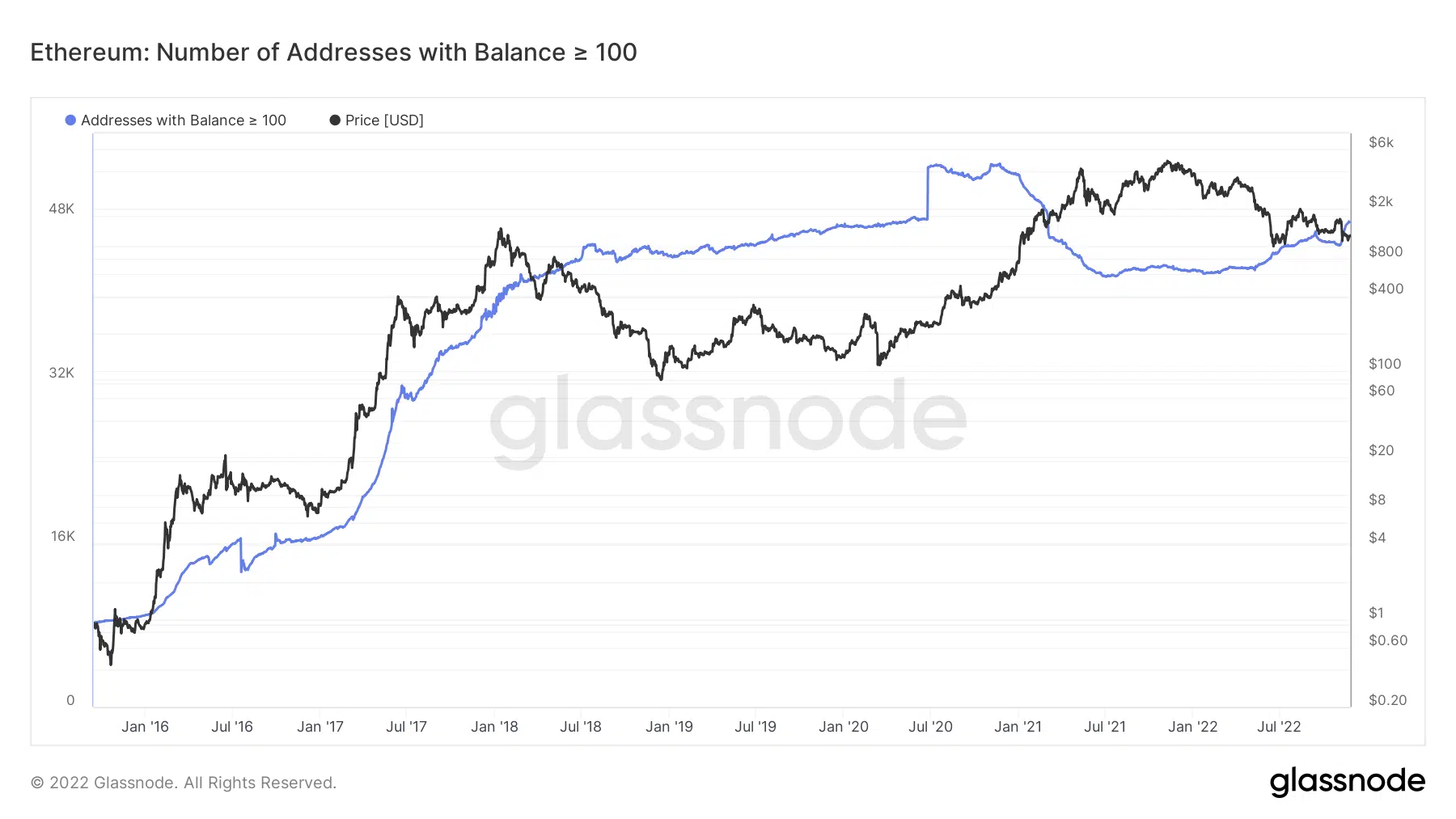

Why Ethereum addresses holding more than 100 ETH increased suddenly

- Ethereum addresses holding more than 100 ETH increased in the past weeks

- Staking rewards and the current price of ETH might be a motivation for the increased accumulation

The price of Ethereum [ETH] has fluctuated between extreme highs and lows during the last few months, making investors less eager to invest in the coin. Nevertheless, despite the apparent drop in price, some specific groups of Ethereum holders appeared to be increasing their accumulation.

Read Ethereum [ETH]’s Price Prediction for 2022-2023

According to data from Glassnode, HODLers had acquired over 100 ETH over the last few days. This was evidenced by the uptrend after a decrease. The fact that it appeared to have started up again suggests that more users were stockpiling over 100 ETH.

Some possible reasons for the increased accumulation

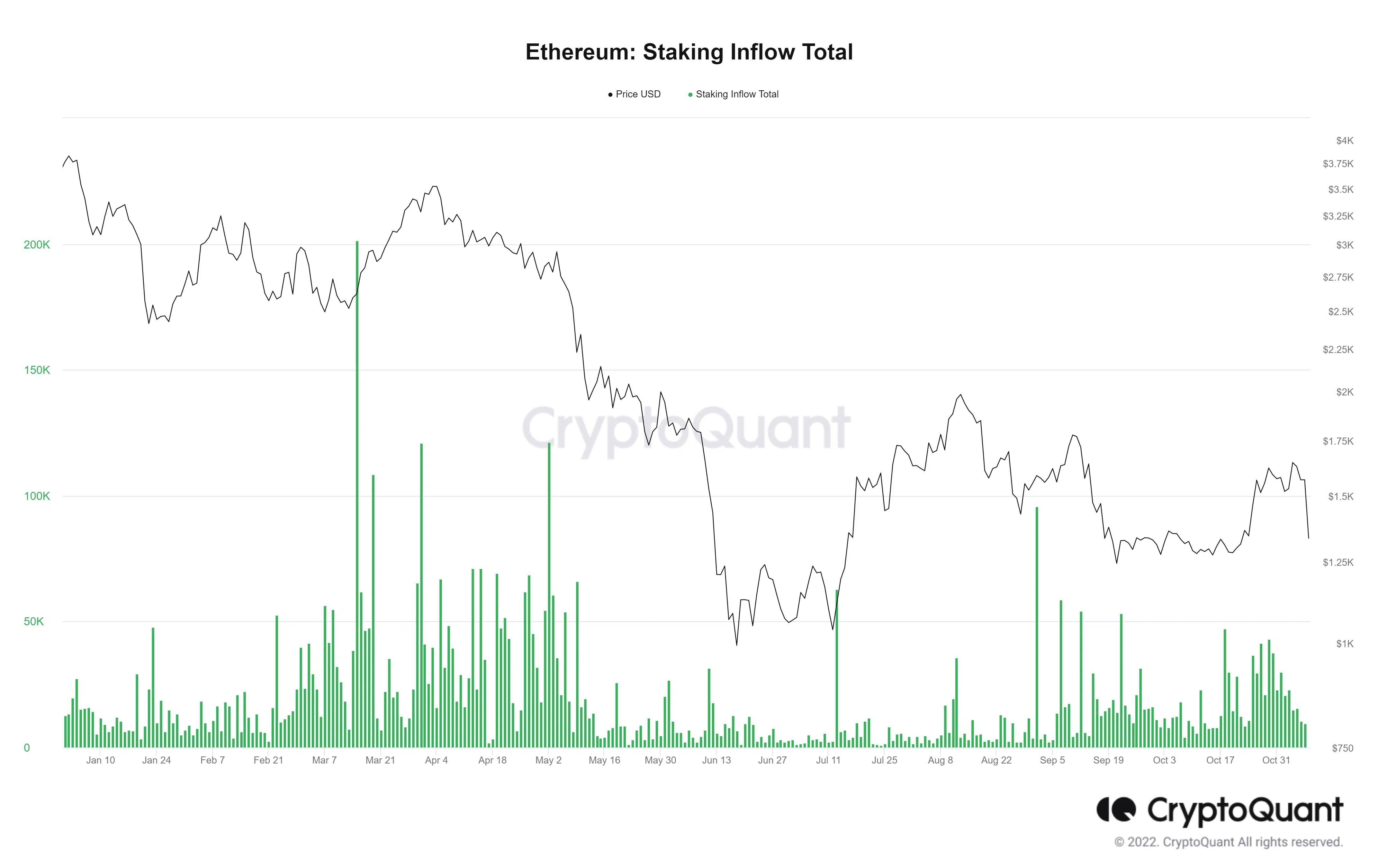

Before switching to the Proof of Stake network, Ethereum was the second-largest Proof-of-Work network after Bitcoin. The transition created a way for ETH holders to get rewards because it meant that stakers would protect the network. According to CryptoQuant’s Staking Inflow analytics, November saw a steady inflow, even though there were few spikes.

Additionally, ETH’s value decreased due to the price volatility it experienced over the previous several months. The token was trading at roughly $1,200, at the time of this writing.

ETH was trading above $3,000 until April this year. However, from that time till today, it has plummeted and lost over 50% of its worth, similar to other coins in the market.

ETH in a daily timeframe

In the daily timeframe, the short (yellow line) and long (blue line) Moving Averages were visible above the price fluctuation. At various levels, these lines were acting as the asset’s resistance. The yellow line was acting as resistance around $1,300, and the blue line was acting as resistance around $1,500.

Thus, ETH may test both resistance levels and surpass them during an extended rally. Additionally, it could continue to climb and possibly retake the $2,2000 area. If investors were to accumulate at the current level, they would benefit by over 50% if the price rises past the existing resistance levels.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)