This is how DeFi adoption stats flip the script on the USA and China

The exponential growth of DeFi over the past couple of years has been fascinating. These decentralized protocols, built mainly on top of the Ethereum network, have provided investors worldwide with a vast array of decentralized investment tools. However, while it remains one of the crypto-economy’s fastest-growing sectors, its adoption has been somewhat disproportionate.

The biggest adopters in the world are…

According to Chainalysis’ 2021 Global DeFi Adoption Index, the U.S has led the way in DeFi adoption. The United States is followed by countries like China, U.K, Vietnam, and several other Western European nations.

Curiously, its findings were in contrast to the Crypto Adoption Report released by the firm last week. It had found that grassroots adoption of the larger cryptocurrency ecosystem is being driven by emerging markets like Vietnam, India, and nation-states in Africa.

Moreover, Finder’s crypto-survey released last week also placed Indonesia, Malaysia, and the Philippines in its top crypto-adopters. USA and UK, on the contrary, fared at the very bottom of the list.

However, the latest DeFi report paints a different story. DeFi adoption since 2019 has been driven by middle to high-income countries that already possess developed cryptocurrency markets, particularly those with “strong professional and institutional markets.”

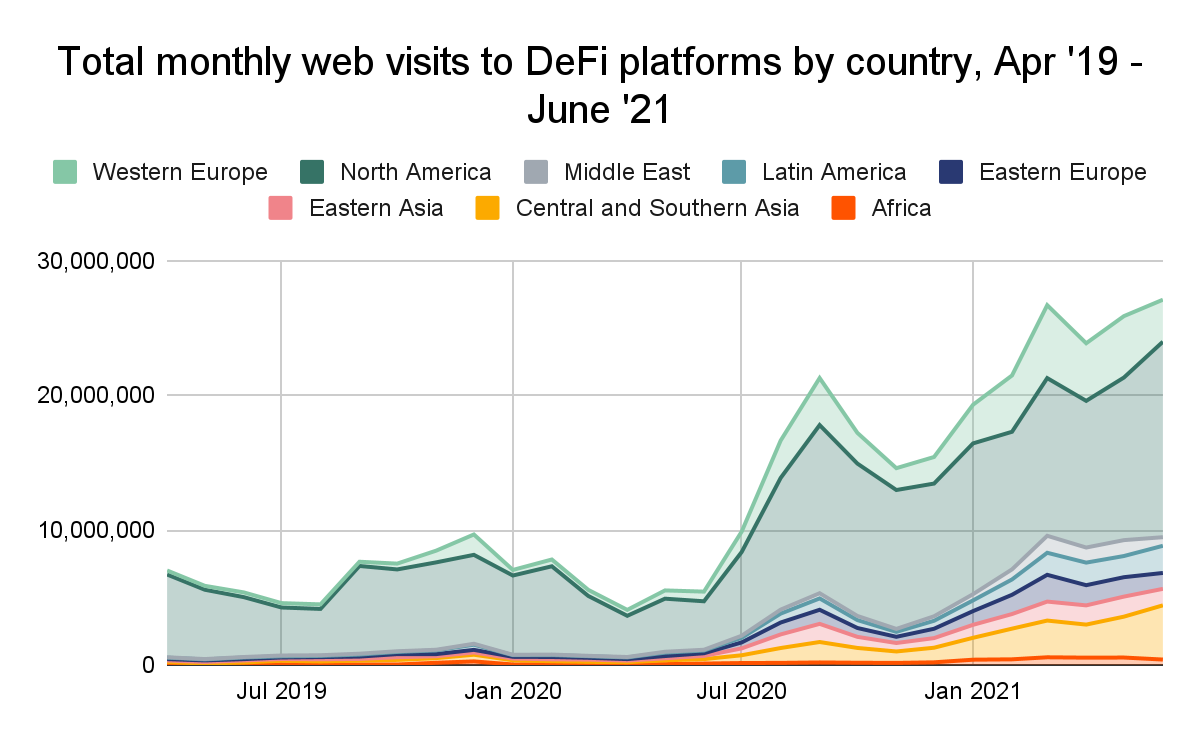

Take the attached chart, for example. North America, Western Europe drove web traffic to DeFi protocols till mid-2020, before the rest of the world finally caught up with significantly lower numbers.

It should also be noted that while African nations like Kenya, Nigeria, and Togo fared in the Crypto Adoption Index’s top 10, African traffic remains negligible when it comes to DeFi.

USA v. China – A study in contrast

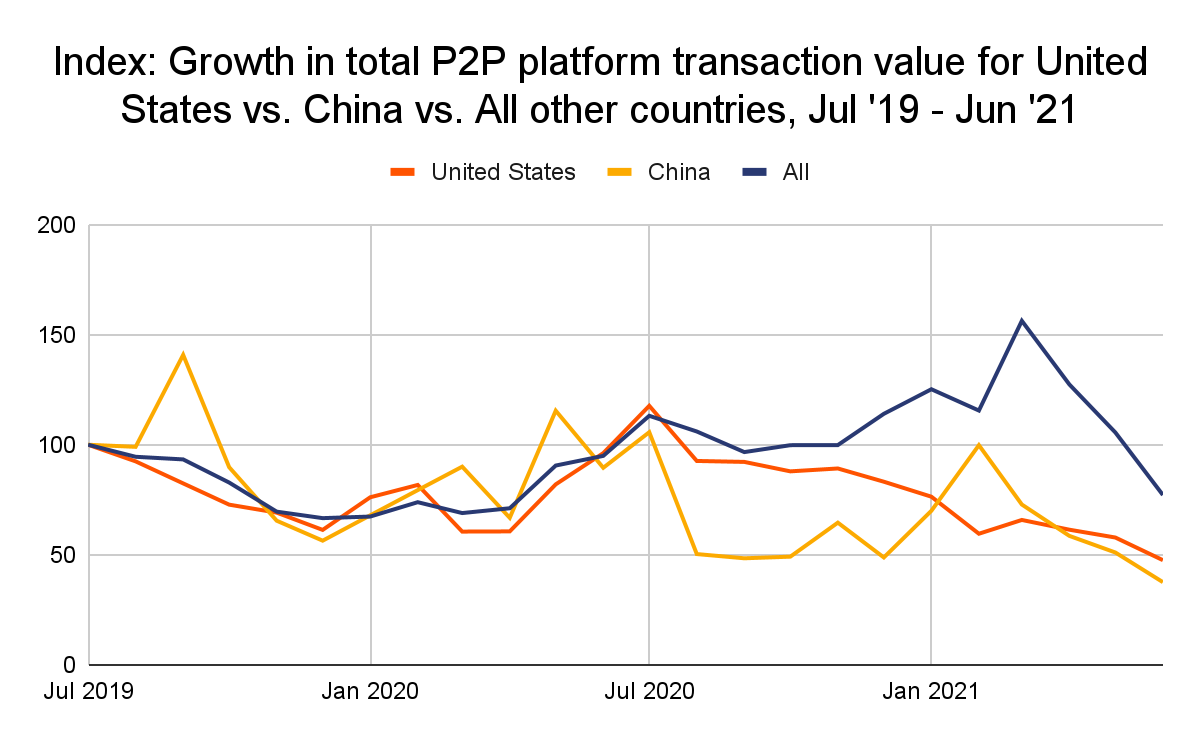

Another interesting aspect in the comparison of both reports is the performance of the U.S.A and China. The growth in total P2P transaction volume across both countries started to considerably decline after June 2020, when compared to the rest of the world.

While the same still remains noticeably lower, both countries had some of the largest DeFi transaction volumes over this time.

The report also highlighted the stark distinctions between the DeFi ecosystem and the cryptocurrency industry as a whole. One factor driving this distinction was the motive for cryptocurrency adoption.

Emerging markets in the global south are increasingly using Bitcoin as a store of value to fight inflation in their own economies. Moreover, many of these nations have huge immigrant populations working in western nations that send remittance payments back home. These transactions are often executed via cryptocurrencies to avoid high exchange fees.

On the other hand, nations with developed economies are driving DeFi adoption as experienced cryptocurrency traders and investors are using these novel financial tools to further their capital gains. The high level of institutional capital pumped into the DeFi space in 2021 supports this assertion.

Another reason for this trend could be regulatory uncertainty in the USA surrounding the traditional crypto-industry. The SEC-Ripple saga is just one example of how the lack of regulatory clarification has stifled adoption and innovation.

On the other hand, however, DeFi has remained largely hidden from the regulatory radar up until now. In fact, regulators are yet to wake up to this emerging market space.

This may be why professional investors in the country have been more indulgent towards the DeFi ecosystem.