This is why Ethereum DeFi whales prefer these applications

The crypto-industry has seen various products gather steam over the past year, with non-fungible tokens [NFTs] being the rage especially. However, a recent study from DappRadar found that although the sudden popularity of NFTs took the industry by storm, there is no comparison to the value generated by decentralized finance [DeFi].

The DeFi space managed to attract over 590,000 daily unique active wallets in the third quarter [Q3], hitting a total value locked of $178 billion. While Ethereum-based DeFi remains dominant, other competitors like Binance Smart Chain [BSC] are also gaining more ground.

The biggest contributors to the value locked are lending dapps, thanks to a lot of whale activity.

The report also found that Ethereum dapps recorded a higher whale activity than BSC dapps. According to DappRadar, the average size of transactions on Aave [on Ethereum] during Q3 was measured at around $461,000, whereas Alpaca Finance [on BSC] hit $72,000.

It added,

“Even though the gas fee mechanism changed due to the London upgrade, it still remains an ecosystem that favors whales.”

Despite BSC offering a friendlier fee barrier, the network usage remains high on Ethereum. Projects like MakerDAO, Aave, and Compound lead the DeFi-way for Ethereum users. Although MakerDAO is a borrowing protocol hosted on Ethereum, it became relevant to the DeFi space as the supplier of the stablecoin DAI.

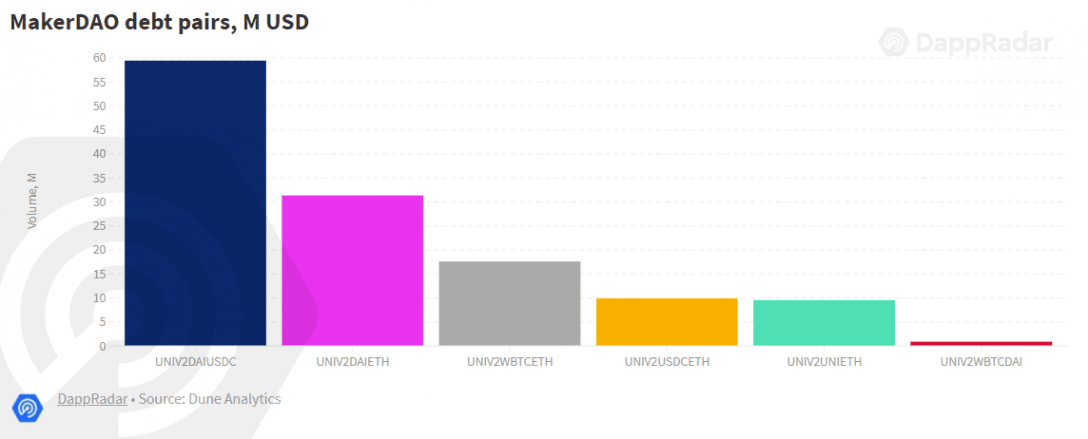

Unlike lending apps, Maker users can only borrow DAI by depositing collateral in the accepted cryptos or by creating a new vault with accepted tokens. The prominent debt pair has remained with liquidity provider Uniswap.

Its flash loans and rate switching made it a favorite of big investors and arbitrageurs. Aave recently hit a TVL of $15 billion in Ethereum and the transaction size has followed the lead of Maker, although the average number of transactions tripled in Q3.

The report added,

“While Aave is certainly a place where whale transactions occur frequently, it is important to note that the size of transactions on Maker are approximately 10 times larger than Aave.”

Meanwhile, BSC’s largest lending protocol Alpaca Finance has also seen transactions grow five times in Q3, measuring at almost $125,000 in October. It was far away from competing with Maker, but not so far from Aave.

Therefore, the new craze of products may come and go. The decentralized finance space is evolving. with whales mainly interested in the Ethereum network.