This particular Bitcoin trend will ‘accelerate hard’ thanks to China

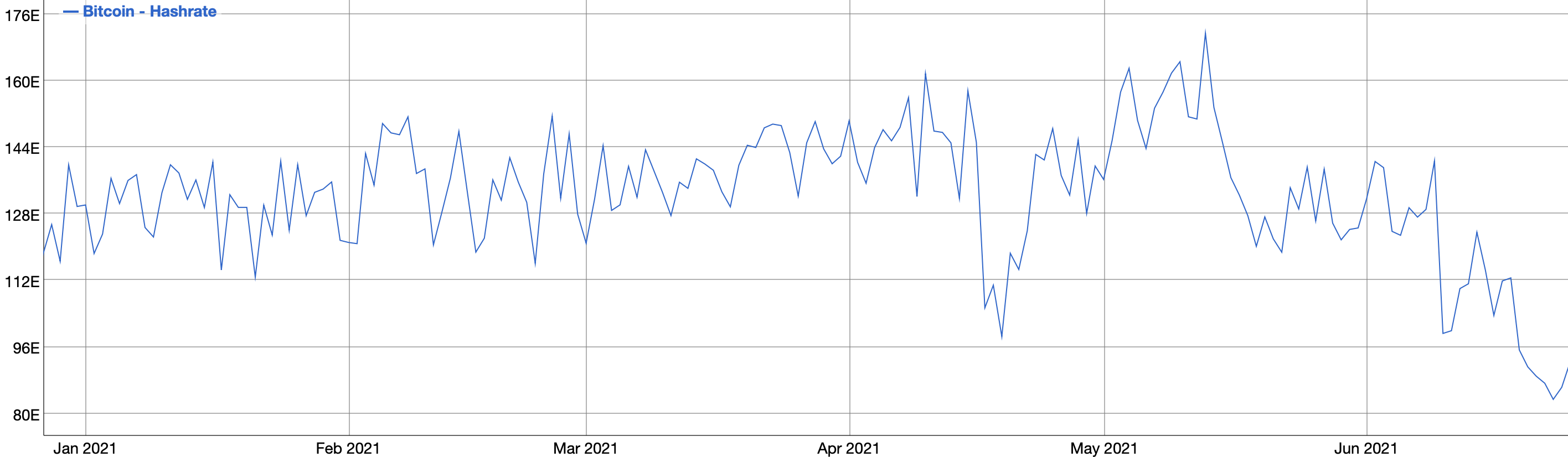

China’s crackdown on Bitcoin mining has affected the world’s largest cryptocurrency, as well as its community. In fact, within a few weeks of the lockdown, the associated hashrate significantly plunged by almost 50% from its top. China, until that moment, was responsible for over 60% of the network’s hashrate.

Ergo, the average hash rate (hash/sec) touched an ATL of around 100 Ehash/sec for the first time since November 2020. At the time of writing, Bitcoin’s Ehash/sec stood at 105.554; +3.1% in the past 24 hours.

Source: Bitinfocharts

Was this a mistake?

Well, according to a renowned crypto-bull on Bloomberg, “It’s a trillion-dollar mistake.”

China's Bitcoin crackdown will be a "trillion-dollar mistake."

MicroStrategy CEO Michael Saylor talks to @emilychangtv https://t.co/Eu4ZAUjjhD pic.twitter.com/AJ951tFr39

— Bloomberg Technology (@technology) June 25, 2021

Michael Saylor, the CEO of MicroStrategy, said,

“The primary dynamic (driving the market) is the China exodus. There’s a forced and there’s a rushed exodus of capital and mining from China that was a bit of a surprise.”

He added,

“I think that given the growth rate of Bitcoin this will prove to be a trillion-dollar mistake.”

Now, while China can afford this “trillion” dollar mistake considering its wealth, Saylor still considers it to be a “tragedy.”

Someone’s loss is someone’s gain?

Well, with the energy FUD news originating from China, Bitcoin witnessed a tremendous hike in selling pressure on different crypto-exchanges. In fact, the development had an adverse effect on BTC’s recovery on the charts.

Taking advantage of the discounted price, Microstrategy recently acquired an additional 13,000 Bitcoins, taking its total BTC holdings to 105,085 BTC.

Interestingly, Saylor was even questioned about his move to ‘Buy the dip’ considering the current bearish sentiment around the flagship coin.

Saylor responded,

“Bitcoin is the dematerialization of property. We are sucking the value out of gold, real estate, and other property assets, and collectibles and art, we are putting them on a blockchain and we’re giving them out to the people. It’s a long-term trend, it’s a million times more efficient than holding your property around on your back.”

China’s disavowing Bitcoin and its mining operations have given a perfect opportunity to Western investors. Thanks to the same, there has been “a massive exodus of miners from China to North America and parts of Europe.”

“North American Bitcoin miners will benefit from this because their cost is the same, but they are going to generate 50% more revenue or 75% more revenue for quite a while.”

This is “fantastic” news, according to the Co-founder and CEO of Blockchain.com Peter Smith who said,

“You’re going to see a diversification of mining operations around the world. We’ve been seeing that trend over the last two years, as large mines are built in Europe, the U.S., and a variety of other geographic locations—but that trend is going to accelerate hard now.”