Uniswap aims to help you save on gas fees through this new upgrade

- Uniswap is trying to spice things up with the addition of two new smart contracts that may support friendlier fees.

- These developments might be an attempt to boost the demand for the platform’s services.

Uniswap is looking to make the DeFi experience much smoother and more convenient for users this year. This is a necessary step, especially in its journey of encouraging adoption. Its latest update reveals interesting improvements aligned with the goal of a smoother platform.

Realistic or not, here’s Uniswap’s market cap in BTC’s terms

Uniswap recently revealed in its latest blog post that it just rolled out two new smart contracts. They include Permit2 which will facilitate the sharing and management of token approvals through a range of applications in a more cost-effective and efficient manner. The other smart contract is Universal Router designed to enable ERC20 and NFT swapping unification.

? Uniswap Labs: Every time we upgrade our router, users have to spend gas to re-approve tokens. But no more!

With Permit2, you'll need to re-approve now, but never again. Spend small for big savings later!

— Uniswap Labs ? (@Uniswap) January 18, 2023

In other words, the two smart contracts have a keen focus on introducing the most cost-efficiency for users. A potential implication of these rollouts is that users will save on gas fees. This move might encourage more people to join Uniswap or more transactions on the network.

Can gas fee savings support more activity?

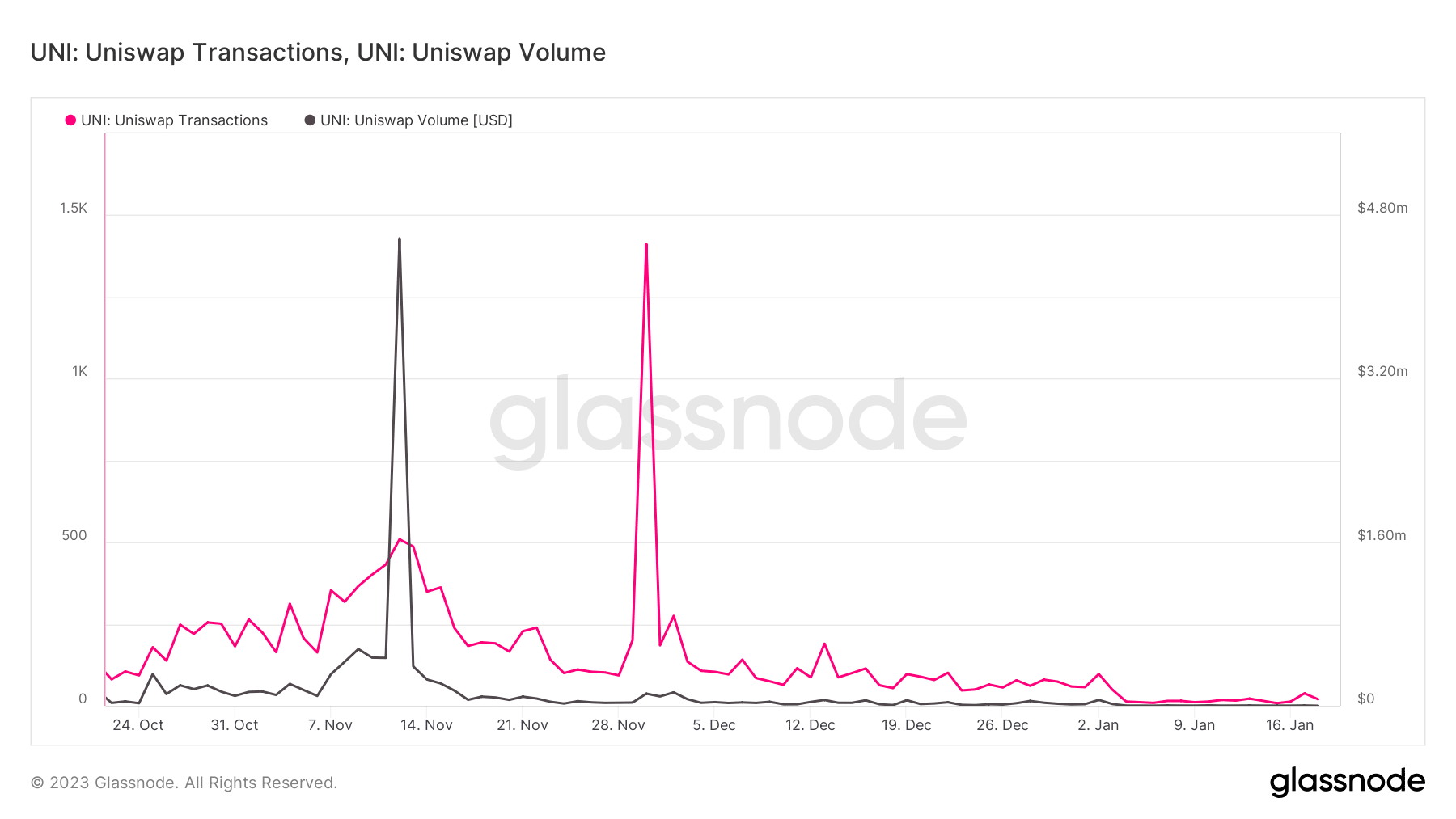

A look at Uniswap’s latest performance may provide a better understanding of why this move is necessary. Uniswap transactions and volume remain low despite the recent excitement in the market.

This is contrary to the expectation that a market pivot followed by a strong demand wave would trigger more volumes and transactions on Uniswap. This is why Uniswap might have to implement some changes to try and make the DeFi platform more interesting for users.

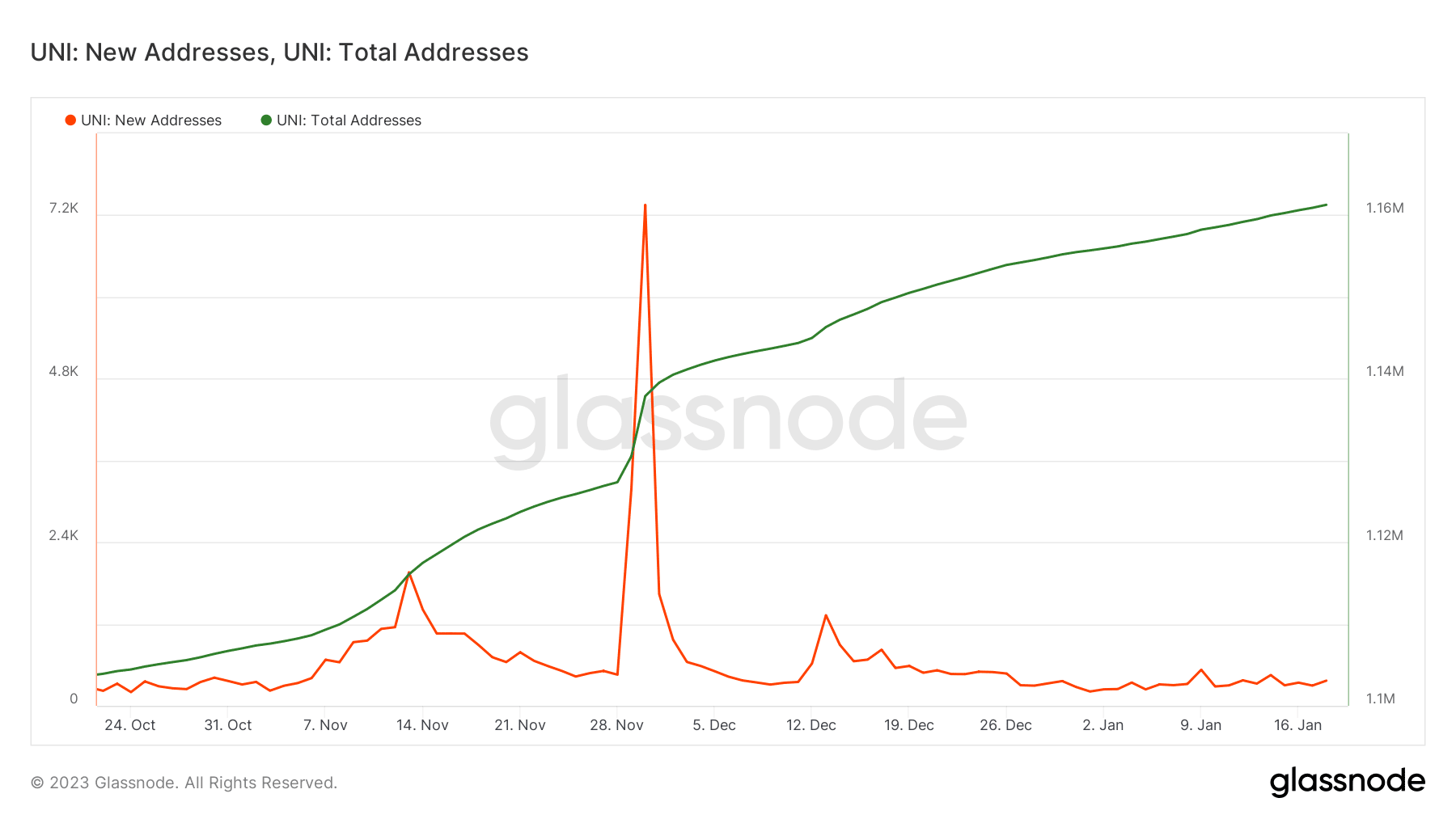

An analysis of addresses on Uniswap reveals steady growth in the total number of addresses using the platform in the last three months. However, the number of new addresses remained low even in the first week of January.

The lack of an influx of new addresses may be due to multiple factors. However, this directly affects Uniswap’s ability to sustain growth, thus the need to do things differently. It may also affect the demand for the native token UNI.

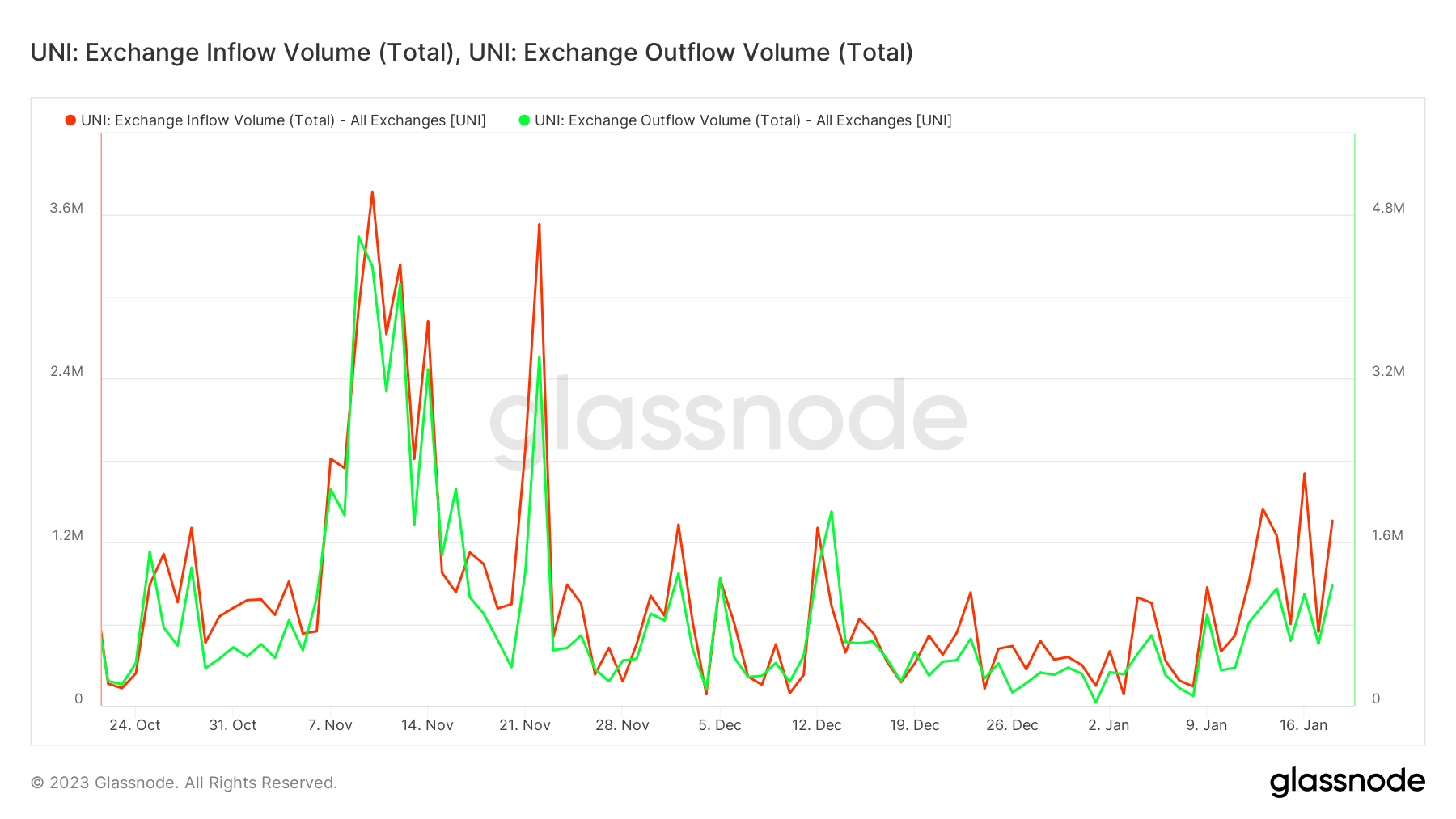

An evaluation of UNI’s exchange flows reveals that there was a notable increase in exchange activity in the first two weeks of January. Nevertheless, exchange inflows have dominated the market, especially in the last few days.

Is your portfolio green? Check out the Uniswap Profit Calculator

The above observation suggests that many UNI holders are taking a profit. One can translate this as a sign that there is a low incentive to hold UNI. It also aligns with UNI’s price action which has so far pulled back by as much as 13% from its current monthly high.

UNI traded at $6.02, at the time of writing. An extended downside may push it as low as $5.74 where it may experience the next price floor. This is because it will interact with the 50-day MA at that level which may act as a psychological buy zone.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)