Uniswap and Stellar possess this particular edge over other altcoins

The entire altcoin market is currently giving out mixed signals. There are massive fluctuations in price, and the correlation between assets is relatively inferior. While Ethereum Classic registered its largest rally in 2021, reaching a top of $179, other alts were either consolidating between key ranges or indicating a trend shift. From a development perspective, Uniswap had a major announcement, with its V3 going live on the Ethereum mainnet.

Stellar Foundation also announced its Q1 2021 report, which highlighted significant positive developments in the network. Keeping these factors in mind, these alts could potentially be gearing up for a steady rally in a few weeks.

Uniswap V3 launch had a different effect on the price

UNI/USDT on Trading View

Uniswap spiked close to 33% towards the end of April. Breaking above its previous resistance range (highlighted in the chart), UNI was able to test immediate resistance at $44. The announcement of the launch was expected to carry the asset forward towards $53. Yet, following the V3 launch, UNI’s value tanked in the chart.

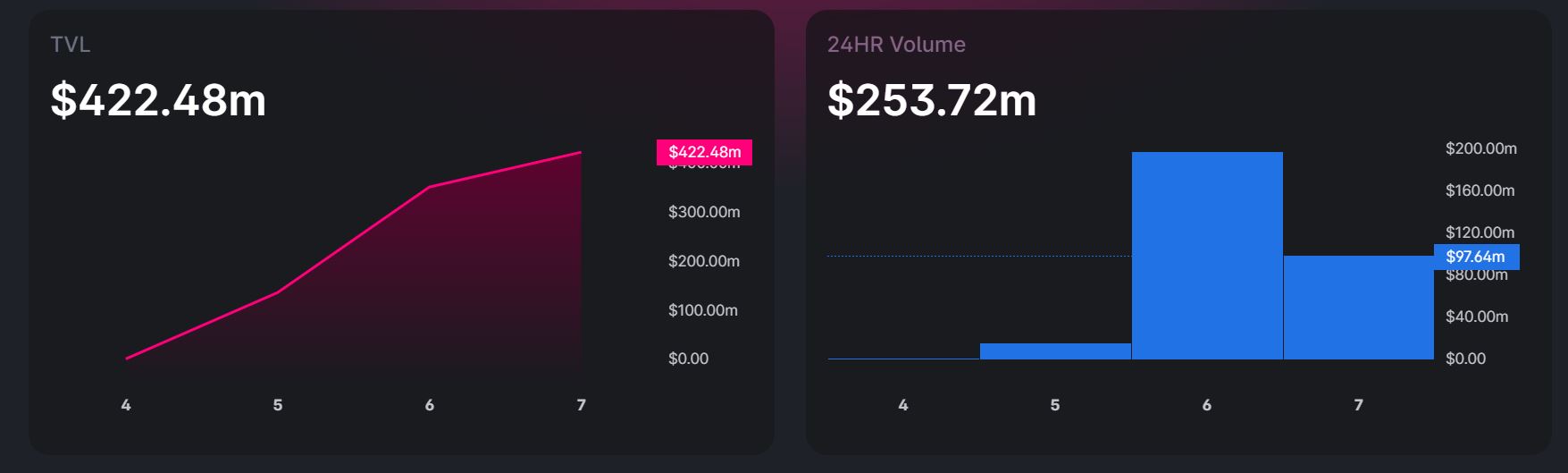

However, it is important to take a deeper look into the fundamentals and according to Uniswap.org, activity on the DEXs was pretty high.

Between 5th May to press time, total value locked (in USD) on the V3 platform had jumped from $135 million to $422 million. The total cumulative trading volume over the past 3 days is more than $250 million, with 24-hour transactions reaching nearly 28,000. That is a significant amount of activity within days of the V3 launch.

UNI’s price may possibly exhibit bullish characteristics on V3’s accord as well. On analyzing the price chart above, UNI’s present position could be a buying opportunity, before it addresses a new rally in the market.

Stellar: $1 dollar possible or not?

Stellar reached a new peak of $0.601 during the massive rally in February. However, since then the asset has oscillated between support at $0.40 and $0.69. A new peak was attained in mid-April, and the price is currently in that range again.

Over the past couple of days, Stellar has experienced a 28% hike, and the possible reason could be its Q1 2021 findings. According to Stellar, relevant asset transactions for XLM tokens reached $280 million. That amounts to a massive 2,798% YOY growth in cross-border and cross-currency transactions.

Source: Twitter

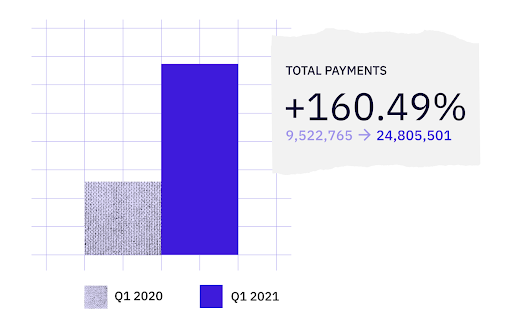

The total number of payments also reached 24.8 million payments, compared to 9 million in Q1 2020. Additionally, the total number of operations and average daily DEX volumes also grew, collectively indicating development growth for the XLM market.

In 2021, development statistics have aided in indicating price appreciation. This was seen in the cases of Cardano and Polkadot. Stellar’s growth from a functionality point of view may collectively take an effect on its price. $1 appears to be a legitimate target based on the above chart, which could be attained in the next few weeks.

Taking a page out of ADA and DOT’s growth, Stellar and Uniswap could be heading in the same direction, based on adequate fundamental growth.