Uniswap tops DEX race with >70% volume share, but the issue…

Scenarios have started to look greener for the global crypto market. Well, Bitcoin and Ethereum in particular. But one specific token has been in an uptrend registering more than 150% gains in a week.

Uniswap’s native token UNI has been steadily charting an upward trajectory. Trading volume for the flagship token narrated a bullish scenario as well. But can the price continue to follow the upward move?

Wouldn’t swap for anything

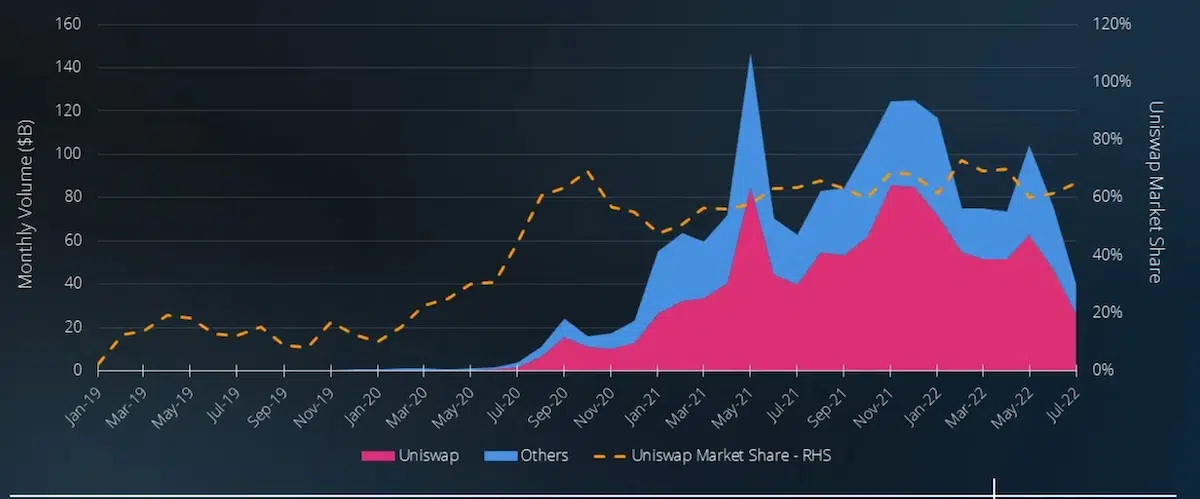

The first decentralized exchange (DEX) based on Ethereum not only provides users with steady revenue but also rivals centralized exchange. Last year, Uniswap lead the sector with an average of $1 billion a day trading volume. This year is no different.

The platform remains the leading liquidity provider (LP) with over 65% share in July.

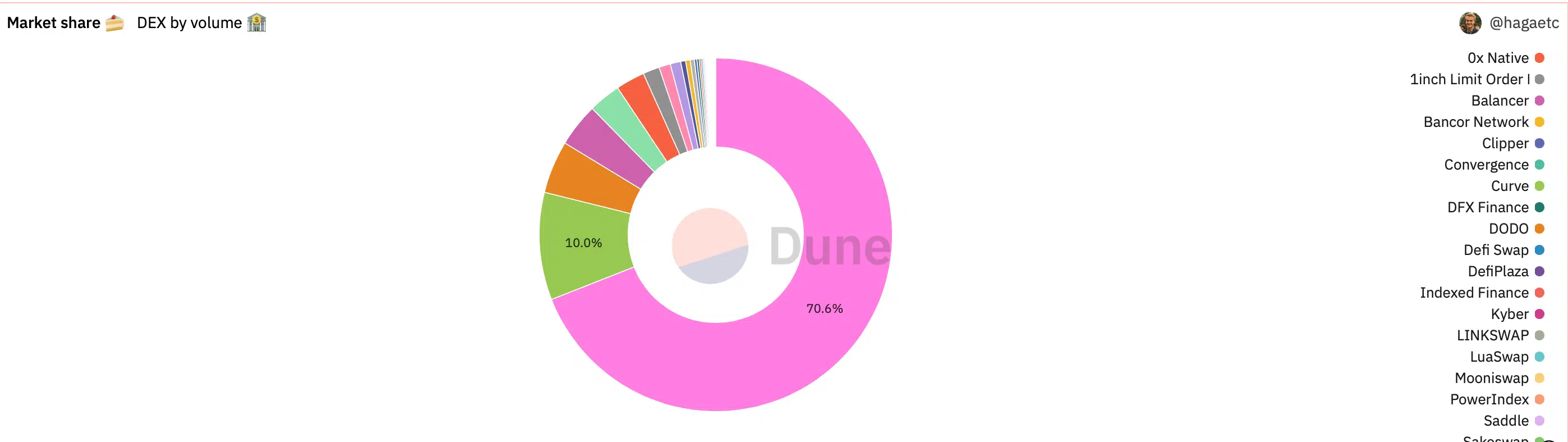

In fact, at the time of writing, UNI controlled 70.6% share as seen on Dune Analytics’ pie chart below followed by Curve Finance, which had around 10% share.

The sheer difference between the first and the second place is something worth praising the winner about.

Thanks to you

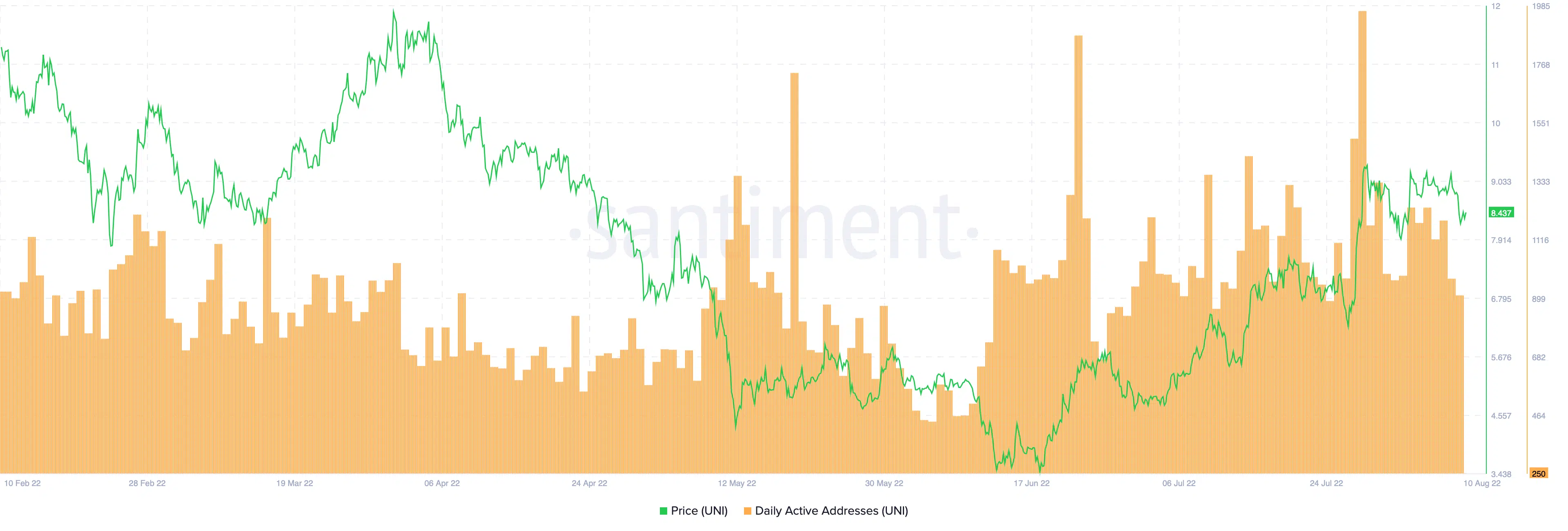

Now, the popular DeFi asset is said to be leading because of strong whale accumulation and rising active addresses.

Talking about the addresses, the active address ascended to above the 1,200 mark.

This showed the bullish stance of enthusiasts with ongoing strong address activity.

Meanwhile, dominant buyers, also known as whales too have acquired more UNI to showcase their support for the token.

Particularly, the 100k to 1 million UNI whale addresses saw a gigantic accumulation spike in the last two weeks. Needless to say, these narratives strengthened Uniswap’s demand for ETH whales.

According to whalestats, UNI bounced back into the top 10 holding list for ETH whales as seen in the tweet below.

JUST IN: $UNI @Uniswap is back on top 10 by trading volume among 2000 biggest #ETH whales in the last 24hrs ?

Peep the top 100 whales here: https://t.co/R19lKnPlsK

(and hodl $BBW to see data for the top 2000!)#UNI #whalestats #babywhale #BBW pic.twitter.com/QKz9omTotM

— WhaleStats (free data on crypto whales) (@WhaleStats) August 8, 2022

Overall, July did play a significant role for the network. Across July, the network activity grew multifold as covered in a previous article.

Having said that, the price couldn’t really reciprocate the same. On CoinMarketCap, UNI suffered a fresh 5% correction as it traded around the $8 mark.