What DASH’s short-term recovery might mean for cryptos like Zcash

Bitcoin’s price movement around the $41,000-mark and the larger market’s consolidation seems to have given way for altcoins to steal the show. At press time, after a rather slow weekly start, some coins picked up the pace.

DASH, the #77 ranked token, noted 24-hour gains of 8.38%. It was followed by AAVE, with just over 5% gains, while Zcash (ZEC) registered daily gains of 4.91%.

This wasn’t the first time privacy tokens have charted solo rallies as the larger market looked stagnant. In fact, towards the end of November too, ZEC outperformed major altcoins and even Bitcoin in terms of price gains, charting over a 50% rise in price in just four days.

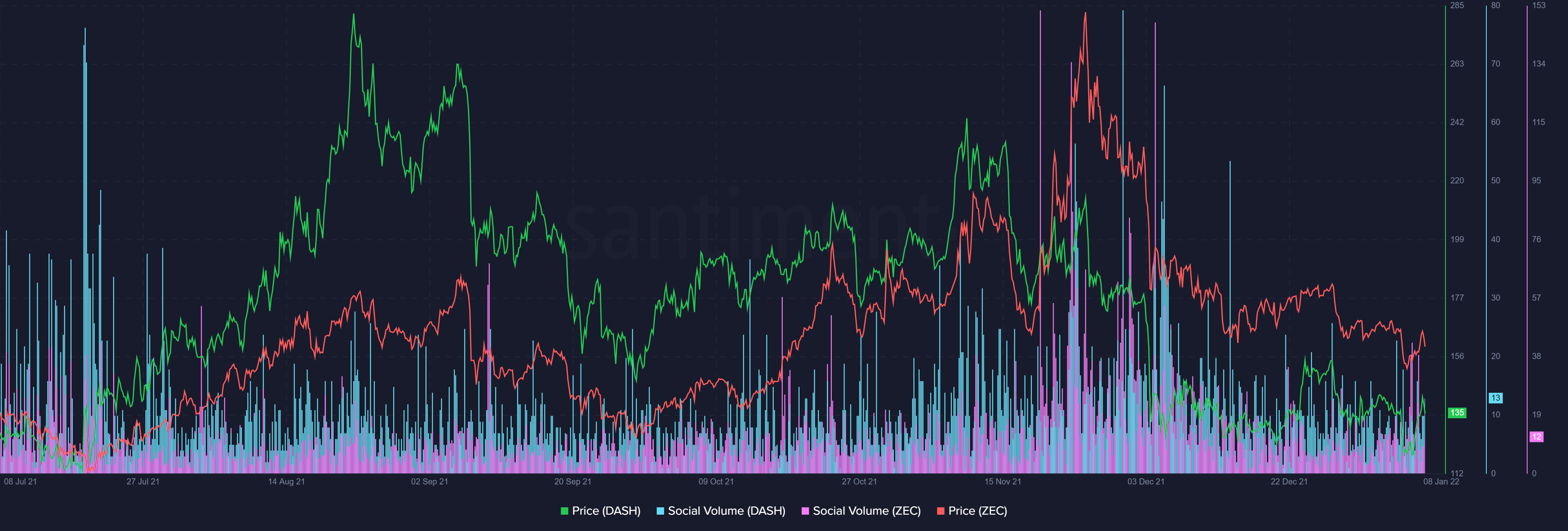

This time, it was DASH’s turn to lead the privacy token rally as ZEC followed closely.

Notably, DASH appreciated by almost 25% in three days while ZEC saw double-digit daily gains on 8 January and was seen losing ground, at the time of writing. However, for DASH, around 41% HODLers were Out of money. In fact, they were losing money at the $143.49-price level. On the contrary, for ZEC, 50% were Out of money at the $135.33-price level.

Losing money, gaining price?

Both DASH and Zcash presented a dissociation from the larger market. Especially since both recorded gains as the global market cap stood at $1.96 trillion, down by 0.60% over the last 24 hours.

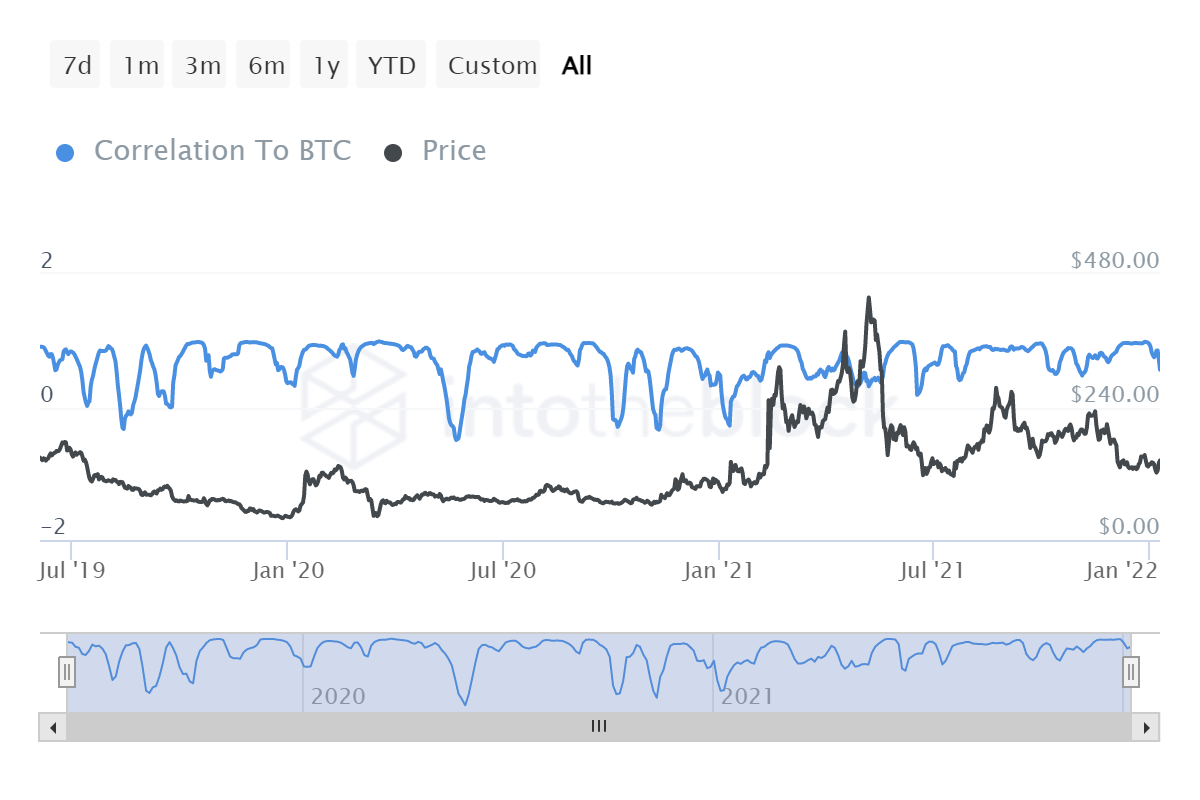

Interestingly, DASH’s correlation with BTC was on a downtrend as the price rose, with the same hitting its lowest level since November.

For ZEC, however, the correlation to Bitcoin is still at a high. And, with ZEC losing ground price-wise, the same made sense. Nonetheless, with volatility for both ZEC and DASH noting lower values, the same is a good sign for their larger trajectories.

Despite the rise in price, both privacy tokens have seen low social volumes. This could be partly credited to the constant debate around privacy tokens being used for illicit purposes, as presented in a previous article.

So, the question here is – With the price seeming to catch up, what could be in store for DASH and Zcash?

What next?

DASH noted a considerable uptick in large transaction volumes alongside price gains. This could be indicative of bigger fish re-entering the market.

That being said, for DASH, HODLers still dominate the scene. Curiously, both DASH and ZEC lack retail euphoria which could be key to rallies in the future. While DASH saw an almost 60% rise in daily trading volumes, ZEC seemed to be struggling for the retail push.

Even so, for now, DASH Is still around 90% down from its 2017 ATH of $1,542.20. An uptick in Sharpe ratio can be seen to have paved the way for healthier gains.

However, it’ll be crucial for DASH to bridge the fair value gap from $150 to $227 before an uptrend towards its ATH can be seen.

For ZEC, with the price rally weakening, the Sharpe ratio too was low, in the negative territory at -2.76.

Recovery of the two tokens above their crucial resistances supported by a healthy uptick in Sharpe ratios could indicate a reversal in the mid-short term.