Why MATIC’s price action failed to register more upside in last 24 hours

MATIC holders might be in for an interesting week ahead especially now that the Polygon-native token is attracting crypto whales.

The latest WhaleStats analysis revealed that MATIC was among the top 10 most acquired digital coins by ETH whales.

Here’s AMBCrypto’s price prediction for MATIC

According to the whale tracking site, the whale fear and greed index is now leaning towards the greed level. But does this indicate that MATIC’s price is headed up?

Well, not necessarily. It turns out that buying whales were not the only participants in the last 24 hours. The number of buying whales and selling whales was equally matched at 21.

JUST IN: $MATIC @0xPolygon now on top 10 purchased tokens among 500 biggest #ETH whales in the last 24hrs ?

We've also got $APE, $AXS, $HEX & $AURA on the list ?

Whale leaderboard: https://t.co/tgYTpODGo0#MATIC #whalestats #babywhale #BBW pic.twitter.com/uprLYJGefb

— WhaleStats (tracking crypto whales) (@WhaleStats) October 24, 2022

MATIC’s buying volume was notably lower at $584,000 compared to the $607,000 selling volume, at press time. This may explain why the crypto token’s price action failed to register more upside in the last 24 hours compared to its bullish performance on 23 October.

MATIC traded at $0.87 at press time, with its daily candle indicating a 2.65% drop. This performance was more consistent with the higher selling volume.

The token demonstrated higher relative strength in the last four days, as indicated by the RSI. Its MFI also pivoted in favor of the upside.

Enough bullish momentum backed by healthy whale activity may push MATIC near the overbought zone towards mid-week. This outcome will depend on whether whales will continue accumulating.

Uncertain fate in turbulent waters

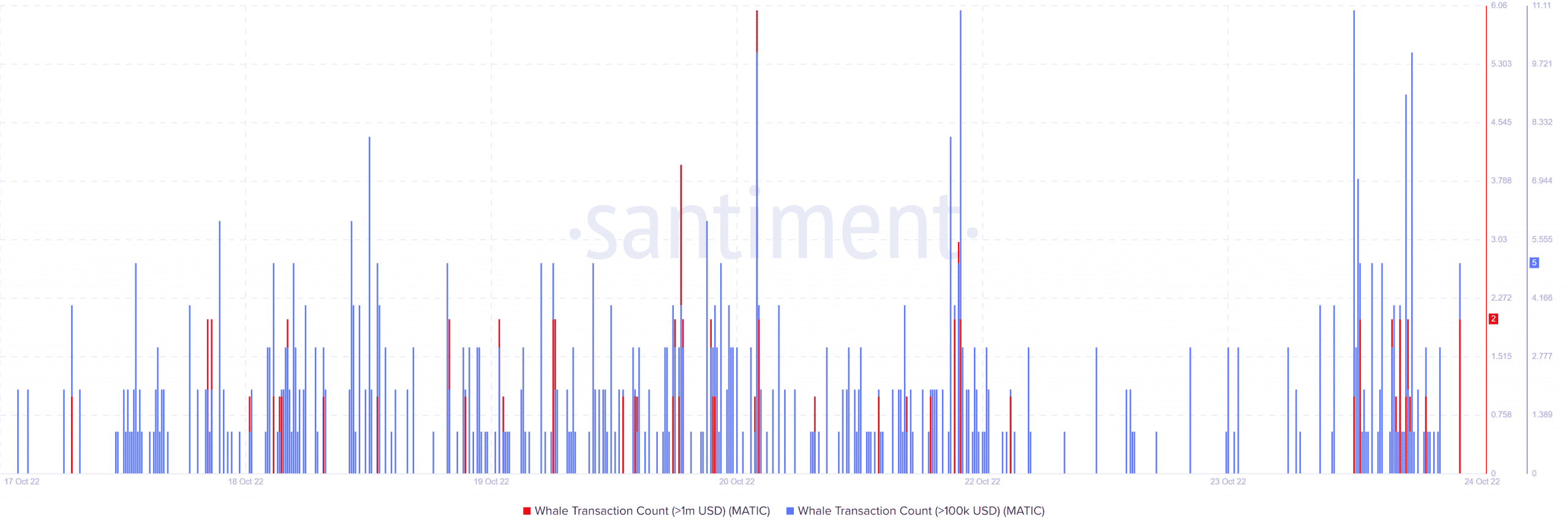

A look at MATIC’s on-chain metrics confirmed that whale activity did register a significant uptick in the last 24 hours. Whale transactions count registered a sizable increase in addresses holding over $100,000 and $1 million in the last 24 hours.

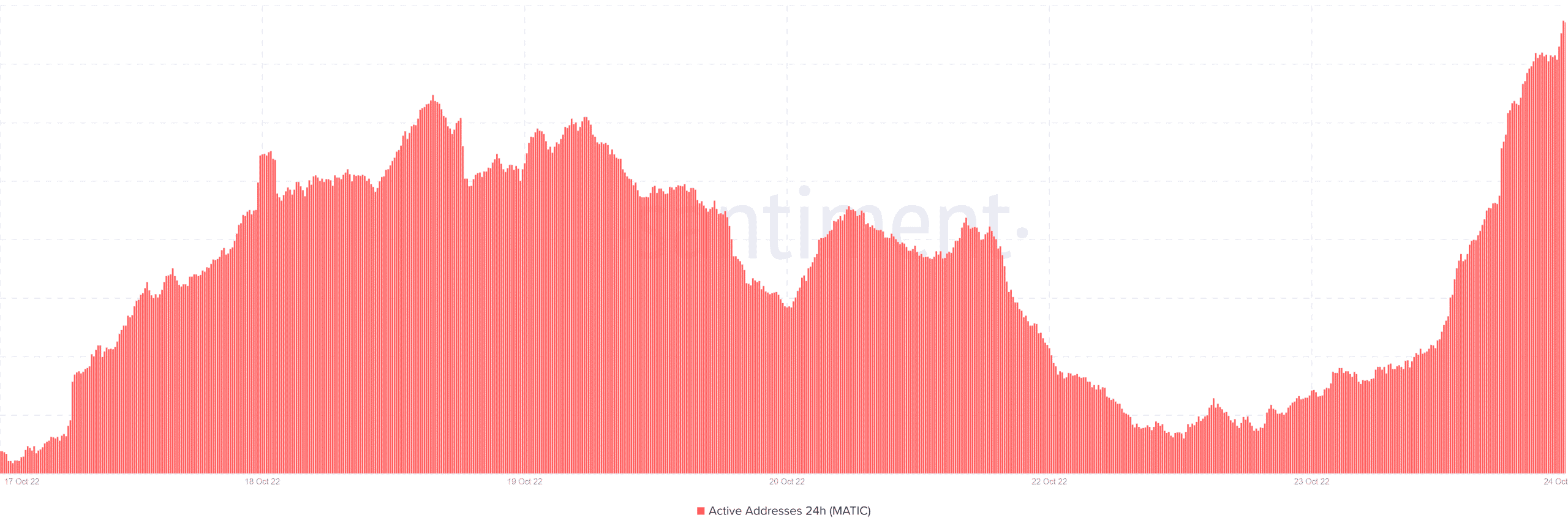

The above observation aligns with the WhaleStats report. In addition, MATIC’s daily active addresses registered the highest weekly levels after a strong return of activity in the last two days.

The increase in the number of daily active addresses confirms that retail traders are also getting in on the action. However, neither the whale transaction count nor the active addresses metrics provided an accurate distinction between the buying and selling pressure.

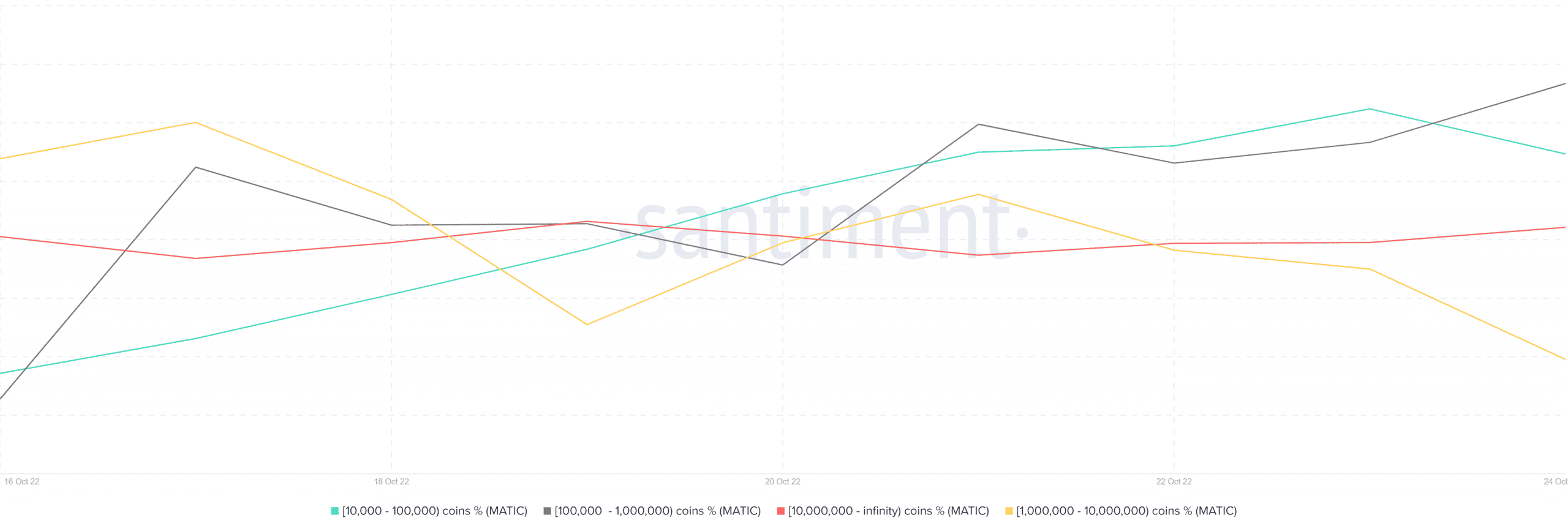

Fortunately, the supply distribution metric provides a better snapshot of whale activity.

According to the supply distribution, addresses holding more than 10 million MATIC increased their balances by 0.06% in the last 24 hours.

This is noteworthy because this whale category currently controls the lion’s share of MATIC’s supply.

Furthermore, addresses holding between one million and 10 million MATIC tokens trimmed their balances by 0.07% in the last 24 hours.

This category controls the second-largest share and likely contributed to the observed sell pressure. Undoubtedly, these two groups have the largest impact on MATIC’s price action.

Conclusion

Since the largest whales are bound to influence the rest of the market, investors should keep an eye on the supply distribution.

A pivot from the second-largest whale would likely trigger more upside and a potential short-term rally into overbought territory.

On the other hand, the downside is to be expected if the largest whales start selling.