With PancakeSwap rivaling Uniswap, should you buy a piece of CAKE?

Uniswap, one of the crypto market’s leading DEXs, has for long been christened a giant of its space, with its position at the top of the charts once seen by many as unimpeachable. Over the past eight months, however, this confidence in Uniswap’s market dominance has steadily eroded. How has this come to pass?

Well, simply put, alternatives have emerged, alternatives that are eating into Uniswap’s market share. One of these alternatives, SushiSwap, is one that has been touched upon repeatedly. However, there is another food-themed DEX that is somewhat going under the radar despite its stupendous growth – PancakeSwap.

Challenging Uniswap

The Binance Smart Chain-based DEX was the subject of Deribit Insights’ latest issue, with the same finding that over the past few months, PancakeSwap has not only competed against the likes of Uniswap and SushiSwap, but it has rivaled it.

Consider this – Since the start of the year, the DEX’s liquidity has surged at a pace that has been much higher than its competitors, with the same climbing to over $2.4 billion from $140 million on the 1st of January.

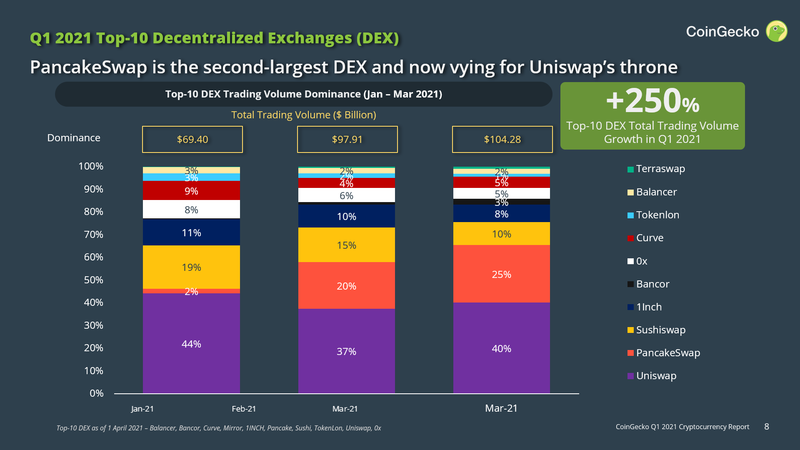

Further, according to the latest CoinGecko report, the first quarter of the year saw PancakeSwap’s market share rise by 25%, with the DEX eating into Uniswap’s share more than any other protocol. In fact, April even saw the former (briefly) flip the latter, before market corrections set in a few days ago.

Source: CoinGecko

Similar hikes can be seen when other metrics are considered as well, namely, Total Value Locked, 24-hour volumes, Daily Active Addresses, Daily number of users, and New users v. Old users.

Source: Deribit Insights

Ethereum v. Binance Smart Chain… Again

This brings us to the question – What has fueled PancakeSwap’s rise?

Well, it can be argued that the battle for DEX supremacy is actually a shadow war between Ethereum’s blockchain and Binance Smart Chain.

Think about it – While DeFi mania was a highlight of the year last summer, it also put a spotlight on Ethereum’s own shortcomings, namely, its network congestion and gas prices. Needless to say, alternatives emerged, with BSC being one of them. PancakeSwap, a clone of sorts of Uniswap by some accounts, was built on the BSC, with the latter promising to address all the shortcomings of the Ethereum blockchain.

Despite its very obvious issues with centralization, Binance Smart Chain has been a success since its launch in September, with its own momentum being passed on to the projects built on top of it, including PancakeSwap.

Not just a copycat

There are other, more local reasons as well. For starters,

“PancakeSwap’s native token, CAKE, follows an infinite mint and burn token mechanism; it’s an inflationary token with no hard cap but can turn deflationary if burns outpace emissions. This design allows the platform to incentivize a deep pool of liquidity, which has proven essential to the health of the AMM.”

Further, according to the author of the aforementioned report,

“People who write off the project as an Ethereum copy-cat lacking in innovation are missing some of the important ways in which PancakeSwap has expanded beyond its Uniswap-fork roots.”

Should you buy the CAKE?

Needless to say, the protocol’s fortunes have had a corresponding effect on the DEX’s token – CAKE. For instance, before the latest market corrections set in, CAKE had risen by over 180% on the price charts, with the same valued at $23.15 at the time of writing. What’s more, according to Messari, the crypto now ranked 38th on CoinMarketCap’s charts was recording YTD gains of over 3,800%.

Source: CAKE/USD on TradingView

That’s an astounding number; while UNI rose by “just” 69% over the said time period, SUSHI had fallen past its 1 March price level, at press time.

In light of how PancakeSwap is doing, it can be argued that there’s more upside to be had for CAKE, especially in the short term. The same assertion can be backed up by the fact that at the time of writing, CAKE’s 30-day and 90-day RoIs against the U.S Dollar were 127% and 2,992%, respectively.

While market corrections might be the most dominant market narrative right now, CAKE, like the rest of the market, will recover. Hence, this could also be an opportunity for traders to get in on CAKE.