Will Bitcoin [BTC] mining see a resurgence? This new data suggests…

![Will Bitcoin [BTC] mining see a resurgence? This new data suggests…](https://ambcrypto.com/wp-content/uploads/2022/12/andre-francois-mckenzie-JrjhtBJ-pGU-unsplash-5-e1671717341563.jpg)

- Bitmain’s mining rigs sell out in under 27 seconds, however, volatility persists in terms of mining revenue.

- Retail investors show faith in Bitcoin, as traders take long positions.

Leading Bitcoin mining rig company, Bitmain, managed to sell out their new mining servers in 27 seconds. Despite the FUD surrounding Bitcoin mining and the immense selling pressure being faced by miners, it appeared that there were some people who still had hope for the future of mining.

Read Bitcoin’s Price Prediction 2023-2024

Mine your business

The mining rig cost its customers $2092. According to the Bitmain website, only five units were available per customer.

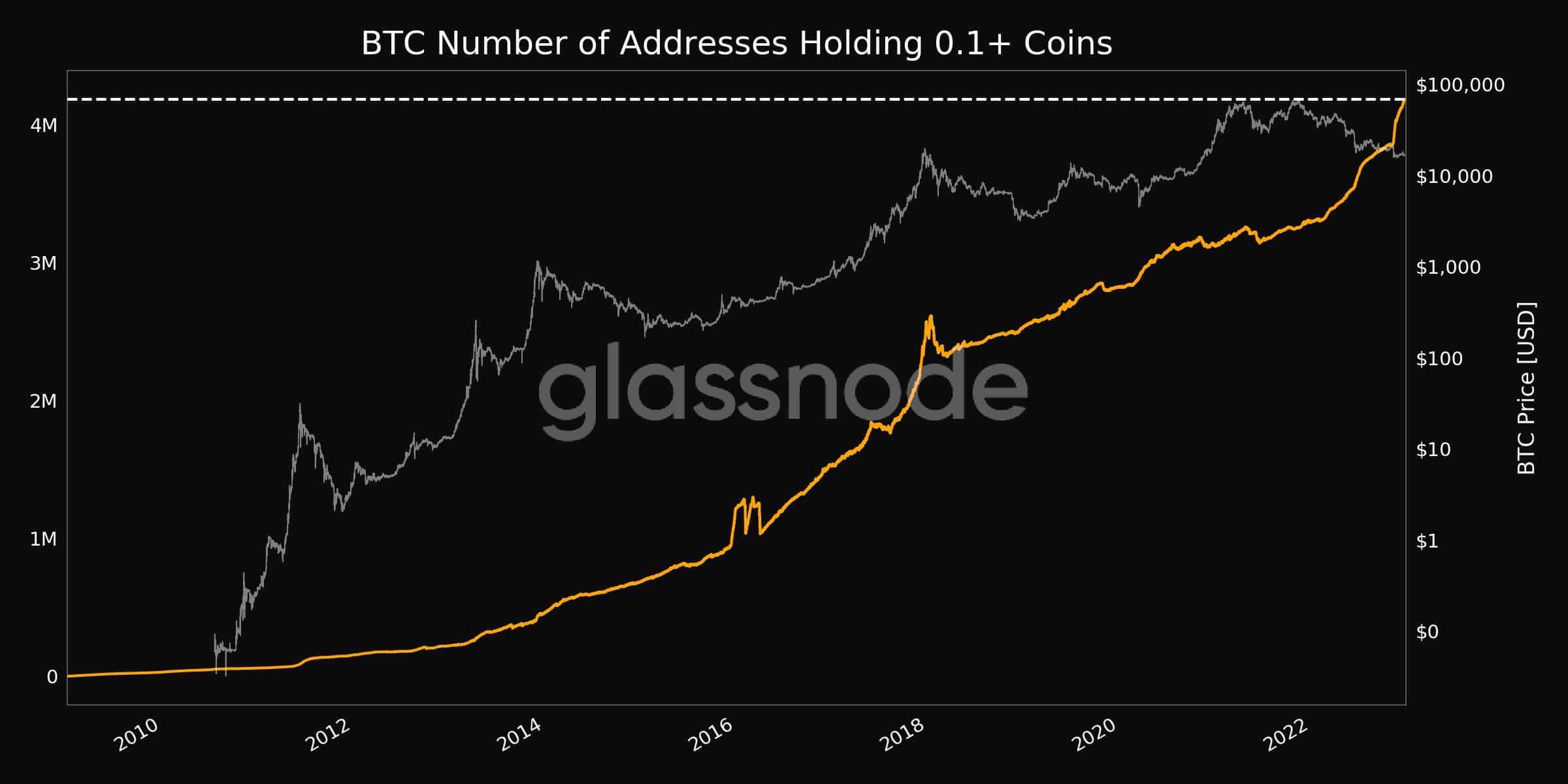

Even though mining rigs have been flying off the shelves, uncertainty around the revenue generated by mining still persists. From observing data provided by glassnode, it can be seen that the fees being generated by Bitcoin miners declined materially over the past few weeks.

Even in terms of the revenue generated by the Bitcoin miners, it appeared that the amount of revenue collected by miners on a given day fluctuated massively over the past few months.

These factors coupled with the increasing energy costs and declining BTC prices could increase the selling pressure on miners even further.

One of the ways in which miners could generate steady revenue and profits would be if BTC’s price increased.

Even though a spike in BTC’s prices in this bearish market appears to be a far-fetched dream, the resurgence of interest from retail investors in the king coin could help make that dream a reality.

According to data provided by glassnode, the number of addresses holding more than 0.1 coins grew significantly over the past few months. At the time of writing, the number of addresses holding more than one coin had reached an all-time high of 4.1 million addresses.

Long or Short?

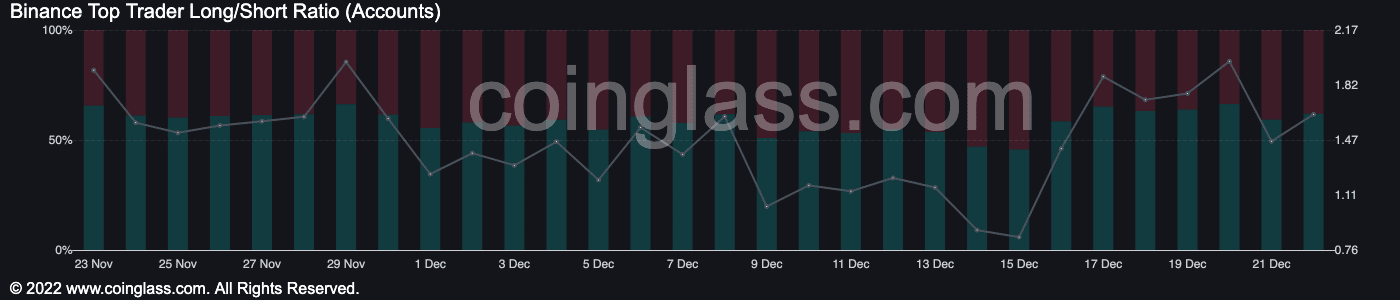

But it wasn’t just retail investors who were optimistic about the future of Bitcoin, big traders on Binance also showed interest in the king coin.

From coinglass’ data, it was observed that after 15 December, the number of traders who had long positions on BTC increased significantly. At press time, 61.97% of trader accounts were holding long positions for BTC, whereas the other 38.03% of the traders were shorting Bitcoin.

One of the reasons for betting against Bitcoin could be its declining activity.

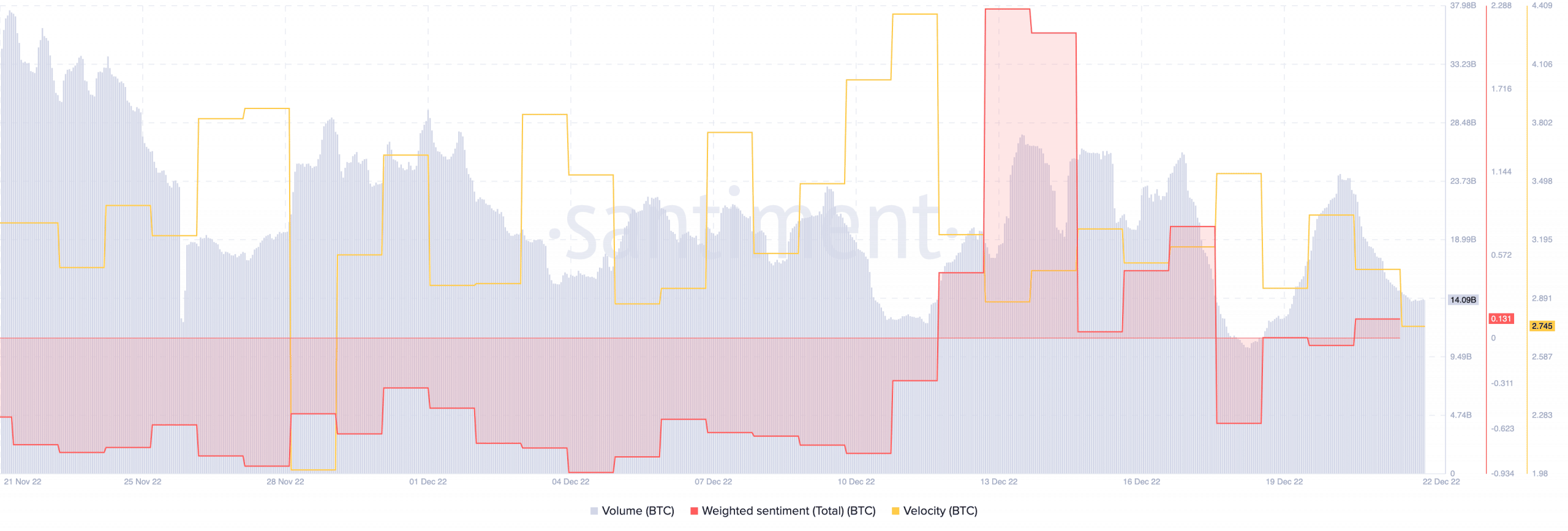

One indicator of decreasing activity would be Bitcoin’s velocity, which reduced dramatically over the last few days. This indicated that the frequency with which BTC was being exchanged amongst addresses had decreased.

Adding to that, Bitcoin’s volume declined too. Over the past month, the volume fell from 37.18 billion to 14.1 billion.

Despite the ongoing crypto winter, the sentiment towards Bitcoin remained positive. At the time of writing, the weighted sentiment for BTC was 0.131.