Will increasing activity on DEXes propel Ethereum towards the top

- Activity on DEXes on Ethereum increased over the last few years.

- Moreover, the number of validators on the Ethereum network grew.

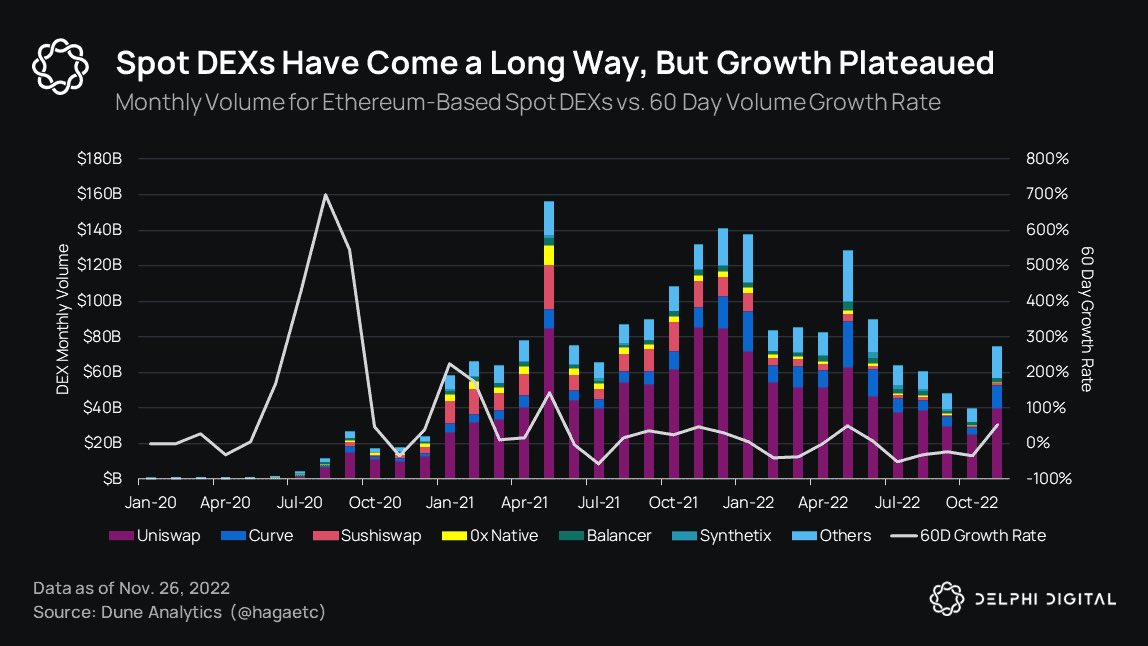

According to a tweet by Delphi Digital on 29 December, the DEX activity on Ethereum [ETH] surged significantly over the past year. One reason for the same could be the mistrust in CEXes caused by the collapse of FTX.

Ethereum DEX volume had a 402.4% compounded annual growth rate from January 2020 to November 2022. pic.twitter.com/ZQbupsVfCX

— Delphi Digital (@Delphi_Digital) December 29, 2022

Are your ETH holdings flashing green? Check the profit calculator

A spike in activity

From January 2020 to November 2022, the DEX volume on Ethereum grew by 402.4%. Even though the growth plateaued over the past few months, Ethereum could capitalize on the increasing DEX activity on its network.

This increasing activity was coupled with interest from retail investors. According to Glassnode, the number of addresses with non-zero balances reached an all-time high of 91.97 million addresses.

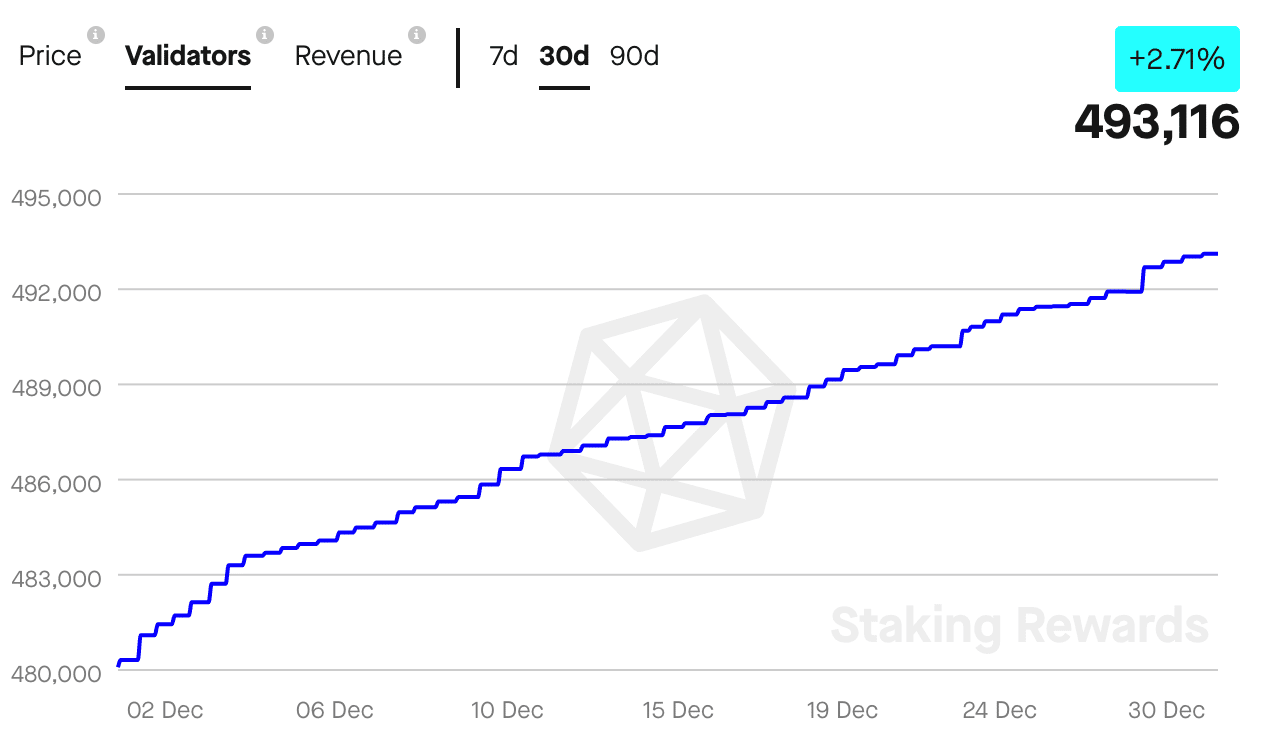

Along with retail investors, the number of validators on the Ethereum network grew. Over the last 30 days, the number of validators grew by 2.71%. However, the revenue generated by the network declined during the same period, according to data provided by Staking Rewards.

Looking at the on-chain data

Coupled with the growing number of validators, the number of large addresses on the Ethereum network also grew.

However, Ethereum wasn’t able to generate interest from new addresses. This was indicated by the declining network growth, which suggested that the number of new addresses that transferred Ethereum for the first time had reduced.

Furthermore, Ethereum’s velocity fell during the same period, implying that the frequency with which Ethereum was being transferred amongst addresses declined.

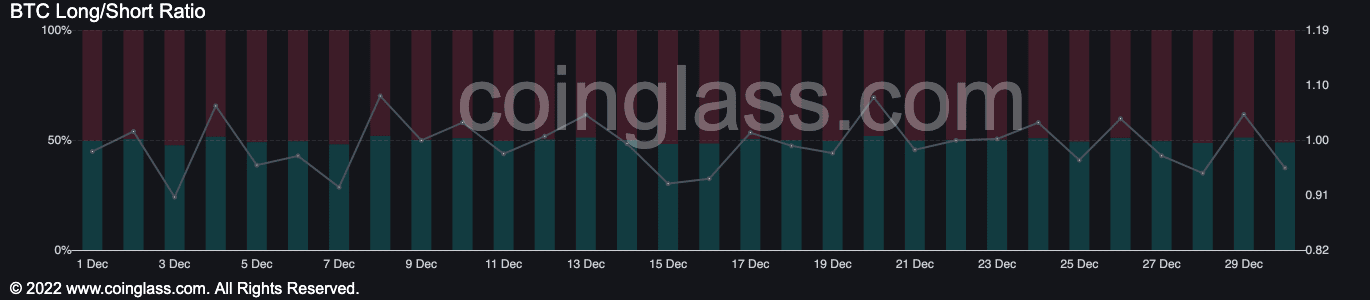

Even though whales remained optimistic despite the declining activity on Ethereum, traders in the crypto market held a different view.

How many ETHs can you get for $1?

According to data provided by Coinglass, the number of short positions being held against Ethereum increased. At the time of press, 51.07% of traders had taken a short position against ETH.

It remains to be seen whether the traders turn out to be right in betting against Ethereum. At the time of writing, ETH was trading at $1,192.5 and its price fell by 0.67% in the last 24 hours, according to CoinMarketCap.