XRP closing in higher than Bitcoin on this metric is a rare phenomenon

XRP’s fall that took the alt’s price from its all-time high of $3.31 to under $1, shook its investors and traders. However, this rally came as a sigh of relief to these investors as the alt’s price rallied almost 40% in a week. Oddly, Bitcoin, Ethereum, and even BNB had registered lower price gains as compared to XRP which was one of the top weekly gainers at the time of writing (second only to Cardano).

While the XRP traders have a lot of cheer about as the alt finally reclaimed the $1 mark for the first time in 10 weeks, it’ll be interesting to see how this price rally unfolds for the alt that dropped more than 80% in the last cycle.

Finally, high market value for XRP

A month ago when XRP oscillated close to $0.5, and made headlines but not about its price gains or metric tops but about the SEC vs Ripple case, the thought of the alt reclaiming $1 levels would be a distant dream. Now as XRP tests this crucial $1 mark, questions about its rally sustaining are back on the table.

Well, for one XRP’s price recovery was backed by a solid rise in MVRV (60day), which highlighted an anomaly (high values) at the time of writing, as per Santiment. This meant that this was in fact a bull run and that long-term holders were finally reaping some benefits out of it. MVRV value for the alt at the time of writing was equivalent to the May 15 levels corresponding to XRP’s price top at that time.

Source: Sanbase

XRP’s return to the overbought zone for the first time since its April price ATH was nothing short of a miracle for the alt’s holders. On the downside, since XRP is still down 69.98% from its ATH, RSI in the overbought zone could mean that the price might fall after selling pressure sets in. But as long as other metrics hold up XRP could still sustain its gains. On this note, looking at the development side gave a lot of reassurance for XRP.

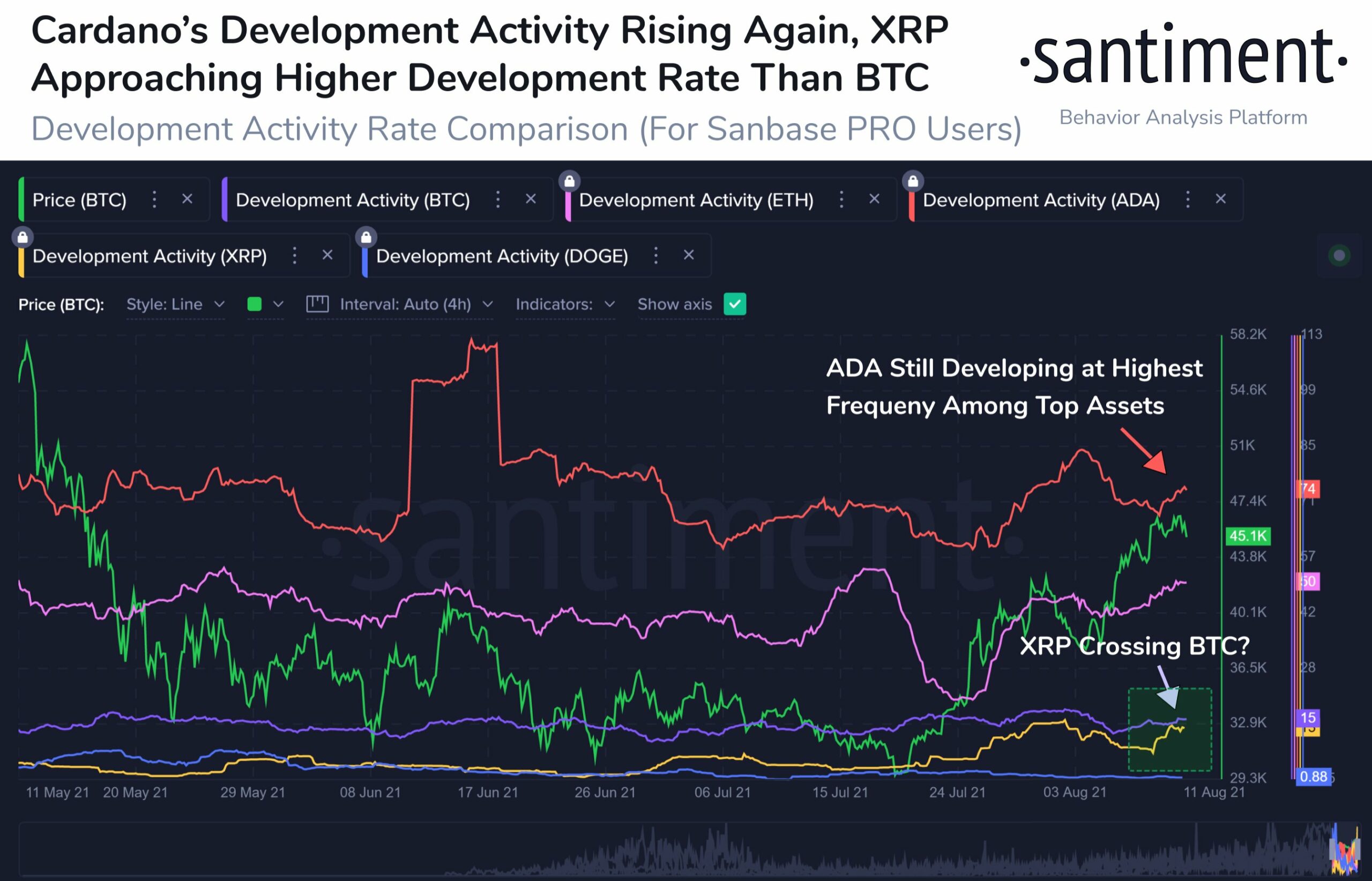

A Santiment tweet highlighted how development activity rates for the top cryptos showed continued dominance. Interestingly, however, in a never seen before trend, the XRP Network was closing in on a higher daily github development rate than Bitcoin, ‘which has rarely occurred.’

Source: Santiment

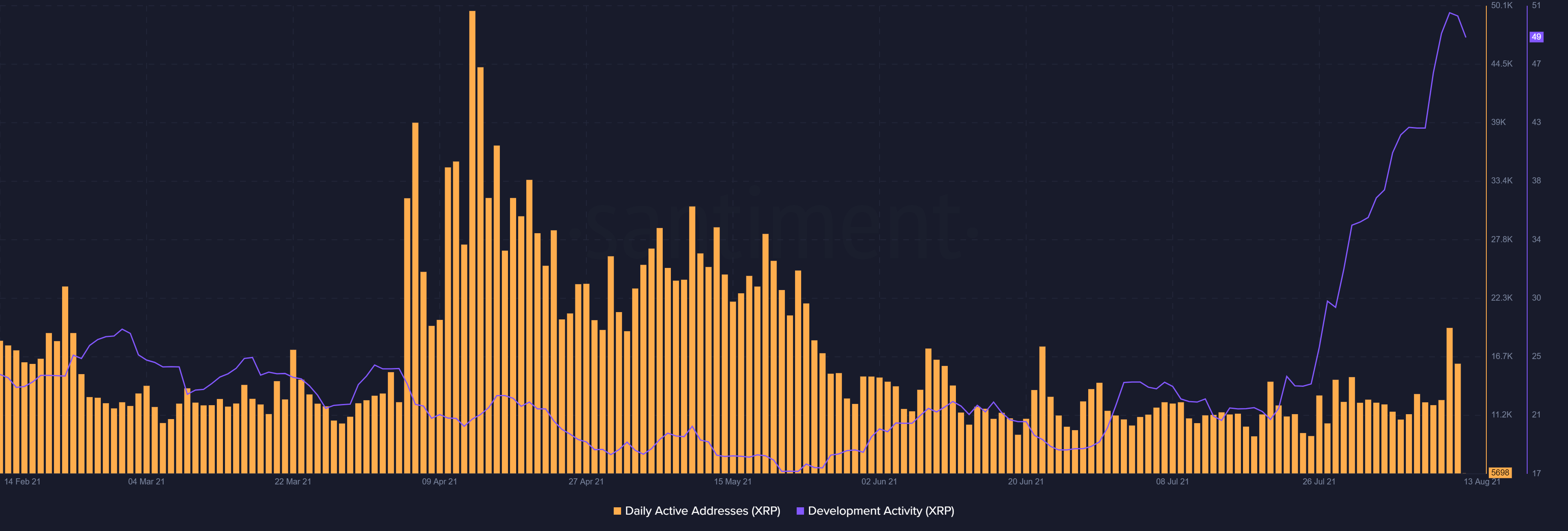

That being said, while XRP’s social sentiment didn’t highlight any major upticks for the alt, its active addresses peaked to May 15 levels on August 11. Additionally, development activity for XRP was seeing new all-time high levels at the time of writing. Daily active addresses also held up pretty well along with high trade volumes and rising prices.

While everything looked good for the sixth-ranked alt, it will be best to look out for warning signs like decline in the active addresses or low trade candles on high prices. Especially, keeping in mind XRP’s almost 10% price fall on August 12, it will crucial to watch important levels like the $0.8 mark.