Litecoin, its growing mining difficulty, and why it could go against LTC’s price action

- Litecoin mining difficulty continues to increase, potentially risking miner profitability

- Litecoin’s upside was experiencing slow momentum at press time

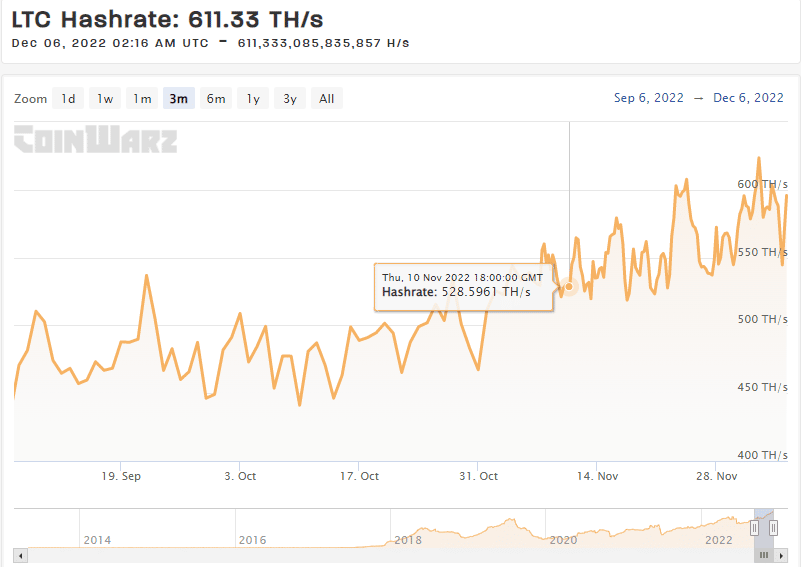

Litecoin [LTC] demonstrated positive growth in multiple facets over the last few weeks. Those areas included its hash rate and price. The network’s latest announcement confirmed that mining difficulty also went up and here’s why that might spoil the party.

Read Litecoin’s [LTC] price prediction 2023-2024

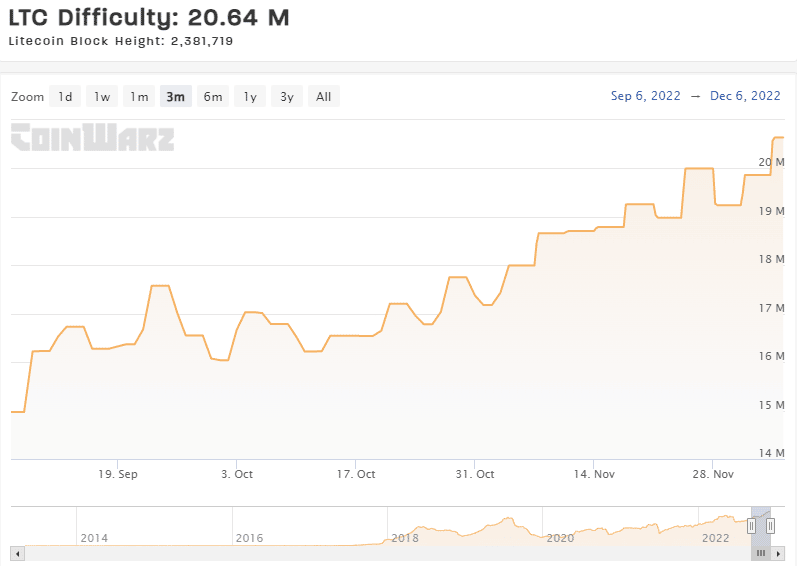

At first glance, an increase in difficulty doesn’t necessarily mean a bad thing. In fact, it is often considered a good way to measure of a network’s decentralization level. However, Litecoin’s counterpart Bitcoin [BTC] lowered its mining difficulty due to low profitability which led to many miners halting their operations.

As a result, Bitcoin’s hash rate was negatively affected. But is the recent increase in mining difficulty a sign that Litecoin might be headed in the same direction?

Litecoin mining difficulty is continuing to rise hitting new highs!??

Difficulty is a variable measure of how difficult it is to find a hash below a given target. An important metric for mining & how the truly decentralized #Litecoin network controls new coin issuance. pic.twitter.com/w0NidBRpcB

— Litecoin Foundation ⚡️ (@LTCFoundation) December 5, 2022

As noted earlier, Litecoin’s hash rate witnessed substantial growth in the last few months. There are benefits such as a higher security and decentralization score. However, the higher mining difficulty will eventually make Litecoin mining less profitable especially if more miners jump on board.

LTC’s latest upside represented strong demand which had been quite accommodative for miners. More trading activity means there are sizable transactions to facilitate miner rewards.

This also means that a drop in LTC trading activity might make mining less profitable for Litecoin miners. The higher mining difficulty would further exasperate the situation.

How LTC price action can potentially set the dominos in motion

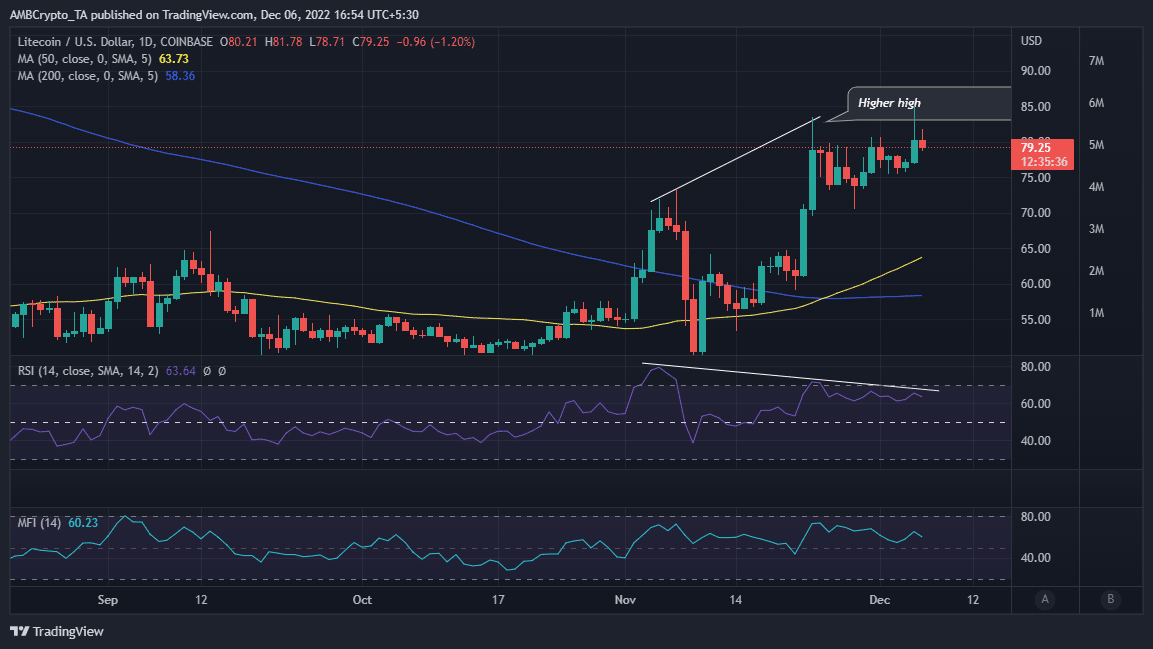

LTC’s upside was starting to show signs of slowing momentum. A potential outcome here could be that investors may sell, leading to a sizable pullback. On the other hand, traders may opt to hold since LTC was still trading at a hefty discount from its ATH. If the latter happens then LTC might go through a phase of low volatility. Such an outcome would mean lower profitability for miners.

LTC’s latest price action already indicated that sell pressure was gaining traction. Furthermore, the Relative Strength Index (RSI) already indicated that the bulls were growing weaker. Furthermore, the price-RSI divergence may give way to more downside.

The Money Flow Indicator (MFI) should indicate strong downside but it currently showed slight outflows. This suggested that sell pressure was still low, further supporting the expectation of sideways price action.

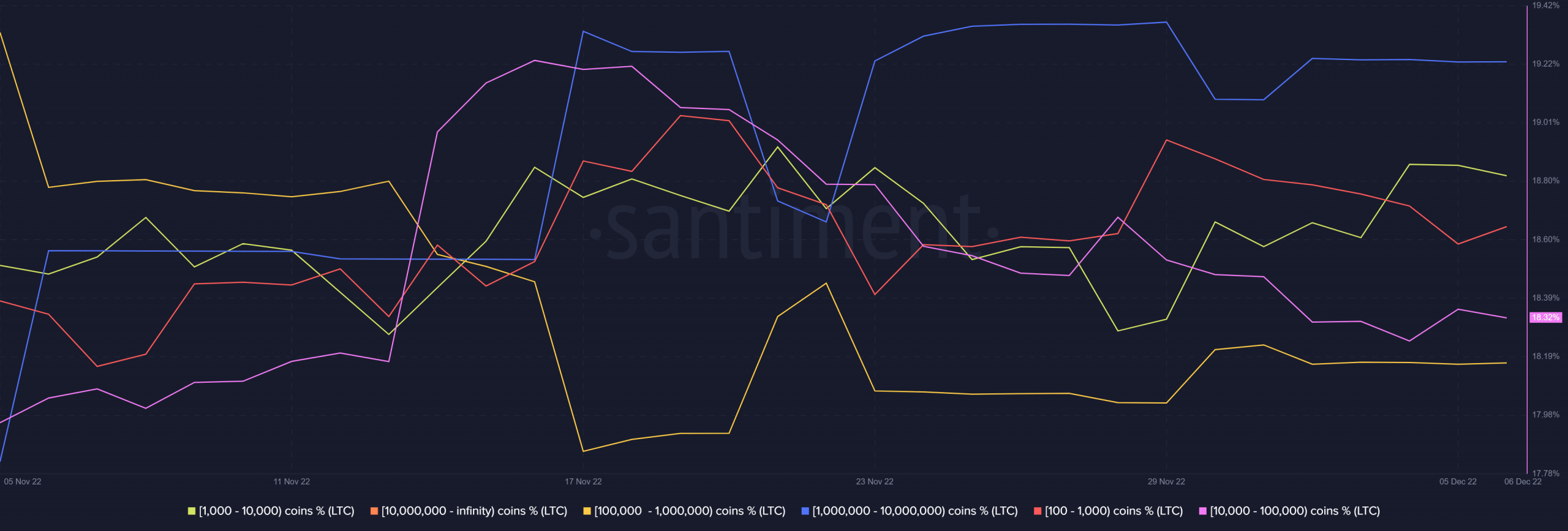

An evaluation of Litecoin’s supply distribution also confirmed that whales weren’t currently contributing much to the existing sell pressure.

While the above observations indicated a lack of strong sell pressure, a sudden change of pace was still probable.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)