A Bitcoin ETF will come ‘sometime this year,’ but what can investors do till then

A Bitcoin and cryptocurrency ETF has been long-awaited by many crypto-enthusiasts as it would bring in cash inflows from big-ticket investors. While countries like Canada and Brazil have already authorized Bitcoin and Ethereum ETFs, the American SEC has been reluctant to do so. Dave Nadig, however, thinks this might happen as soon as the end of this year.

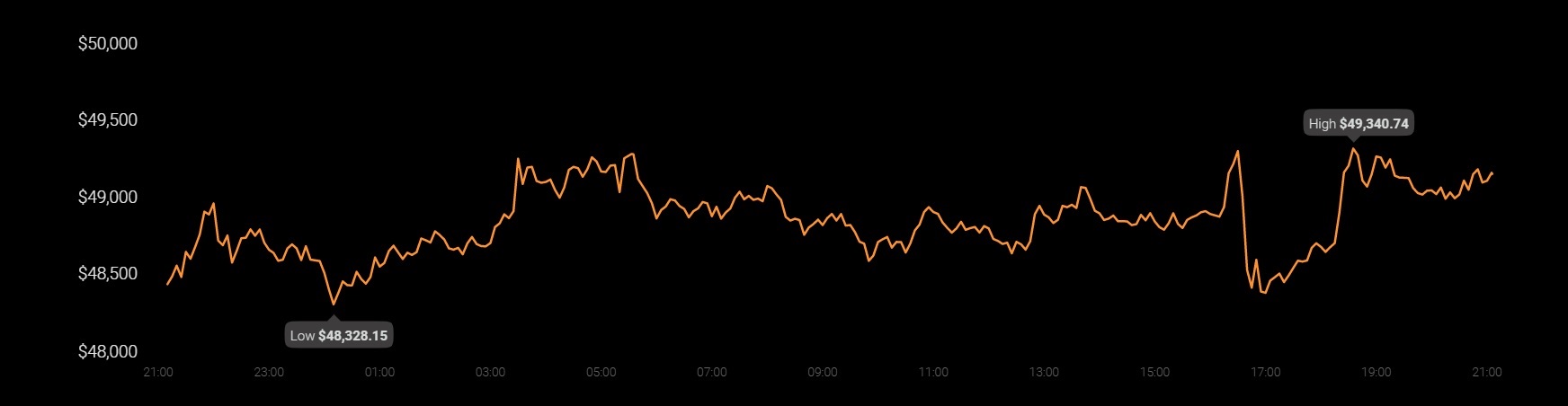

Source: Coinstats

An ETF is coming

According to the CIO and Director of Research for ETF Trends, a Futures-based Bitcoin ETF might receive authorization before the end of this year. He added,

“The SEC has made it clear that’s the direction they want the industry to go. But I think an actual Bitcoin ETF that sort of acts like a GLD for Bitcoin, I think that’s probably now at least a year off.”

Over a dozen Bitcoin ETF applications have been filed with the SEC over the past year. However, none have been authorized yet. Even so, SEC Chief Gary Gensler recently hinted at considering Bitcoin Futures-based ETFs under stringent guidelines.

Several companies starting with Investco have filed for Bitcoin and Ethereum Futures-backed ETFs. It’s worth noting, however, that Nadig’s optimism contrasts with recent comments made by Todd Rosenbluth about the authorization of futures ETFs.

Rosenbluth, who is the Head of ETF and mutual fund research at CFRA, thinks this is because Futures-based ETFs would contain “unique risks.” These will include higher costs and the fact that they would not track the price of the underlying digital asset.

No options?

He also stated that there’s “nothing an investor can do” until the authorization is granted. Nadig, however, does not believe that to be true. While talking about which ETFs Americans can invest in while the country battles with “stagflation,” the researcher suggested options for investors willing to indirectly invest in Bitcoin and cryptocurrencies through ETFs.

“The best you can do in a traditional ETF is to invest in the companies that are actually driving this digital transformation.”

Here, he was referring to VanEck’s “great” digital transformation ETF, DAPP. The ETF, in turn, invests in companies that are heavily contributing to the crypto-industry. These include “the Coinbases, the Squares, the MicroStrategies.” He concluded,

“Firms that are either bringing crypto onto their balance sheets as a kind of proxy for direct investment as an investor, or firms like Coinbase and Square that are really helping drive the ecosystem forward.”