Avalanche unlocks more liquidity through Bitcoin, but what’s next

AVAX is finally showing a recovery sign after recently breaking through its short-term support and almost retesting its June low. A new Avalanche announcement might strengthen its potential upside by enabling more access to Bitcoin within the network.

Here’s AMBCrypto’s price prediction for AVAX

Avalanche recently announced that users can now bridge Bitcoin into the network through the Core app. Access to Bitcoin, as well as its utility within the Avalanche ecosystem, were previously limited especially due to low DeFi activity and lack of smart contracts.

Bridge Bitcoin to Avalanche using @coreapp, and unlock the possibilities with your BTC in the Avalanche DeFi ecosystem ✅ https://t.co/8S1vXWeQtw

— Avalanche ? (@avalancheavax) October 17, 2022

Unlocking more liquidity for Avalanche

One of the main advantages of the new bridge is that it will usher in more liquidity in the form of Bitcoin. This means Avalanche might enjoy more utility if it overcomes the previous limitations.

Higher liquidity means more utility which may in turn trigger higher velocity and volatility for AVAX. These characteristics are quite useful to AVAX traders and investors.

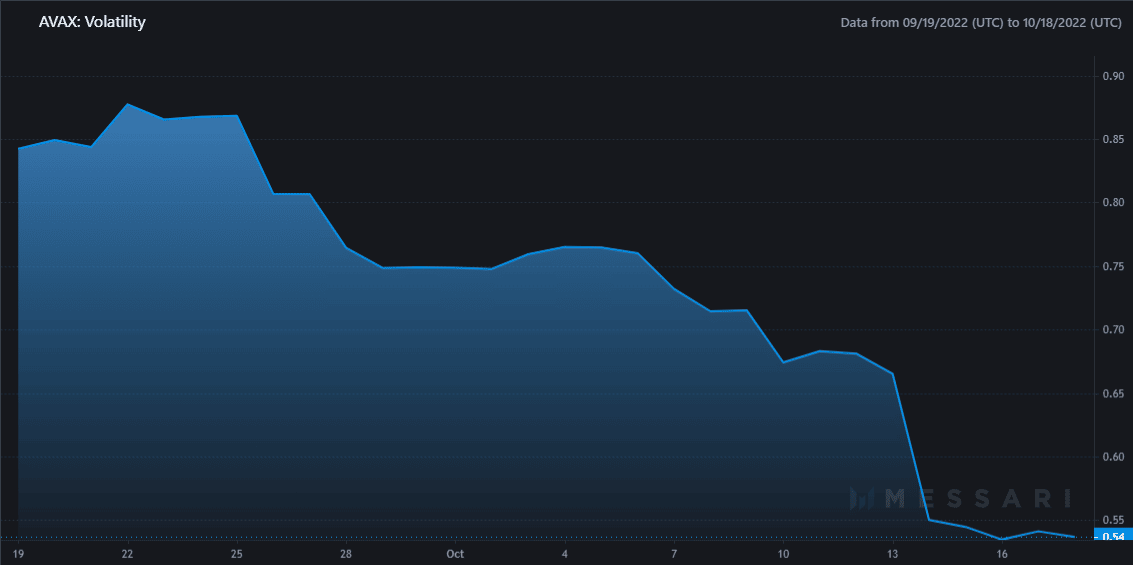

Unfortunately, AVAX volatility has been on a downward trend for the last four weeks. This made it less attractive to traders, hence a drop in volume.

An increase in more liquidity and network usage may boost AVAX’s volatility in the long term. As for the short-term outlook, AVAX might be at the start of a bullish relief.

The news of the new bridge enabling BTC transfer into the Avalanche network might boost investors’ sentiment and trigger more upside.

Both the weighted sentiment and social dominance metrics experienced sizable upticks in the last 48 hours. This activity might be associated with the Bitcoin bridging news, and if that is the case, then the market responded positively.

AVAX traded at $16.10 at press time, which was almost an 11% upside from its lowest price point last week.

AVAX’s pivot occurred after retesting June’s support levels, although it managed to reverse considerably above the 2022 low. The price bounce also occurred right before it dipped into the RSI’s oversold territory.

The bullish bounce at the 5-month support level confirms that investors have been buying back at the same zone. Unfortunately, this also means investors are buying back near the perceived bottom. However, it is still too early to tell if AVAX is about to deliver a strong bullish short-term performance.

The crypto market has been up significantly since the start of this week and AVAX is among the coins that have enjoyed some upside. The overall market conditions have an impact on its ability to deliver a sustainable recovery.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)