Decoding ApeCoin’s [APE] high MVRV ratio and recent data breach

![Decoding ApeCoin's [APE] high MVRV ratio and recent data breach](https://ambcrypto.com/wp-content/uploads/2023/01/1672378903003-25890197-e796-4d95-bf88-adb9c19ce3b0-1-e1674110668940.png)

- A high MVRV ratio suggested a potential selling pressure for APE holders.

- A recent data breach negatively impacted the public sentiment towards APE.

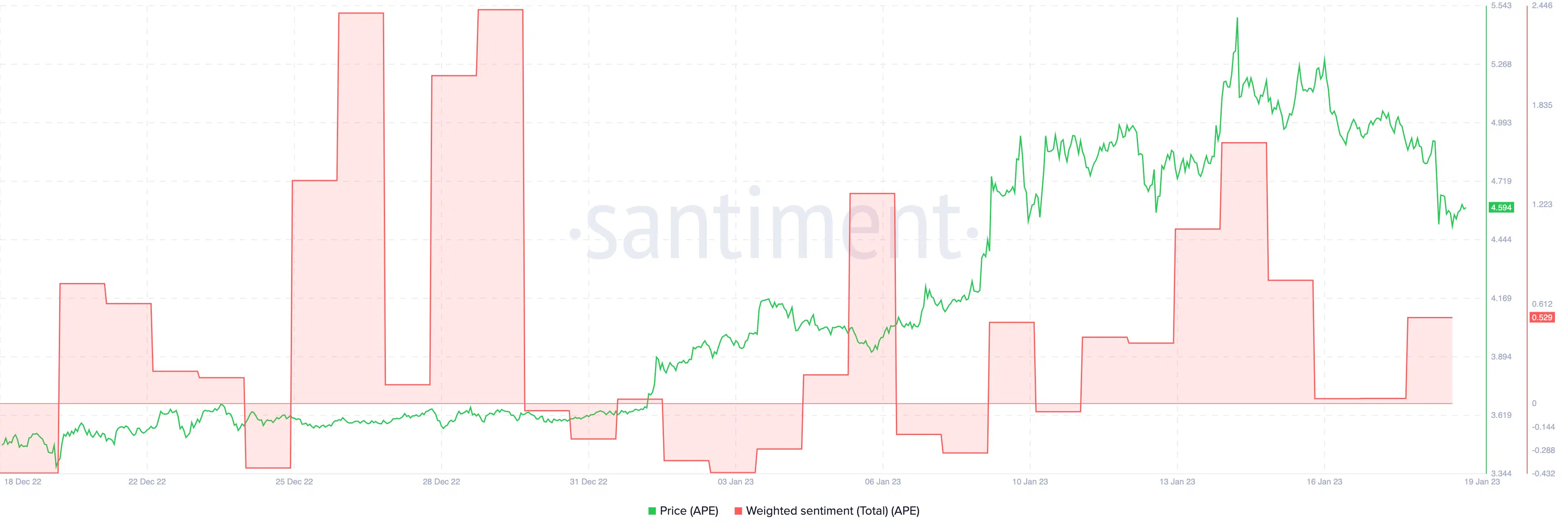

Based on Santiment’s data, it was observed that the 1-year MVRV ratio for APE was much higher compared to other altcoins. This simply meant that most ApeCoin addresses holding onto APE would be generating a profit if they decided to sell.

Now, this opportunity could result in a significant amount of selling pressure for the token in the coming future. The reading of the MVRV metric also indicated that APE was in an overbought zone which might initiate a trend reversal soon.

How many are 1,10,100 APE worth today?

Source: Santiment

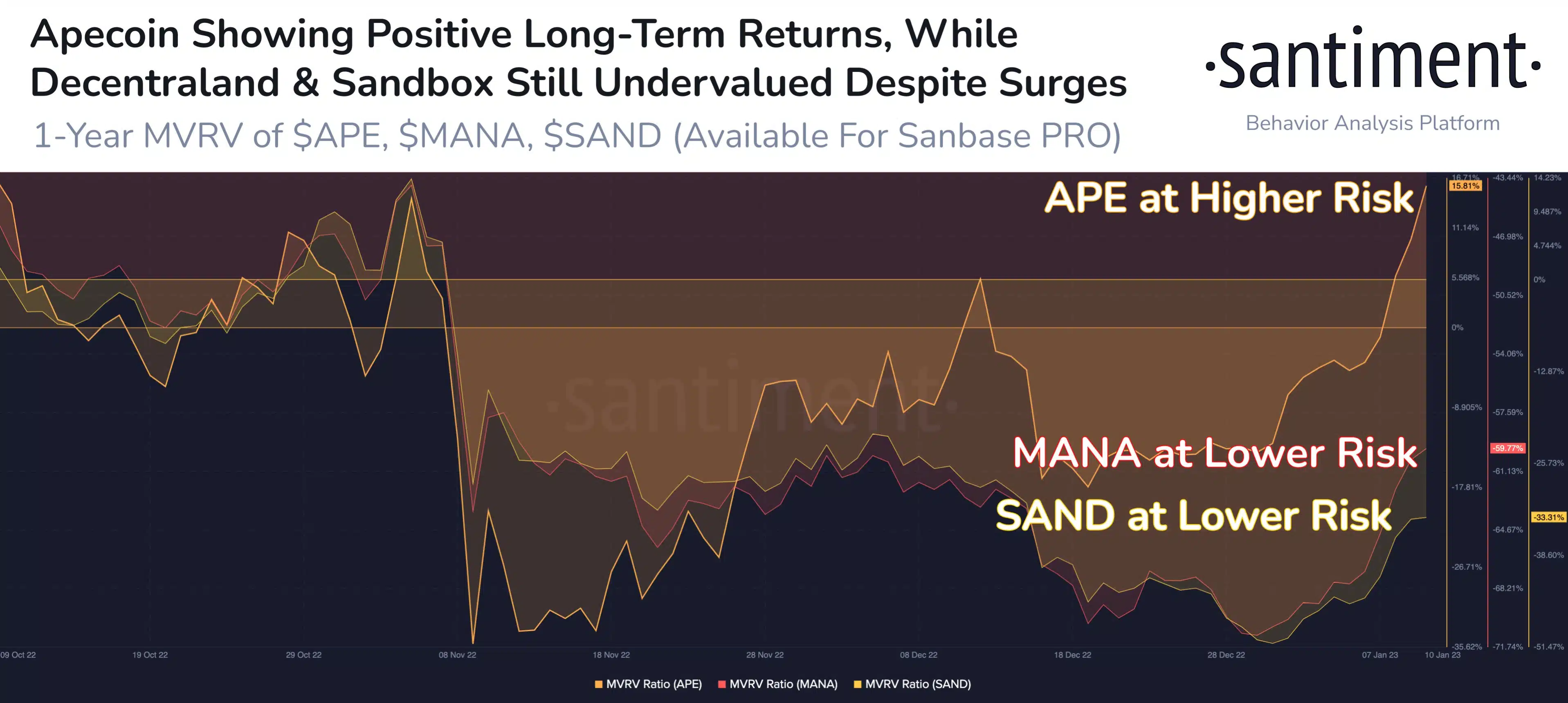

People remain optimistic

However, the public sentiment around APE remained largely positive. Notably, this sentiment could soon change owing to the recent data breach that occurred for Yuga Labs.

The data breach occurred because Yuga Labs was using a service called Mailchimp which got compromised. Well, this could certainly lead to a decline in trust among the community members.

Another factor that could impact APE would be the state of NFTs that are associated with the token.

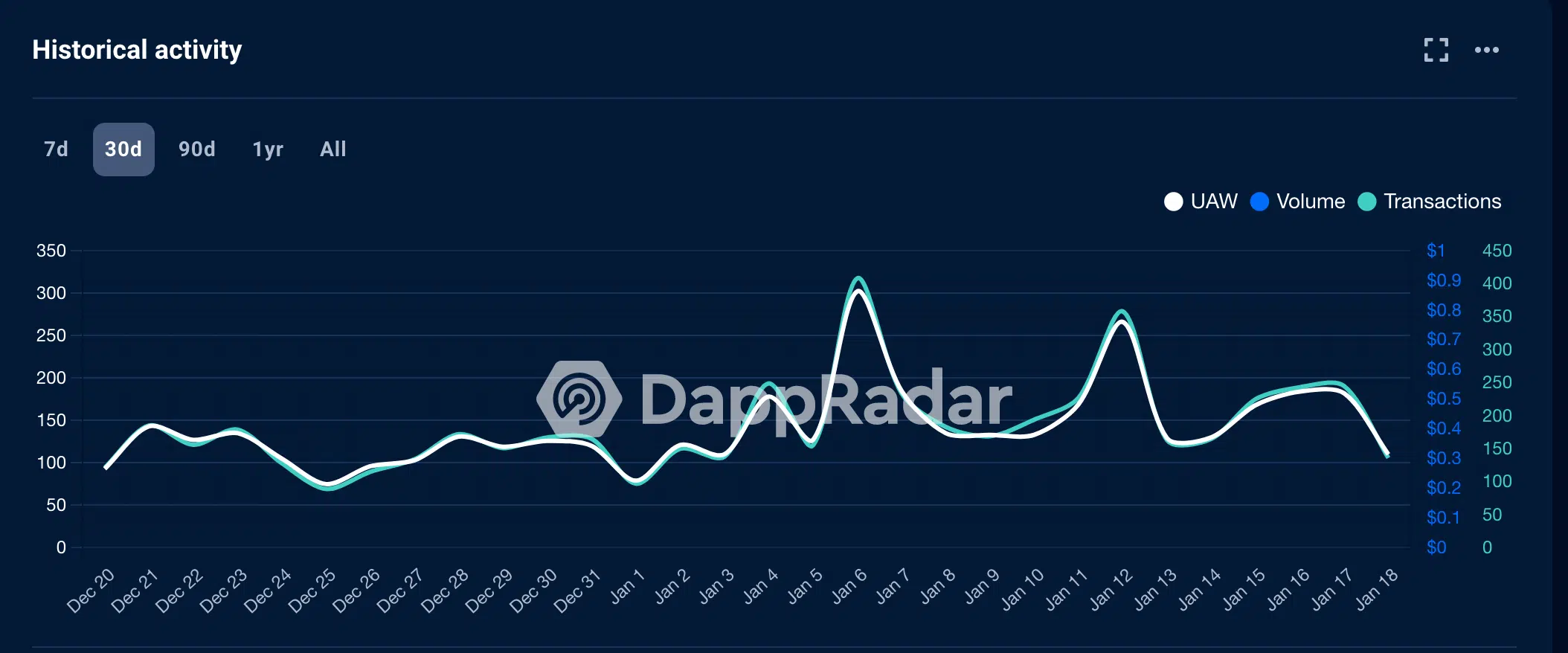

The BAYC NFT (Bored Ape Yacht Club) witnessed a decline in terms of volume and sales. The volume for the BAYC collection declined by 17.7% and the number of sales being made decreased by 5.88% in the last seven days.

Similarly, the MAYC collection (Mutant Ape Yacht Club) also witnessed stagnancy. The number of unique active wallets holding the NFT collection decreased by 10.6% in the last 30 days.

Moreover, the number of NFT transactions being made also declined by 8.52% in the same period, according to DappRadar.

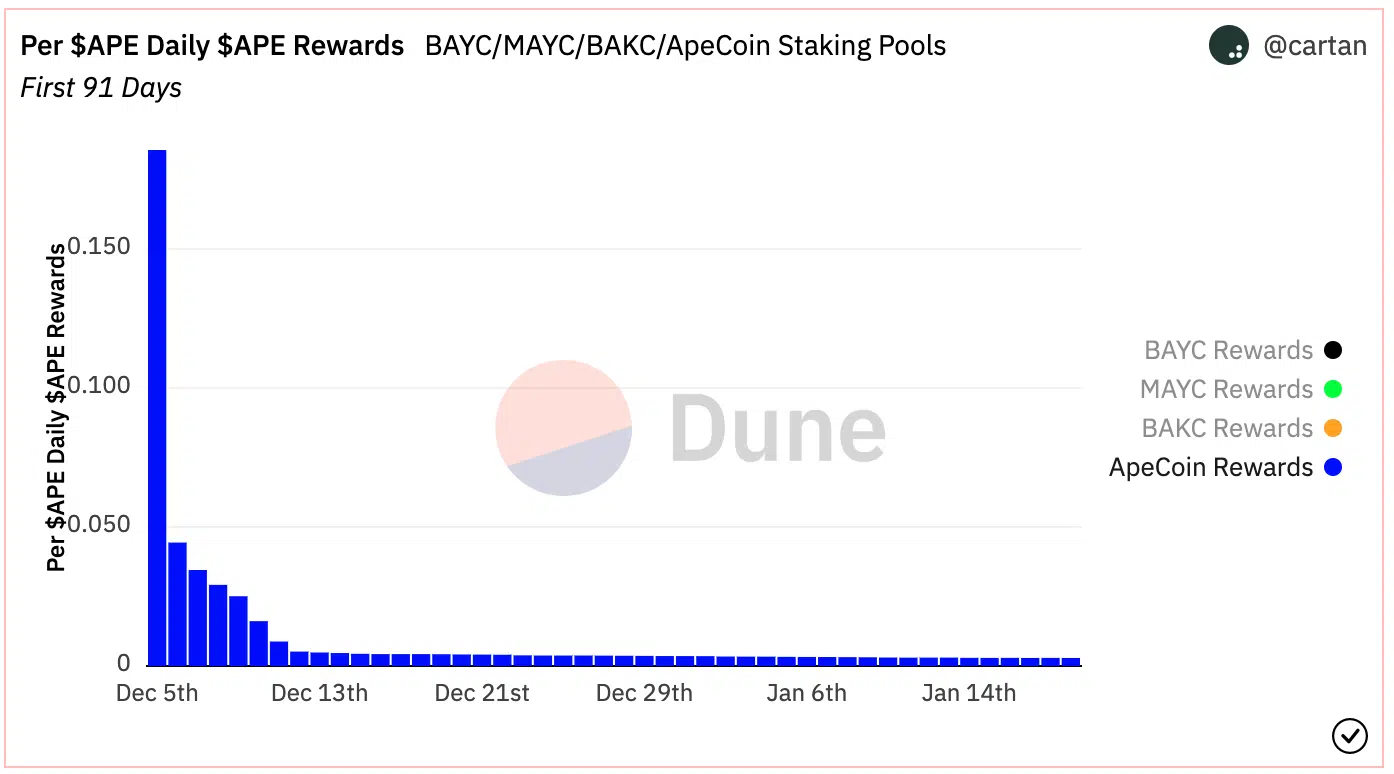

Staking Rewards dwindle

Lastly, the overall state of staking APE and the rewards associated with that could also contribute to the selling pressure faced by APE holders. According to Dune Analytics, the staking rewards for APE decreased materially over the last few months.

This could lead to a decline in interest, as staking is a popular way for holders to earn passive income. Now, with lower staking rewards, holders may be less inclined to hold onto APE and may choose to sell the token.

Read APE’s Price Prediction 2023-2024

That said, it remains to be seen whether the APE holders succumb to the selling pressure or whether they continue to HODL. Anyway, at press time, the price of APE was $4.58 and it increased by 6.77% in the last 24 hours.